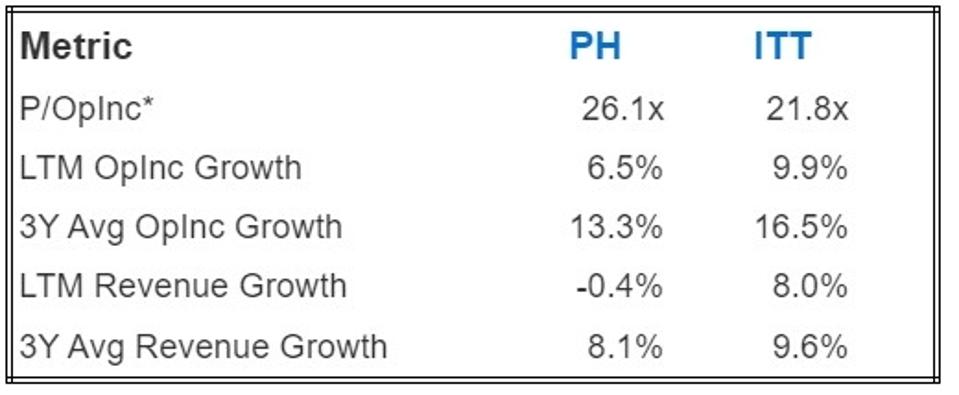

ITT is Parker Hannifin’s counterpart in the Industrial Machinery & Supplies & Components industry that offers:

1) A lower valuation (P/OpInc) relative to Parker Hannifin stock

2) However, higher revenue and operating income growth

This disparity between valuation and performance suggests that purchasing ITT stock may be more advantageous than acquiring PH stock

No matter the direction of PH stock, your investment portfolio should continue to progress. Discover how High Quality Portfolio can assist you in this regard.

Key Metrics Comparison

OpInc = Operating Income, P/OpInc = Price To Operating Income Ratio

Do these figures ultimately convey the entire narrative? Read Buy or Sell PH Stock to determine if Parker Hannifin still possesses an advantage that stands up when closely examined. To provide some context, Parker Hannifin (PH) offers motion and control technologies and systems across mobile, industrial, and aerospace markets, including applications for commercial and military airframes and engines.

This method is merely one way to assess investments. Trefis High Quality Portfolio considers a broader scope and aims to mitigate stock-specific risk while allowing for potential gains.

Is The Discrepancy in Stock Price Temporary?

A method to evaluate whether Parker Hannifin stock is currently overvalued relative to other companies is to analyze how these metrics compared across firms one year ago. In particular, if a noticeable reversal in the trend for Parker Hannifin has occurred over the last 12 months, it indicates that the present mismatch may be prone to correction. Conversely, a prolonged underperformance in revenue and operating income growth for Parker Hannifin would further solidify the notion that its stock is overpriced compared to its peers, potentially delaying any reversion.

Key Metrics Compared One Year Ago

OpInc = Operating Income

Additional Metrics to Consider

OpInc = Operating Income

Purchasing based on valuation can be appealing, but it requires careful evaluation from multiple perspectives. This multifaceted analysis is precisely how we formulate Trefis portfolio strategies. If you seek upside with less volatility than an individual stock, consider the High Quality portfolio, which has outperformed its benchmark—a blend of the S&P 500, Russell, and the S&P midcap index.