Key News

Asian equities had a strong start to the week and month despite a slightly firmer US dollar, except for Japan, which was closed for Culture Day.

The US and China eased tariff and rare earth export controls following the Trump-Xi meeting. The US and Chinese militaries reinstating lines of communication is an understated positive. Sure, we had Treasury Secretary Bessent flexing on tariffs, though that’s meant for a domestic audience. Far more important were President Trump’s positive comments on China and President Xi on 60 Minutes. Have you seen the White House’s Trump Xi video on X and Twitter? In poker, they call that a tell.

The October privately tracked purchasing manager’s index (PMI) survey for manufacturing, compiled by Rating Dog and formerly by Caixin, was released overnight. The Manufacturing PMI was 50.6 versus September’s 51.2 and expectations of 50.7, as employment increased from September. The PMI did not meet expectations, though only six economists provided an estimate.

OPEC’s anticipated production cut lifted the energy sector in Hong Kong, where it gained +2.86%, and Mainland China, where it gained +2.48%, which inserted a value bias into today’s market action. Hong Kong grinded higher on strong breadth, though volumes were a touch light.

Growth heavyweights were off on no news, as Alibaba fell -1.15%, Tencent fell -0.16%, CATL fell -0.63%, and Semiconductor Manufacturing International (SMIC) fell -2.87%, though Xiaomi gained +3.52% after President Xi gave Korea’s Lee one of their phones. Internet media and entertainment stocks had a good day, with Kuaishou up +1.52% and Tencent Music Entertainment up +1.5%. Financials, including banks, insurance, and capital markets companies were higher. General autos and electric vehicles (EVs) were mixed based on October sales data. BYD fell -1.49% despite selling 441,706 EVs and hybrids, which represents a decline of -12.13% YoY and +11.47% month-over-month (MoM).

There were a couple of new product updates in the robotics and autonomous fields overnight. Xpeng gained +4.59% as it moves closer to mass production of its flying car called Aridge and humanoid robot mass production beginning in 2026. Midea fell -1.9% despite the company debuting its Mei La housekeeping humanoid robot that is due to arrive in two to three years. How do I get on the early delivery list?

Precious metals were off on China’s retail gold value-added tax (VAT) rules, which effectively increase the tax on gold purchases.

Baidu gained +0.77% after reporting more than 250,000 autonomous taxi rides last week, which brings the total cumulative rides to 17 million across twenty-two cities. Baidu’s Apollo Go reports one airbag deployment for every 10.14 million kilometers (6.3 million miles) versus Waymo’s one per 4.54 million kilometers. Human drivers experience 1.65 airbag deployments per million miles versus Waymo’s 0.35, which is 79% lower, and Baidu’s 0.16 per million miles.

Auto and auto parts maker Seres Group’s Hong Kong IPO will raise $1.8 billion, with more than 300 institutions participating. Pony.ai’s Hong Kong IPO will be priced at HKD 139.

It was a similar situation on the Mainland as Hong Kong in terms of value sectors outperforming growth. Energy and financial names were strong, while semiconductors, autos, and non-ferrous metals names were all weak. Technology hardware and clean energy were mixed, as Foxconn gained +4.01% and LONGi gained +6.77%.

Shanghai will host the 8th Annual China International Import Expo starting on Wednesday, which will kick off with a speech from Premier Li.

The quarterly holdings of the “National Team”, institutional investors associated with China’s sovereign wealth, which include China Securities Finance Co., Central Huijin Investment, CSF Asset Management, and the Social Security Fund, were released. The three investment managers held 800 stocks at the end of the third quarter, including 33 with the value held exceeding RMB 10 billion. The three largest holdings are the Agricultural Bank of China, with a value of RMB 1.1 trillion held, the Bank of China, with a value of RMB 1.03 trillion held, and ICBC, with a value of RMB 1.02 trillion held, as these stocks make up a significant percentage of Mainland indices. LONGi, Mindray, and BYD were also Among the growth stocks owned.

The Wall Street Journal (WSJ) had a good article titled “How the U.S. Economy Has Defied Doomsday Predictions on Tariffs”. Companies using their pandemic-inflated prices to eat margins and far more exemptions occurring than headlines acknowledge are among the interesting insights.

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

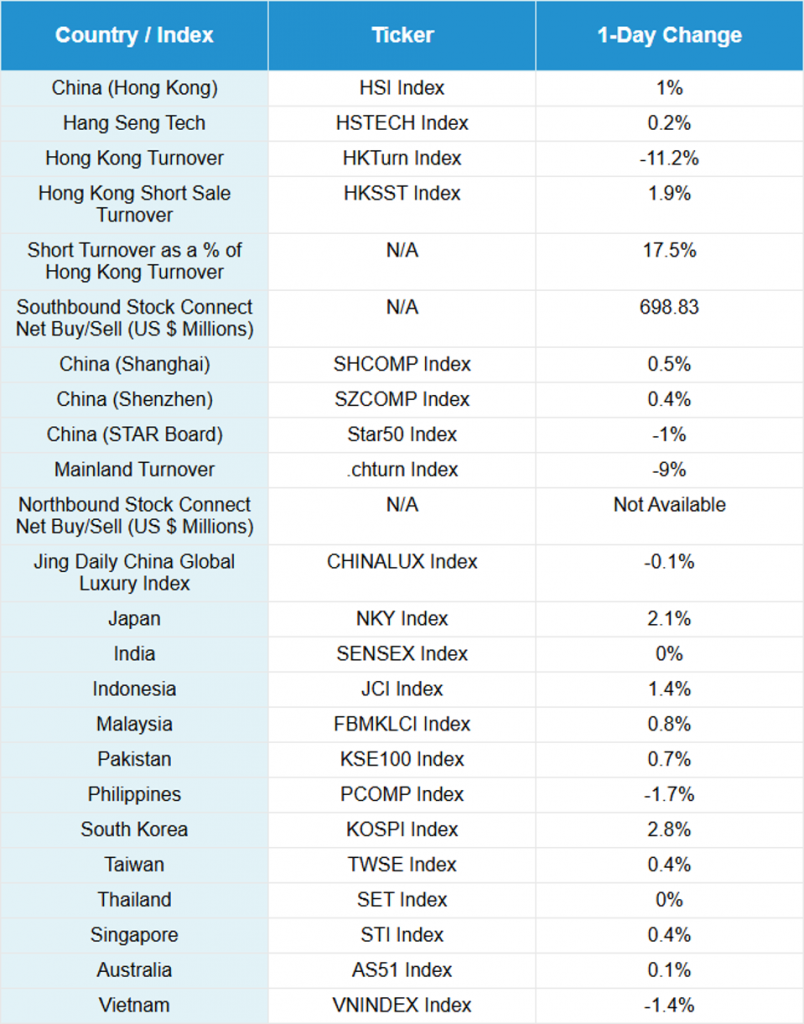

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.12 versus 7.12 yesterday

- CNY per EUR 8.20 versus 8.20 yesterday

- Yield on 10-Year Government Bond 1.79% versus 1.80% yesterday

- Yield on 10-Year China Development Bank Bond 1.87% versus 1.87% yesterday

- Copper Price -0.15%

- Steel Price -0.68%