Oracle stock dropped -29% in the previous month. You may feel inclined to increase your investment, or you might consider decreasing your exposure. However, there is a completely different viewpoint you could be overlooking. Is there a superior alternative? It appears that its counterpart, Adobe, offers more.

The recent decline in Oracle stock comes amid concerns over growth and rising costs, as well as insider selling of the stock. While Adobe (ADBE) stock too has seen a bit of volatility, it provides superior revenue growth during critical periods, enhanced profitability, and a comparatively lower valuation in relation to Oracle (ORCL) stock, indicating that investing in ADBE may be advantageous.

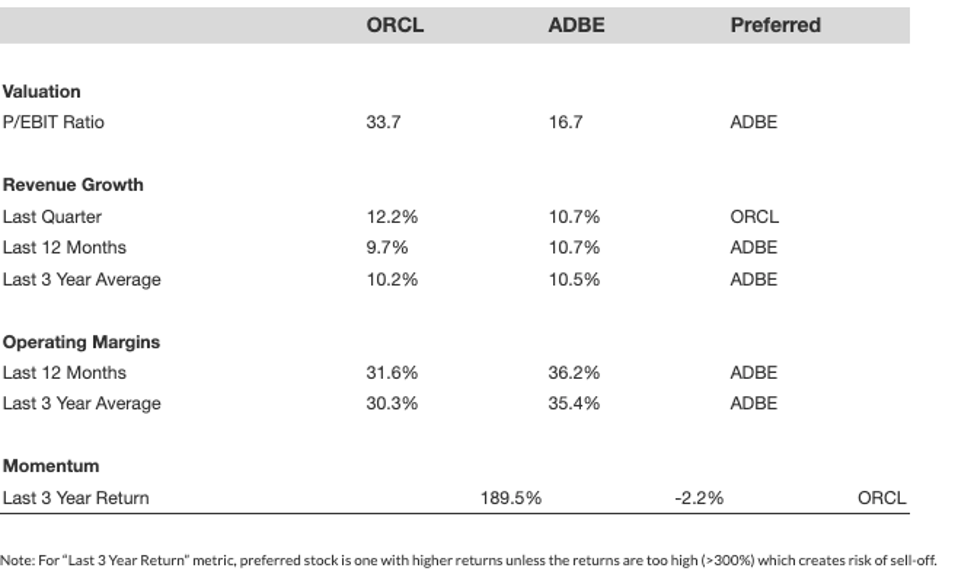

- ADBE’s last 12 months revenue growth was 10.7%, versus ORCL’s 9.7%.

- Moreover, its last 3-year average revenue growth was reported at 10.5%, surpassing ORCL’s 10.2%.

- ADBE outperforms on profitability for both periods – having a last twelve months margin of 36.2% and a 3-year average of 35.4%.

These distinctions become more evident when comparing the financials side by side. The data emphasizes how ORCL’s fundamentals compare to ADBE in terms of growth, margins, momentum, and valuation multiples.

Valuation & Performance Overview

Note: For “Last 3 Year Return” metric, preferred stock is one with higher returns unless the returns are too high (>300%) which creates risk of sell-off.

See more revenue details: ORCL Revenue Comparison | ADBE Revenue Comparison

See more margin details: ORCL Operating Income Comparison | ADBE Operating Income Comparison

You can view detailed fundamentals on Buy or Sell ADBE Stock and Buy or Sell ORCL Stock to evaluate which stock seems superior. However, while individual stocks may fluctuate, a balanced asset allocation remains stable. Trefis’ Boston-based wealth management partner combines strategy and discipline to mitigate market volatility.

Returning to the comparison, let’s explore how these two stocks have performed for investors over recent years.

Historical Market Performance

No matter how impressive the figures, stock investment is never a seamless experience. There is a risk involved that you must consider. Read ADBE Dip Buyer Analyses to understand how the stock has declined and recovered historically.

Regardless of your perspective on either of these stocks, investing in a single stock or two remains a precarious venture. Instead, the Trefis High Quality (HQ) Portfolio, which encompasses 30 stocks, boasts a history of comfortably outperforming its benchmark that encompasses all three — the S&P 500, S&P mid-cap, and Russell 2000 indices. What accounts for this? Collectively, HQ Portfolio stocks have yielded higher returns with diminished risk compared to the benchmark index; providing a gentler ride, as demonstrated in HQ Portfolio performance metrics.