It’s been a long time since we talked about pandemic bargains, but believe it or not, there’s still a big one out there with REITs.

I do think it’s finally on borrowed time, though, which is why it’s on our radar now.

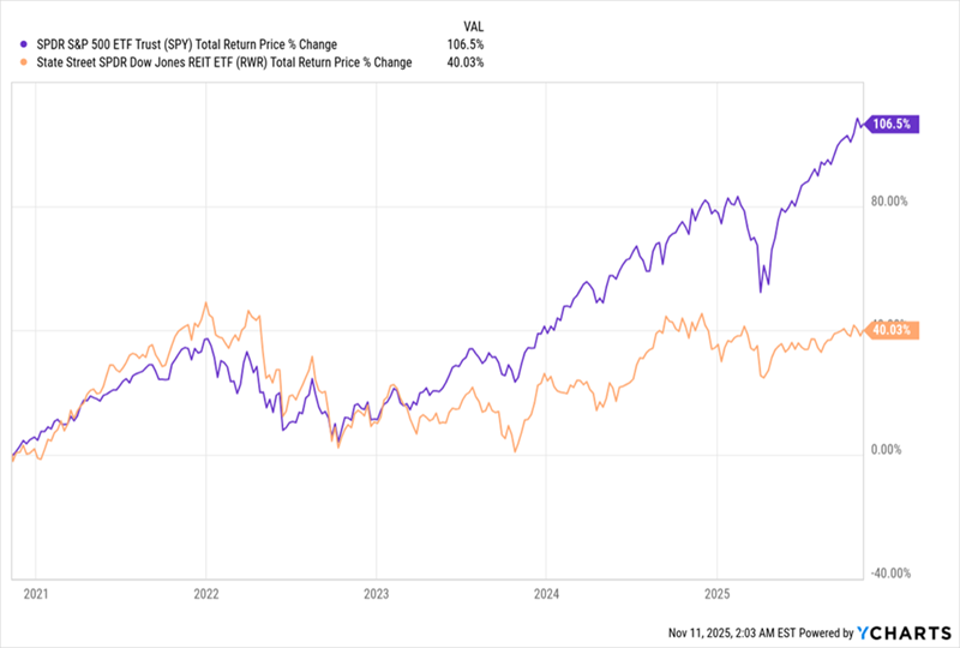

I’m talking about publicly traded real estate investment trusts (REITs). What we’re looking at with REITs is a classic “buy the dip” play with a (very!) long buy window indeed. Here’s a snapshot:

Over the five years since the depths of the pandemic, the S&P 500 (shown by the popular index fund in purple above) has posted a 106.5% total return, as of this writing. Meantime, REITs—shown by the benchmark State Street SPDR Dow Jones REIT ETF (RWR), in orange—have returned just 40%.

Now, of course, no one would turn up their nose at a 40% return, but a look at the long term (the nearly 20 years since both of the above funds have been on the market) shows just how unusual this lag is.

So why does this deal exist—and how are we going to play it? Well, before we get to that, for any real estate play, we need to add one key factor—interest rates—to get the full picture. When we do, we see that over the last five years, REITs have returned that 40% as borrowing costs rose at the fastest pace in American history:

But look at the right side of that chart: Rates are now in a downtrend, and are likely to fall further. Here’s where our opportunity comes in, because this fact is not showing up in REIT performance:

Instead, the market is overlooking REITs, even though these firms can now borrow to invest in properties more easily than at any point in the last three years. This means REITs can expand their profit margins (lower borrowing costs, more properties collecting rents). It also means their higher rent potential is not being priced in.

REITs, when all is said and done, are undervalued.

It’s almost as if the market forgot about REITs’ income potential, and how that income helped REITs outperform the stock market for decades.

Part of this is due to a misunderstanding. Housing costs, which Americans are keenly aware of, have been soaring, largely because the country isn’t building as many homes as it needs to. But this doesn’t mean all real estate is rising in value. In fact, other REIT subsectors haven’t been, which is why REITs as a whole aren’t rising as fast as they historically have.

All of this focus on home prices means investors are forgetting just how much value there is in other real estate sectors, like data centers. Again, that’s a buying opportunity.

The trick is to buy a fund that’s highly diversified and pays a large, sustainable dividend, so we’re getting most of our return in cash.

After all, if you own just one house in one city, you’re exposed to many risks: Poor local-government policy and urban planning, bad neighbors or even just bad luck can harm your investment. But if you own many properties, any bad luck affecting one is offset by the many other properties you’re exposed to.

The Best Way To Invest In REITs

That’s why we favor REIT-focused closed-end funds (CEFs) like the Cohen & Steers Quality Income Realty Fund (RQI). This CEF sports an 8% yield but also trades at a 5.4% discount to net asset value (NAV, or the value of its underlying portfolio). That’s a sweet deal when you consider that RQI owns some of the top REITs in their industries.

Not only is this portfolio well-diversified, but note how two of its top 10 positions—Digital Realty Trust (DLR) and Equinix (EQIX)—are in data centers, which are booming due to AI demand. The fund is also diversified into health care, self-storage and other areas. The result is that RQI, thanks to its hundreds of holdings, is exposed to tens of thousands of individual properties housing a wide variety of tenants.

RQI hasn’t just done well over the long haul, either—it has also returned far more than the index fund since both have been around (see orange line below).

This outperformance is stunning given that RQI trades for 5.4% less than NAV. (ETFs like RWR, meantime, never trade below NAV.) In fact, I feel that RQI deserves a premium, yet its discount has been widening as of late.

Why is RQI trading at a bigger discount than at any other point in 2025, including the April tariff selloff? There’s no good answer to that. But we do know that RQI has beaten the REIT sector this year at a time when its discount is getting bigger and investors are less focused on REITs.

That’s the definition of a buying opportunity in CEFs. And the truth is, I could see the discount on this “last COVID bargain” lingering for a few more weeks. In the longer run, though, this markdown opens the door to strong gains as investors (inevitably, in my view) come around.

Michael Foster is the Lead Research Analyst for Contrarian Outlook. For more great retirement income ideas, click here for our latest report “Indestructible Income: 5 Bargain Funds with Steady 10% Dividends.”