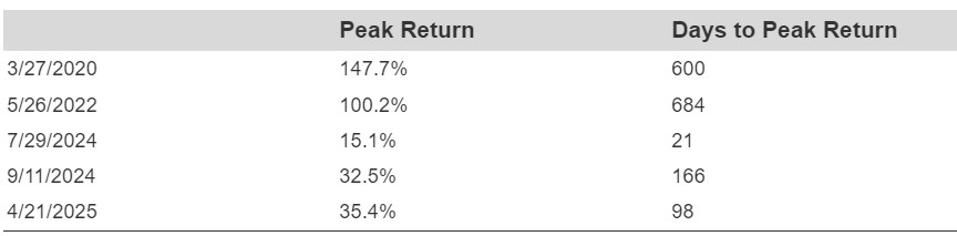

DexCom (DXCM) stock ought to be included on your watchlist. Here is why – it is presently trading within the support range ($55.31 – $61.13), levels from which it has bounced significantly in the past. Over the last 10 years, DexCom stock attracted buying interest at this level 5 times and subsequently produced an average peak return of 66.2%.

However, is the price movement sufficient on its own? It definitely supports the case if the fundamentals are solid. For DXCM, read Buy or Sell DXCM Stock to evaluate how compelling this buying opportunity could be.

Markets fluctuate. Quality endures. Discover how High Quality Portfolio maintains its equilibrium.

Below are some quick data points for DexCom that should assist in decision-making:

- Revenue Growth: 9.3% LTM and a 17.3% average over the last 3 years.

- Cash Generation: Almost 13.3% free cash flow margin and a 16.0% operating margin LTM.

- Recent Revenue Shocks: The lowest annual revenue growth for DXCM in the last 3 years was 9.3%.

- Valuation: DXCM stock is valued at a PE multiple of 39.9.

For a quick overview, DexCom offers continuous glucose monitoring systems, which include the next-generation G7 CGM, developed, designed, and made available for use in the U.S. and abroad.

What Is Stock-Specific Risk If The Market Crashes?

DXCM isn’t exempt from significant declines. It dropped nearly 87% during the Global Financial Crisis and suffered a decline of around 48% in the 2018 correction and 58% during the inflation spike. The Covid pandemic even resulted in a drop of close to 37%. While favorable conditions are significant, history indicates that this stock can still experience severe downturns when the market turns.

Yet, the risk is not confined to major market crashes. Stocks can decline even when markets are performing well – consider occurrences such as earnings reports, business updates, and changes in outlook. Check DXCM Dip Buyer Analyses to see how the stock has recuperated from sudden dips in the past.

The Trefis High Quality (HQ) Portfolio, featuring a selection of 30 stocks, has consistently shown a track record of comfortably exceeding its benchmark, which includes all three – the S&P 500, S&P mid-cap, and Russell 2000 indices. What is the reason for this? As a collective, HQ Portfolio stocks have delivered higher returns with reduced risk compared to the benchmark index; offering a more stable ride, as reflected in HQ Portfolio performance metrics.