This is part 1 of a two-part look into the 50-year mortgage plan.

President Trump started promoting 50-year mortgages as a way to help younger people buy homes. On the surface, it sounds like promoting a trade-off between higher total interest and longer term with smaller monthly payments. But what people gain may not be what they lose.

Furthermore, there are likely other reasons, with no thought to the need for housing, that the administration is pushing long-term financing.

House Prices And Future Reality

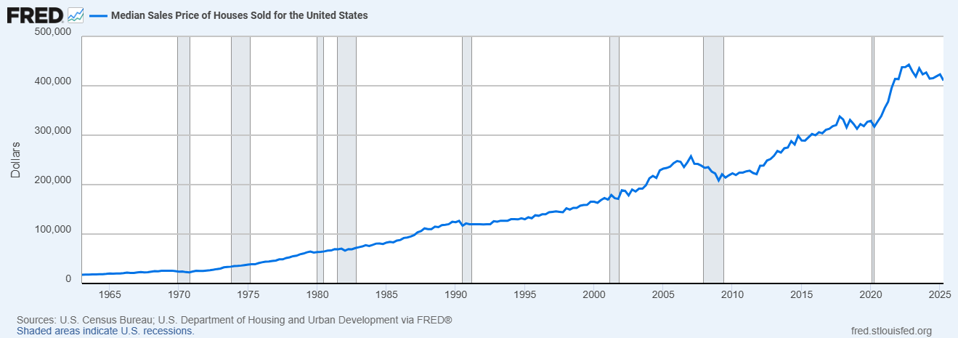

Start with the median — the middle — sale price of houses in the U.S. Financing options are only a way to mitigate the problem. Below is a graph from the Federal Reserve Bank of St. Louis.

The median price at the end of the second quarter of this year was $410,800. Ten years ago, it was $289,100.

Next, another St. Louis Fed graph, this time of median household income.

In 2015, it was $56,520, while in 2024 it was $83,730.

Over about 10 years, the median house price grew by 42.1%. Median household income was up by 48.1%. That would seem to make it relatively straightforward for households to buy a house. But as former Forbes staff writer Katherine Haan wrote in July 2025, the median annual wage of the 20-to-24-year-old group is $41,184. For 25-to-34 it is $58,500. For 35-to-44 it is $69,264.

Two people in the lowest group might have an annual wage of $82,368. Using a NerdWallet calculator, with an $80,000 down payment, 6.485% interest rate, and 30-year term, the couple could afford a $360,788 home price, with a loan of $280,788 and monthly mortgage payment of $2,471 at a 36% debt-to-income ratio.

For a $410,800 house with $82,100 (20%) down on a 30-year loan at 6.5%, a couple would need an annual income of $112,524. The math doesn’t work.

For that same house with the 30-year, 6.5% loan, the monthly payment is $2,809.82 with total loan payments of $747,802.21 and total interest payments of $419,162.21.

Looking at cheaper properties is where institutional investors engage heavily to make their buy-and-rent plans to work, and they buy something like 26% of available properties now, according to Mortgage Professional America.

Double The Term Only Helps So Much

Would a 50-year mortgage help fix this? Yes and very much no. Technically, that is true so far as it would lower monthly payments. Using a 50-year mortgage calculator and keeping everything else the same, the monthly payment would be $2,202.94 rather than $2,809.82, reducing the monthly payment by $606.88, a significant drop. But the total interest expense would now be $783,062.44. The amount of time before the borrower would gain significant equity would be much longer.

A 50-year mortgage turns people into permanent renters. Historically, that isn’t an unusual position. In large metropolitan areas like New York City, there was a needs-based tradition of people living in rental properties their entire lives.

But in such cases, everyone knew they were renters. There was no pretense of ownership. If there was a problem with a landlord, a move, while inconvenient, didn’t necessarily have long-term consequences.

When the context is a mortgage, however, things are different. There isn’t simply a move. There is a sale and accompanying costs. The build of equity eventually should make the next purchase easier, except under a 50-year loan term makes the equity accumulation difficult.

The only advantage is locking in a payment. Rents always trend upward. Within six to 10 years, the pace of rent growth becomes faster than the growth of house prices. In that time gap, the house can become more affordable and also, if necessary, disposable. The more equity, the more easily you can sell without taking a loss. The presumption has been that under a 30-year mortgage, the typical seller is in the house for 15 years, according to Zillow research. The selling penalty is much longer with the extended mortgage.

The discussion also is about far more than the practicality of buying a property. It’s about what other plans the government and Wall Street might have. The second part will be up this week.