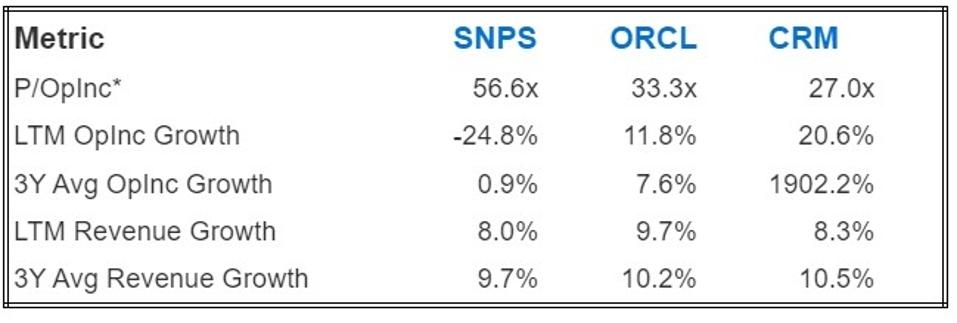

ORCL and CRM are Synopsys’s competitors in the Application Software industry that possess:

1) A lower valuation (P/OpInc) relative to Synopsys stock

2) However, they demonstrate higher revenue and operating income growth.

This disparity between valuation and performance suggests that purchasing ORCL and CRM stocks may be more advantageous than buying SNPS stock

Individual stocks can experience volatility and may lead to selling, but strategic allocation and diversification allow you to remain invested. Our Boston-based wealth management partner’s asset allocation strategy is designed specifically for this purpose.

Key Metrics Compared

OpInc = Operating Income, P/OpInc = Price To Operating Income Ratio

But do these figures provide the complete picture? Read Buy or Sell SNPS Stock to determine if Synopsys still possesses an advantage that is sustainable. For context, Synopsys (SNPS) offers electronic design automation software and intellectual property solutions for integrated circuits, catering to USB, PCI Express, DDR, Ethernet, SATA, MIPI, HDMI, and Bluetooth low energy applications.

This is merely one method to assess investments. Trefis High Quality Portfolio evaluates significantly more and aims to mitigate stock-specific risk while providing upside exposure.

Is The Mismatch In Stock Price Temporary

One approach to determine if Synopsys stock is currently overpriced compared to other tickers would be to examine how these metrics stacked up across companies exactly one year ago. Specifically, if there has been a distinct reversal in the trend for Synopsys over the past 12 months, it suggests that the existing mismatch may indeed reverse. Conversely, a continual underperformance in revenue and operating income growth for Synopsys would strengthen the notion that the stock is overpriced compared to its peers and may not correct soon.

Key Metrics Compared 1 Yr Prior

OpInc = Operating Income

Additional Metrics To Consider

OpInc = Operating Income

Buying based on valuation, while appealing, requires thorough evaluation from various perspectives. Such multi-faceted analysis is how we develop Trefis portfolio strategies. If you’re seeking upside with a smoother experience than holding an individual stock, consider the High Quality portfolio, which has surpassed its benchmark – a blend of the S&P 500, Russell 2000, and S&P midcap indexes.