Some of our favorite bond funds (yielding 8%+) just took a header. And it’s setting up the best buying opportunity we’ve seen in nearly three years for CEF investors.

We can thank panicked mainstream investors for our shot here.

CEF Investors Are Ultra-Conservative (and Easily Spooked)

This opportunity is coming to us in closed-end funds, which we love for a lot of reasons—not the least of which is the fact that they’re a small corner of the market.

As of the end of 2024, there were just 382 CEFs out there, with $249 billion in assets among them. Compare that to roughly $11 trillion in ETFs, as of the end of June. The CEF market’s small size keeps institutional players out, leaving these funds mostly in the hands of everyday investors.

And weak hands they are!

There’s a very predictable pattern of these investors (typically on the conservative side) getting spooked out of their holdings at any hint of bad news. It’s a pattern we can easily play—and we’ve got another shot now.

The trigger? The recent collapse of auto-parts supplier First Brands and subprime car-loan lender Tricolor. Both sparked worries of cracks in private credit markets.

JPMorgan Chase & Co. (JPM) CEO Jamie Dimon—never one to pass up a chance to play the Prince of Darkness—piled on, commenting that, “When you see one cockroach, there are probably more.”

History Repeats

Weak-handed investors worry that smaller banks’ credit issues are resurfacing—echoes of March 2023, when Silicon Valley Bank collapsed. That turned out to be a buying opportunity.

And we have its sequel in front of us now—with a few key differences (all of which work in our favor).

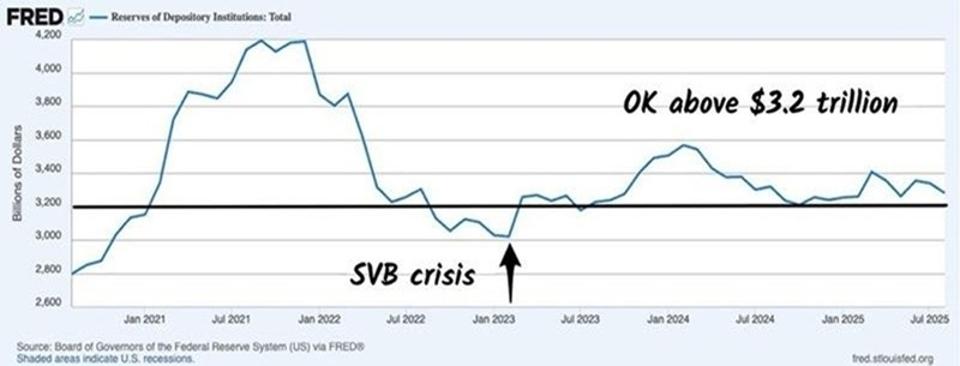

Back then, aggregate bank reserves had plunged near $3 trillion, a danger zone for liquidity. The Fed was raising rates and beginning “quantitative tightening”—letting government bonds “roll off” its balance sheet.

Today bank reserves are healthy at $3.3 trillion. The Fed is cutting rates and, following last week’s Federal Open Market Committee meeting, said it would end quantitative tightening on December 1. Plus, as we discussed in last Tuesday’s article, Uncle Sam is buying Treasuries, putting downward pressure on long-term rates.

In other words, liquidity is plentiful. This money will keep flowing into bank balance sheets, cushioning credit markets and, by extension, high-yield bonds.

And yet, “first-level” investors are selling off high-yield bond CEFs, just as they did in March 2023.

CEF On Sale #1: Western Asset High Income Fund II (HIX)

Take the Western Asset High Income Fund II (HIX), which holds about 62% of its portfolio in US-based high-yield corporate bonds.

Over the last few weeks, the fund has seen its market-price-based return (in purple below) slip as worried investors sold. Meanwhile its NAV return—or the return of its underlying portfolio, in orange—has sailed along:

The result is that the fund, which had been trading around par for most of the year (save for the April “tariff tantrum,” another episode the first-level crowd overreacted to), trades at around a 2.7% discount to NAV as I write this. Not bad!

This is a pattern we’ve seen across many of the bond funds in the portfolio of our Contrarian Income Report service. And it’s why I’m urging investors to buy them now.

CEF On Sale #2: RiverNorth/DoubleLine Strategic Opportunity Fund (OPP)

And consider this example: The RiverNorth/DoubleLine Strategic Opportunity Fund (OPP), which holds 52% of its portfolio in investment-grade debt and is managed in part by our man the “Bond God” Jeffrey Gundlach.

OPP yields 14%, but its weighting toward investment-grade debt (where bargains are harder to find), and its relatively small size (around $213 million in assets, as of October 28) are two reasons why we don’t recommend it in Contrarian Income Report.

Nonetheless, the fund does offer low volatility, with a five-year beta-rating of 0.64, meaning it’s 36% less volatile than the S&P 500.

No matter. Investors dumped it anyway. Check out the dip in OPP’s market-price-based return (in purple below) over the last few weeks, while its portfolio (in orange) has—you guessed it—motored along.

The result: an 8.5% discount, as of this writing, that’s well below the fund’s five-year average of 6.2%.

In a way, this is easy to understand: OPP’s focus on investment-grade debt means it’s likely held by more-conservative investors. In other words, the folks most likely to sell on the first negative headline.

Something similar happened to OPP back in March and April of 2023. Back then, its discount bottomed out at 16%. That, too was a buying opportunity:

A 39% gain in two-and-a-half years! That’s a huge move for a bond fund, especially one weighted to investment-grade credit. And every pullback since has been a buying opportunity.

That’s the beauty of CEFs: When a big discount appears, we look deeper.

If it’s the result of the mainstream crowd selling in a panic, while NAV is chugging along, that’s almost always a great time to buy. This is the kind of window this private-credit “crisis” is giving us now.

Brett Owens is Chief Investment Strategist for Contrarian Outlook. For more great income ideas, get your free copy his latest special report: How to Live off Huge Monthly Dividends (up to 7.6%) — Practically Forever.