Artisanal Small Scale Mining (ASM) is emerging as a credit investment opportunity and potentially an asset class in its own right with superior relative value characteristics.

ASM is a low-tech, labor-intensive, informal mining sector where valuable metals are exploited for high-added value global industrial applications. Manual extraction processes are slow and fraught with risk for the miners, but the operating margins are phenomenal. According to the October 2025 issue of Mining Technology, the five rarest metals, and their corresponding market prices per troy ounce, are Rhodium ($8000), Iridium ($4,500), Gold ($4,000), Platinum ($1,600) and Palladium ($1,500).

To put these prices in economic context: If Rhodium were baker’s flour, a loaf of bread would cost $4 million to bake, whereas the labor is dirt cheap. A typical miner’s monthly earnings are well under $600 globally and less than $200 in Africa.

Unstoppable Demand Drives ASM’s Credit Potential

ASM investing doesn’t fit the classic profile of an asset class suitable for debt capital market finance. It is too risky, too fragmented, too technical, too far out-of-the-mainstream for mainstream U.S. and European institutional investors: pension funds, insurance companies, banks or asset managers.

Today the supply chains for gold, silver, palladium, platinum, and some base metals feed into the global commodity exchanges like London Metals, Chicago Mercantile, and Shanghai Gold, where the end product is traded. But no ready-made credit infrastructure exists to support the supply chains via the issuance of ASM bonds. Also, the supply chain’s primary stakeholders–the miners themselves–have no natural economic representation or sponsorship.

This structural arrangement contributes to the perception of ASM as unbankable. And if cheap labor were the industry’s main business driver, the credit case for ASM would be untenable.

The Credit Implications Of Demand-Led Profitability

But ASM is demand-led, not supply-led. And, recent events in the global political economy are changing the perception of both risk and opportunity in ASM.

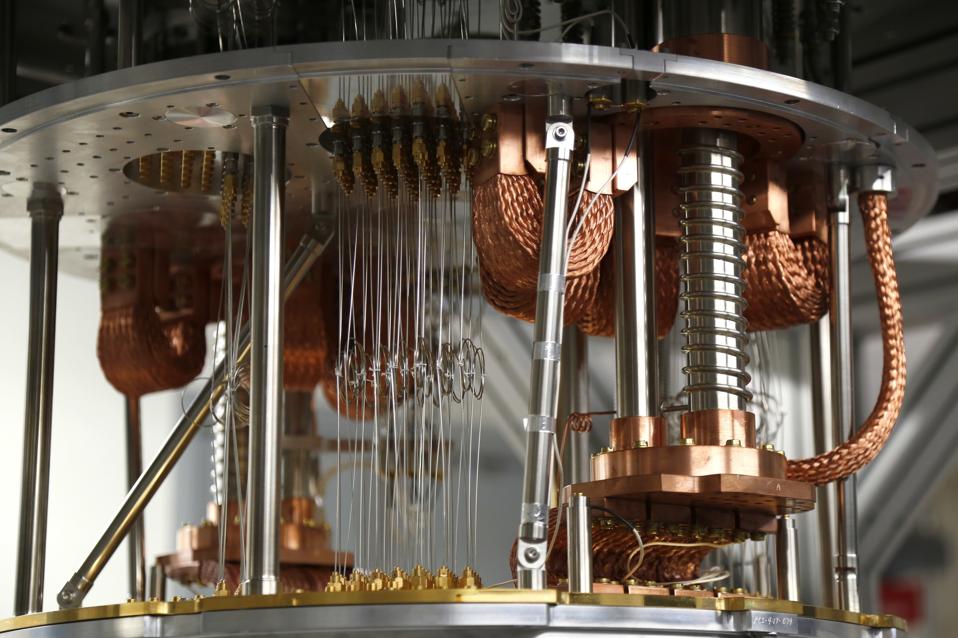

Demand for rare elements is rising in response to clean energy transition technologies, consumer electronics, quantum computing and defense manufacturing. Financing for supply to match the demand is lagging.

The International Energy Agency (IEA), an autonomous intergovernmental agency within the OECD, predicts robust demand for industrial-use rare earth minerals through 2040 and beyond. That is because rare earth element inputs are essential to an assured continued future for advanced computing and clean energy. According to the IEA, an additional $500 billion of capital for investment is needed to meet demand.

The economic case for investing in ASM is clear. Artisanal small scale mining is both the sweet spot and the choke point for industrial supply to meet the demand for precious metals and rare earth elements.

Investment in upgraded technology, professionalism and working conditions would build the capacity that creates commercially desirable outcomes: elevated commodity output, quality control, enhanced supply chain predictability, stabilized contingent liabilities and costs. Such changes would dramatically improve the credit optics for small-scale global mining.

ASM: The Global Mining Industry’s “Craft Beer” Sector

In a pure credit perspective, it makes sense to see the mining industry by analogy with the beer industry. Large-scale mining operates on a massive scale with significant access to capital, advanced technology, complex infrastructure and significant political clout.

A recent S&P mining sector report showed over one-third of the 131 companies they rate are Investment Grade. Household names involved in raw materials extraction (upstream) include Korea Mine Rehabilitation and Mineral Resources Corporation ( A+), Glencore PLC, Barrick Mining Corp, Newmont and Grupo Mexico S.A.B. de C.V. (all BBB+). The rest are Speculative Grade, from BB+ to CCC-, with risky financial profiles and exposure to developing market economies where the sovereign’s creditworthiness may cap the rating (see my Forbes comments here and here). Yet despite these risky profiles, they continue to operate.

The small, informal mining sector consists of 45 million artisanal miners spread out over nearly 100 countries. They produce critical and precious minerals, gems and construction materials in economically significant quantities—including 20% of gold and 85% of sapphires, copper, cobalt, nickel, and other critical minerals, according to The Blended Capital Group’s Rob Karpati, who once managed process integration and transformation within DuPont’s global finance teams.

Karpati observed: “ASM work is clustered in places where life is harder: Peru, DRC and Zambia. It is legal in some places, illegal in others. Some operations are the worst of the worst in terms of child labor or forced labor. In other places, it’s decent.”

The Evolving Perception of Capacity-Building As A Credit Value Play

Given their obscurity, low upstream margins, lack of glamor and their sheer heterogeneity, the odds of building a debt capital market for ASM would appear to be remote. But as the world turns, perceptions change. China’s rising dominance is creating geopolitical incentives for the U.S. to winnow its way into these assets.

One way to compete with the entrenched players is by offering better terms. A smart way to marshal funding is to reframe the ASM investment opportunity as the commercially attractive, exotic asset it is by investing making upstream value more predictable: more creditworthy. The methods for it exist. They simply haven’t been deployed before the political and market incentives to work smarter materialized.

The ASM credit opportunity is also being shaped by new trends in the environmental, social and governance space. Paradoxically, ASM is getting a new look just when sustainable investing has officially fallen out of favor. Since the U.S. Agency for International Development closed their doors July 1, 2025, seasoned professionals with the skills and networks for grassroots development that traditional banks lack have begun polishing and repurposing their know-how for bond markets.

ASM: A Credit Value Opportunity To Outshine Private Credit In 2026?

Right now I am hearing about new concepts being hashed out by experienced credit professionals with boots-on-the-ground experience in Africa, Latin America and the U.S., who are coming together and forming new teams—far from where mainstream credit conversations take place. It may take another six-months for their idea pipelines to be established as offerings and another year for deals to come to market. Not every idea will be feasible. But by comparison with the hand-wringing over “cockroaches” coming out of private credit markets, some ASM credit opportunities may actually offer good relative value.