Key News

Asian equities rebounded overnight as yesterday’s AI bubble kerfuffle was short-lived.

Nvidia’s Jensen Huang said that China could win the AI race due to loose regulations and cheap energy at the Financial Times’ Future of AI Summit. Huang’s comments gave a strong tailwind for Mainland China and Hong Kong-listed growth stocks. I have been advocating that investors consider China’s green technology, as AI’s strong energy demand aligns with China’s low electricity costs, which are driven by renewables such as solar, wind, hydro, and nuclear.

Coincidentally, yesterday on X, a Goldman Sachs Investment Research piece showed that China is currently building 29 nuclear reactors, compared to India’s six and zero in the US. China has 58 nuclear reactors in operation, accounting for approximately 5% of its electrical output. The US has 94 nuclear reactors, accounting for ~18% of its electrical output, which is higher than I would have thought.

Hong Kong had a broad rally, although volumes were a touch light, as growth stocks rebounded, led by internet stocks, semiconductors, autos, electric vehicles, EV batteries, technology hardware, and non-ferrous metals. It was a broad rally, with insurance performing well alongside machinery and coal. Mainland investors bought $704mm of Hong Kong stocks, with the Hang Seng Tech ETF, seeing strong inflow.

Alibaba rose +4.1% as the company’s booth at the World Internet Conference Expo featured Quark AI-enabled glasses and Ding Talk AI, which attaches to cell phones, allowing for 45 hours of AI-enabled phone calls, communication transcription, and analysis. Alibaba also announced a partnership with GE Healthcare on utilizing its AI in CT scanners. XtalPi rose 8% after announcing it would work with Eli Lilly on AI-driven drug development, according to Bloomberg. A Goldman Sachs report that Xiaomi’s +0.28% recent 50% increase in short interest attracted attention overnight. The company reports Q3 on November 19th, with analysts expecting 22% revenue growth YoY and adjusted net income +61% YoY.

After the Hong Kong close, BeOne Medicines (formerly Beigene) gained +1.62% after announcing Q3 financial results that beat analyst expectations, as revenue increased +40% YoY, driven by strong sales of its blood cancer drug Brunkinsa. EPS swung to profitability for the first time in three years, and guided full year 2025 revenue from $5.1 billion to $5.3 billion. After the close, Hua Hong Semiconductor gained +9.05% after reporting Q3 financial results that beat analyst expectations on revenue that increased +21% YoY, though the company missed on net income, down -45% YoY, and Q4 revenue guidance. Mainland China’s rally wasn’t as broad, though growth took the lead, as semiconductors, non-ferrous metals, autos, auto components, and pharmaceuticals all outperformed. It was a fairly quiet night otherwise!

It was high times last night for index geeks as MSCI released its pro forma for the November Semi-Annual Index Review. China’s weight will remain the same, up +0.01% to 29.7% of the Emerging Markets Index, as the 560 stocks are a little less than half of the index’s 1,196 holdings. Notable additions include Zijin Gold International, following its Hong Kong IPO, and Hua Hong Semiconductor. China’s weight is more than 2.5 times that of all of EM Europe, the Middle East, and Africa (EMEA), and 4 times that of EM Latin America. It’s hard not to notice that Argentina is not part of the MSCI indices due to its historic capital controls. I wonder if that could be on Milei’s agenda.

Live Webinar

Join us Wednesday, November 12th at 10 am EST for:

China Q3 Update: Tech Leads Bull Market, Trade Deal Updates, & New Goals Set In 15th Five-Year Plan

Please click here to register

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

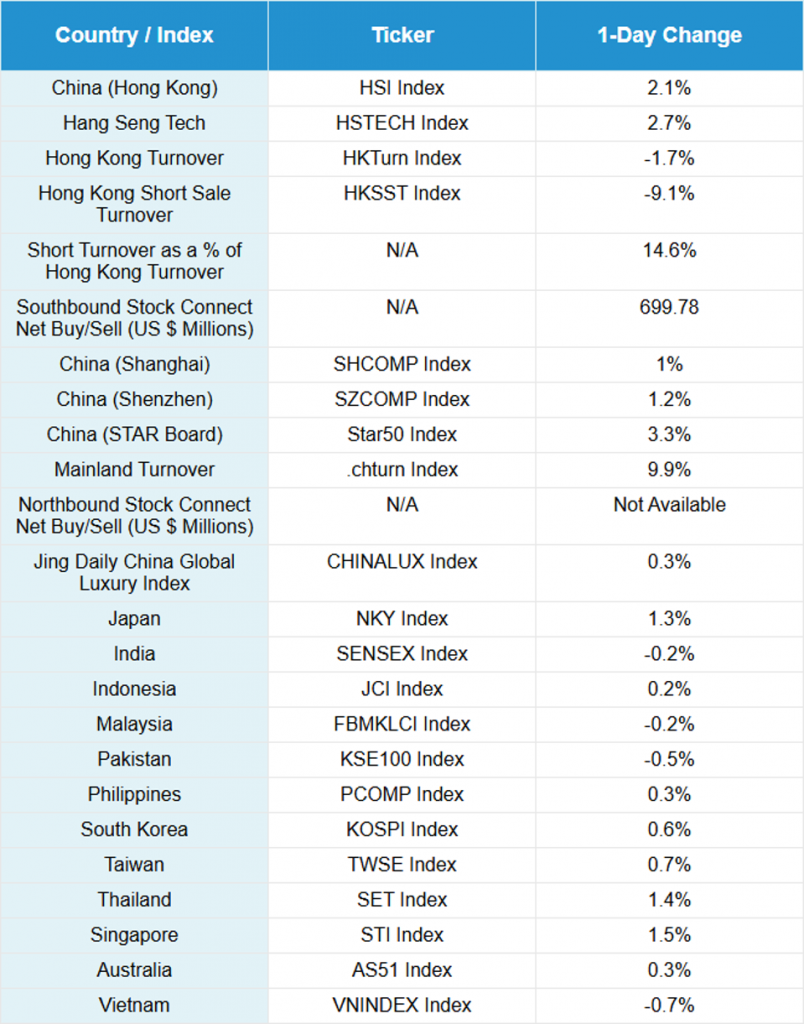

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.12 versus 7.12 yesterday

- CNY per EUR 8.20 versus 8.18 yesterday

- Yield on 10-Year Government Bond 1.81% versus 1.80% yesterday

- Yield on 10-Year China Development Bank Bond 1.87% versus 1.88% yesterday

- Copper Price +0.63%

- Steel Price +0.10%