- Why Invest In Exchange-Traded Funds (ETFs)?

- How These ETFs Were Selected

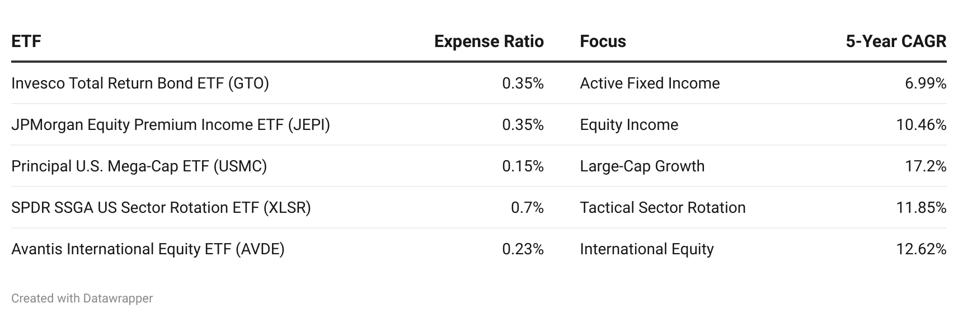

- 5 Top ETFs To Buy In 2026

- 1. Invesco Total Return Bond ETF (GTO)

- 2. JPMorgan Equity Premium Income ETF (JEPI)

- 3. Principal U.S. Mega-Cap ETF (USMC)

- 4. SPDR SSGA US Sector Rotation ETF (XLSR)

- 5. Avantis International Equity ETF (AVDE)

- Bottom Line

Exchange-traded funds have revolutionized how investors build portfolios, offering flexibility and diversification that traditional investment vehicles struggle to match. As we head into 2026, the ETF marketplace continues to expand with increasingly sophisticated strategies designed to address specific investment needs. From income generation to tactical sector rotation, today’s ETFs offer tools once available only to institutional investors.

The five best ETFs to buy in 2026 combine strong track records with strategic positioning, helping investors pursue income, growt and tactical opportunities. Each brings distinct characteristics to the table — whether through active management strategies, international exposur or innovative approaches to generating returns.

Why Invest In Exchange-Traded Funds (ETFs)?

ETFs combine the best features of mutual funds and individual stocks. They trade throughout the day with transparent pricing, unlike mutual funds that price once daily. This liquidity advantage allows investors to adjust positions quickly, which can be critical during volatile markets.

ETFs also have lower expense ratios than most mutual funds, reducing fees that erode long-term returns. They are tax-efficient, generating fewer capital gains distributions and offer transparency — investors can see exactly what they own at any time.

How These ETFs Were Selected

Examined across multiple market cycles, the top ETFs for 2026 prioritize:

- Consistent performance over one, three, and five years

- Strong risk-adjusted returns, not just raw gains

- Low expense ratios to maximize compounding

- Clear, understandable strategies relevant to current market conditions

- Sufficient assets under management (AUM) for liquidity

5 Top ETFs To Buy In 2026

These five ETFs represent diverse strategies, from fixed income to international equities and tactical sector rotation, reflecting the benefits of a multi-pronged investment approach.

1. Invesco Total Return Bond ETF (GTO)

- Expense Ratio: 0.35%

- Net Assets: $1.94B

- Forward Dividend Yield: 5.29%

- 3-Year CAGR: 6.99%

- 1-Year Return: 5.87%

Fund Overview

The Invesco Total Return Bond ETF actively manages fixed income, seeking total return via current income and capital appreciation. The fund adjusts duration, credit quality, and sector allocation as market conditions change, covering government bonds, corporates, and mortgage-backed securities.

Why GTO Is A Top Buy

With interest rates providing meaningful income, GTO’s 5.29% yield offers substantial current income. Active management adds flexibility, allowing shifts toward higher-quality bonds in recessionary periods or credit sectors in growth periods. Its 0.35% expense ratio is reasonable given the potential value from tactical positioning.

2. JPMorgan Equity Premium Income ETF (JEPI)

- Expense Ratio: 0.35%

- Net Assets: $41.32B

- Forward Dividend Yield: 7.53%

- 3-Year CAGR: 12.22%

- 5-Year CAGR: 10.46%

Fund Overview

JPMorgan Equity Premium Income ETF combines low-volatility stock selection with covered call writing to generate income. The fund’s $41.32B AUM reflects strong demand for strategies balancing growth with income.

Why JEPI Is A Top Buy

The 7.53% forward yield is compelling in a low-yield environment. The fund delivers double-digit annualized returns while mitigating volatility, making it suitable for income-focused investors, particularly retirees.

3. Principal U.S. Mega-Cap ETF (USMC)

- Expense Ratio: 0.15%

- Net Assets: $3.63B

- Forward Dividend Yield: 0.82%

- 3-Year CAGR: 26.16%

- 5-Year CAGR: 17.20%

Fund Overview

Principal U.S. Mega-Cap ETF focuses on large, market-leading U.S. companies with strong balance sheets and competitive advantages. Active management selects which mega-cap names to hold.

Why USMC Is A Top Buy

Mega-cap stocks offer scale, pricing power, and financial resources to grow or weather downturns. Exceptional performance and a low 0.15% expense ratio make USMC a cost-effective way to gain exposure to market leaders.

4. SPDR SSGA US Sector Rotation ETF (XLSR)

- Expense Ratio: 0.70%

- Net Assets: $834 million

- Forward Dividend Yield: 0.62%

- 3-Year CAGR: 18.10%

- 5-Year CAGR: 11.85%

Fund Overview

SPDR SSGA US Sector Rotation ETF rotates among U.S. sectors based on momentum, value, and quality signals. The quantitative strategy systematically adjusts exposure to capture sector trends.

Why XLSR Is A Top Buy

Sector leadership shifts across economic cycles. XLSR’s systematic rotation aims to enhance returns beyond broad-market exposure, offering tactical flexibility for 2026.

5. Avantis International Equity ETF (AVDE)

- Expense Ratio: 0.23%

- Net Assets: $9.73 billion

- Forward Dividend Yield: 3.16%

- 3-Year CAGR: 22.16%

- 5-Year CAGR: 12.62%

Fund Overview

Avantis International Equity ETF provides exposure to developed markets outside the U.S. using a factor-based approach emphasizing size, value, and profitability.

Why AVDE Is A Top Buy

International stocks trade at discounts to U.S. equities, offering potential risk-adjusted returns. Factor-based investing tilts toward characteristics historically linked to outperformance while maintaining diversification.

Bottom Line

These five best ETFs for 2026 provide diverse approaches for the coming year — income, growth, tactical rotation, and international exposure. Each combines proven strategies, reasonable costs, and strong track records. Consider how each aligns with your portfolio goals and risk tolerance as you prepare for the year ahead.