After a strong multi-year rally, Synopsys (NASDAQ: SNPS) shares have pulled back in recent months, bringing the stock closer to a key technical support zone. The company, a leader in electronic design automation (EDA) software, has been a consistent performer, benefiting from the growing complexity of semiconductor design and rising demand for AI-driven chips. While short-term sentiment has cooled, the long-term fundamentals remain solid. This pullback could offer investors an attractive entry point as Synopsys approaches levels that have historically marked the start of major recoveries.

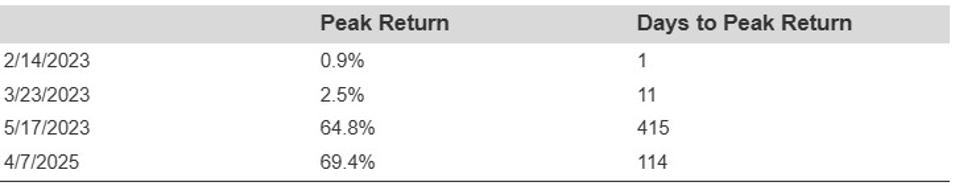

SNPS stock is presently trading within the support range ($378.87 – $418.75), levels from which it has bounced notably in the past. Over the last 10 years, Synopsys stock has drawn buying interest at this level 4 times, rallying significantly on two occasions, resulting in an average peak return of 34.4%.

But is the price movement sufficient on its own? It definitely aids if the fundamentals align. For SNPS Read Buy or Sell SNPS Stock to assess how compelling this buying opportunity could be.

Consider this – Is holding SNPS stock hazardous? Certainly, it is. High Quality Portfolio alleviates that risk.

Here are some quick data points for Synopsys that should facilitate decision-making:

- Revenue Growth: 8.0% LTM and 9.7% last 3 year average.

- Cash Generation: Almost 20.2% free cash flow margin and 17.2% operating margin LTM.

- Recent Revenue Shocks: The lowest annual revenue growth in the last 3 years for SNPS was -3.1%.

- Valuation: SNPS stock trades at a PE multiple of 32.0

For a brief background, Synopsys offers electronic design automation software and intellectual property solutions for integrated circuits, supporting USB, PCI Express, DDR, Ethernet, SATA, MIPI, HDMI, and Bluetooth low energy applications.

What Is Stock-Specific Risk If The Market Crashes?

SNPS is not immune to significant declines. It fell by over 60% during the Dot-Com Bubble and nearly 50% in the wake of the Global Financial Crisis. The downturn in 2018 and the Covid market crash also resulted in declines of approximately 23% and 34%, respectively. Even the inflation impact drove it down nearly 30%. While the stock may possess strong fundamentals, historical trends indicate that sharp downturns are an inevitable part of the experience when markets become unfavorable.

The Trefis High Quality (HQ) Portfolio, consisting of 30 stocks, has demonstrated a performance of consistently outperforming its benchmark which includes all three indices – the S&P 500, S&P mid-cap, and Russell 2000. What accounts for this? As a collective, HQ Portfolio stocks have yielded superior returns with less risk in comparison to the benchmark index; offering a smoother experience, as shown in HQ Portfolio performance metrics.