Since its 2024 merger, Trump Media has reported low quarterly revenues with no growth. Operating expenses, meanwhile, have been larger and have increased. Therefore, the earnings pattern has been poor.

Other SPAC-merger companies with similar financials have seen their stock prices fall significantly below $10 (the usual pre-merger SPAC stock price). However, while Trump Media stock has declined from enthusiastic peaks, it has remained well above $10. But it is now closing in.

Now is different and risk is greater

This month’s selloff is the result of three issues:

First, the 3rd quarter report. It revealed a dramatic change from Trump Social activities, with a financial strategy of holding cash and not borrowing. However, in the past few months, Trump Media has changed its stripes. It has issued $1 billion of convertible notes and is buying large amounts of crypto currencies and other investments.

Second, the structure of the new debt. The bonds enter a convertible or repayment stage in only one year, with investors determining what they want. Additionally, to ensure there is cash available, Trump Media must maintain a $1 billion holding of crypto currencies, investments and cash as collateral for the bonds’ potential repayment.

Third, the heightened risk. Already in the 3rd quarter, the risk became visible, with both the cryptocurrency and the unnamed investments declining. Meanwhile, the convertible note debt increased due to interest accrual.

Why falling below $10 is a concern

Most SPAC-merger companies are selling well below their pre-merger $10 prices. Many even fell below the minimum $1 level required by the NYSE and Nasdaq for a stock listing. Most of those then engaged in reverse stock splits (for example, issuing one new share for five old shares) to raise the one share price above $1. In fact, so many companies resorted to reverse stock splits in 2024 (about 500) that both the NYSE and Nasdaq strengthened their rules this year.

Why should Trump Media shareholders worry about the price falling below $10? For two reasons:

First, the company’s shift has significantly diminished its money-losing businesses, where the company sold new shares of stock to replenish its dwindling cash. The new highly leveraged, cryptocurrency and unnamed investment approach puts the company on a completely different, high-risk path. Will current shareholders accept the shift? Probably not because it does not reflect their “Trump Media” understanding and expectations.

Moreover, it takes some effort to uncover just what is going on. The quarterly report has the information, but it is hard for the average shareholder to understand. For example, here is the entire “overview” that heads the management review: (Underlining is mine)

“We ended September 30, 2025, with $3,106,527.3 [$3.1 billion] of cash, cash equivalents, restricted cash, short-term investments, trading securities, and digital assets, as well as $950,769.1 [$951 million] of debt (excluding lease liabilities). Our $335,838.8 [$336 million] of restricted cash serves as collateral to our debt which may be used to purchase bitcoin and bitcoin related securities, and our unexpired cash-covered put options.“

Later, in “Note 9” of the financial statements, the convertible debt is explained:

Lead-in sentence: “On May 29, 2025, we entered into an Indenture, providing $1,000,000.0 [$1 billion] in 0.00% convertible senior secured notes due on May 29, 2028 (the “Notes”), unless earlier repurchased or converted. The Notes carry a 4.00% original issuance discount. [Therefore, proceeds to Trump Media were $960 million.] Each Note holder has the right at its option, to require us to repurchase its Notes for cash on November 30, 2026, at a repurchase price equal to 100% of the principal amount of the Notes to be repurchased, plus accrued and unpaid interest, subject to the terms and conditions in the Indenture.”

Further down in Note 9 is a fuller explanation: “Required collateral of $1,000,000.0 [$1 billion] was delivered to the Collateral Agent within 45 days of closing. We have utilized this cash delivered to the Collateral Agent to purchase bitcoin and bitcoin related assets to serve as collateral in order to meet our Loan-to-Collateral Ratio. As of September 30, 2025, we have $26,838.8 [$27 million] of restricted cash, $455,000.0 [$445 million] of trading securities, and $487,311.5 [$487 million] of bitcoin serving as collateral.” [Securities and bitcoin price declines reduced the $1 billion by $31 million to $969 million]

At the bottom of Note 9 is this: “The effective interest rate of the Notes is 4.80% per annum.”

Second, President Donald Trump has provided Trump Media stock with a brand name support. It has kept the stock price well above the initial $10 even though the company has produced zero growth in revenues and large negative results.

However, President Trump’s brand name appears to be weakening. Some Republicans have begun to openly question or oppose his actions and pronouncements. Also, his negative polling has begun to worsen. Here are recent average results from The New York Times tracking of dozens of polls:

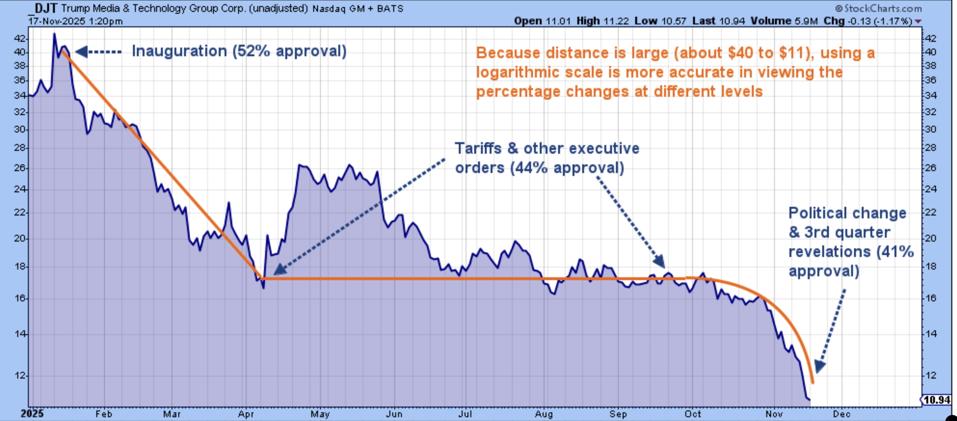

- January inauguration: 52% approval; 43% disapproval

- Popularity declined to April due to tariffs and other actions: 44% approval; 52% disapproval

- Fairly stable polls to mid-September: 44% approval; 52% disapproval

- Decline since then to new low. As of Nov. 17: 41% approval; 55% disapproval

Note the correlation between the polls and the Trump Media’s stock price. Add in the political shifting and the surprising 3rd quarter revelation of huge debt with cyber currency investing (reported Nov. 7), and the recent price drop picked up steam.

The bottom line – Optimistic popularity eventually runs up against fundamental reality

In mid-year 2024, there were many articles questioning how Trump Media stock could be so high when its fundamentals were so low. In response, I wrote an explanatory article (June 14, 2024), “Trump Media Stock (DJT) Requires A Unique Fundamental Analysis.” It led off with this important support:

“Trump Media & Technology Group has a distinctly unique, widely known, and frequently discussed brand: Donald J. Trump. Yes, that brand is disliked by some, but others like it. And it is those others that the company is aiming at.”

The ultimate heyday was when Donald Trump became president for a second time, and his loyal supporters anticipated a thrilling, positive change. However, even though he produced a flood of executive orders and had the support to carry them through, many actions were unexpected (like the tariffs), and some were opposite of expectations (like the widespread firings).

Therefore, while President Trump retained the support of the Senate, the House, and the Supreme Court, he began losing supporters, reflected by the drop in the approval rating. Although the stock price declined, it still stayed well above $10. Then came October and November, when President Trump began to take extreme measures, causing his political support to start weakening. At the same time, he and his family were pursuing money through cryptocurrency actions with foreigners, some of whom had spotty records.

So, think of Trump Media’s stock price decline as a measure of supporter shrinkage. With the depth and speed of the current drop, remaining investors are likely looking for a price that offers fundamental support. It is hard to find.