Key News

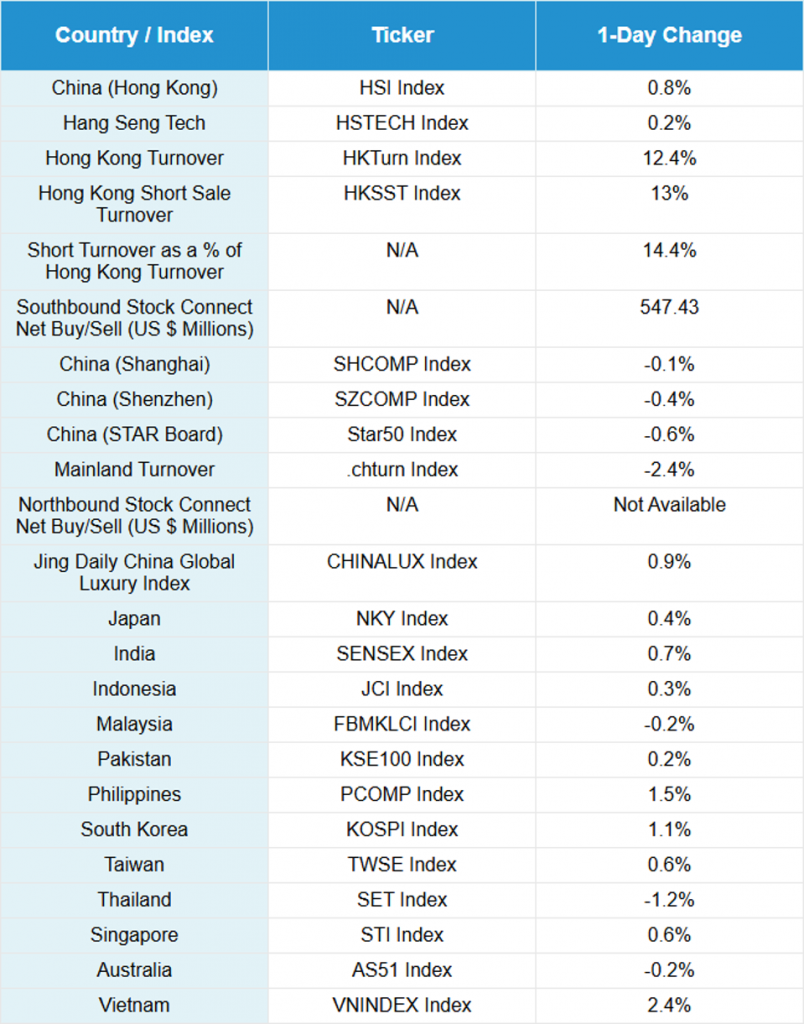

Asian equities were higher, except for Mainland China, despite a slightly firmer US dollar.

Hong Kong stocks grinded higher, posting small gains on light volumes, led by JD.com, which gained +1.3% after announcing a 40% year-over-year (YoY) increase in the number of Singles’ Day shoppers and order volume increasing 60% YoY. JD and E-Commerce peers have stopped giving total sales and gross merchandise value (GMV) sales figures for the sales festival on November 11th (11/11) or Singles’ Day. It was somewhat surprising to see Alibaba fall -2.24% after JD’s announcement, as Mainland investors were large sellers via Southbound Stock Connect. It is possible that Alibaba’s Hong Kong listing is a liquidity source for Hong Kong IPOs and diversifying into other areas? Hard to know.

XPeng was down -3.04% after yesterday’s strong gain, though Mainland investors were large buyers via Southbound Stock Connect. Energy, insurance, oil, home appliances, and healthcare stocks had a good day. Hong Kong and Mainland China-listed metals and gold mining stocks were weak, despite rising gold prices in China. Mainland solar stocks had a very bad day as Sungrow fell -2.78%, LONGi Green Energy fell -7.35%, CSI Solar fell -14.35%, and Tongwei fell -6.06% after internet rumors that companies were lowering prices.

The false news led the China Photovoltaic Industry Association to release a statement that the internet rumors were false and “core purpose of industry self-discipline and internal competition is to restore the market to a level playing field.” Could this be an opportunity to buy the dip in China clean tech before investors realize that energy is the key to AI? Healthcare stocks were resilient as fifty-five drugs announced part of the government’s bulk buying program that is eloquently called “centralized drug procurement”. Mainland China was weak on poor breadth as the market grinds slowly higher.

There are only a handful of U.S.-listed Chinese companies that haven’t relisted in Hong Kong. A Mainland media source noted that E-Commerce company Vipshop (VIPS US) plans on relisting in Hong Kong, though we might need to wait for Q3 financial results for clarity from the company. Full Truck Alliance and Pinduoduo are the other two that haven’t publicly filed, though the former has alluded to a Hong Kong relisting. The key is a dual share class relisting as it allows a company to be added to Southbound Stock Connect. Somewhat shockingly, a host of companies that relisted in Hong Kong are not dual listed, therefore those companies are missing out on getting a piece of the $168 billion that has gone into Hong Kong from Mainland China year-to-date. Companies listed in Hong Kong but not in Connect include Baidu, JD.com, NetEase, Trip.com, and Tencent Music Entertainment.

Alibaba (BABA US, 9988 HK) announced their quarterly results will be released on Tuesday, November 25th after the Hong Kong market close.

President Trump was interviewed by Fox News Laura Ingraham last night. They had an interesting exchange when she asked him about letting Chinese students enroll in US universities as she accused Chinese students of spying and stealing intellectual property. Trump totally shut her down. President Trump can change the Republican Party’s view of China. The Chinese government should realize that President Trump is the only person in Washington DC willing to do a deal or even meet with them. I really hope both sides continue progress on trade talks.

Tencent Music Entertainment Q3 Earnings Review

Online music platform Tencent Music Entertainment (TME US, 1698 HK) announced Q3 financial results after the Hong Kong close today. Results were driven by online music services, which “were RMB6.97 billion (US$979 million), representing 27.2% year-over-year growth. Revenues from music subscriptions were RMB4.50 billion (US$632 million), representing 17.2% year-over-year growth.”

- Revenue increased by +20.6% YoY to RMB8.46 billion (US $1.19 billion) from RMB 7.02B and versus analyst expectations of RMB 8.22B.

- Adjusted net income increased by RMB2.41 billion (US $338 million), a+32.6% YoY increase versus analyst expectations of RMB 2.3B.

- Adjusted EPS increased to RMB1.54 (US $0.22) from RMB 1.16 and versus analyst expectations of RMB 1.45.

- Total cash on the books is RMB36.08 billion (US $5.07 billion).

Live Webinar

Join us Wednesday, November 12th at 10 am EST for:

China Q3 Update: Tech Leads Bull Market, Trade Deal Updates, & New Goals Set In 15th Five-Year Plan

Please click here to register

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.11 versus 7.12 yesterday

- CNY per EUR 8.23 versus 8.26 yesterday

- Yield on 10-Year Government Bond 1.81% versus 1.81% yesterday

- Yield on 10-Year China Development Bank Bond 1.88% versus 1.88% yesterday

- Copper Price +0.03%

- Steel Price +0.16%