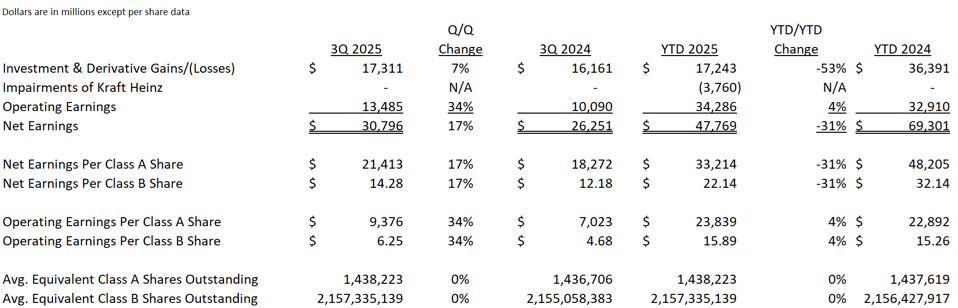

Berkshire Hathaway (BRK/A, BRK/B) reported third-quarter earnings of almost $30.8 billion, above the $26.3 billion in the same quarter of 2024, due to better operating profits and a larger gain in stocks. Operating earnings, which remove the distortion from market changes and better reflect the firm’s earnings power, rose by 34% for the quarter versus 2024. Per-share operating income decreased by 34% for the quarter, with no share repurchases over the past year. Warren Buffett leads Berkshire as CEO and Chairman with Greg Abel, Vice Chairman of Non-insurance, and Ajit Jain, Vice Chairman of Insurance.

Berkshire’s most significant business by operating earnings is insurance, followed by the manufacturing, service, and retailing (MSR) segment.

Insurance underwriting, the BNSF railroad, and the manufacturing, service & retail segment were the primary drivers behind the robust growth in operating earnings. Buffett noted at the annual meeting that Berkshire’s insurance earnings were as good as they get in 2024, so doing almost as well this year is an impressive result. Other income rose significantly, primarily due to accounting for foreign currency (FX) swings on Berkshire’s non-dollar borrowing. Excluding the FX impact on the “other” segment, operating earnings were 17% higher.

Insurance

The two most essential concepts in insurance investing are “float” and underwriting profit. In simple terms, float is created for insurance companies because insurance premiums are paid before any claims are made by the insured. Insurance companies can invest the float, sometimes for years, before reimbursing insurance losses. Berkshire’s float is $5 billion higher than on December 31, 2024, at $176 billion. In general, the value of float increases as yields rise since an insurance company can earn more when investing the cash. Float per share was $122,373, above the $118,897 level at the end of 2024. Share repurchases did not aid float per share growth over the past year.

Significantly, policies in force at GEICO grew in the first three quarters of the year. Unlike many insurance companies, Berkshire has a history of earning underwriting profits, meaning its float costs nothing and generates income, allowing it to earn a profit from investing the float. Berkshire has three main insurance businesses: GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group. All three had a profitable underwriting quarter. Underwriting profit is the positive difference between the insurance premium and all insurance claims and expenses. For example, GEICO had a combined ratio of 84.3% in the third quarter, meaning that only 84.3 cents of every dollar of insurance premiums was spent on losses and expenses. A combined ratio above 100% indicates that an insurance company has an underwriting loss.

For the third quarter of 2025, investment income was 13% below 2024, primarily due to lower short-term interest rates and capital distributions from Berkshire’s insurance subsidiary at the end of 2024.

Railroad

Berkshire owns one of the largest railroads in North America, the Burlington Northern Santa Fe (BNSF) railroad, which operates in the US and Canada. Railroad freight volume improved modestly, and operating earnings rose about 5% versus the same quarter last year. On a positive note, BNSF continued to see improved productivity, which was the primary driver of this year’s earnings improvement. BNSF’s trailing 12-month operating ratio —operating expenses divided by revenue —continued to improve in the third quarter, demonstrating productivity gains. Berkshire has continued to make progress after Buffett noted at the annual meeting that the “railroad is not earning what it should,” but is “getting solved.”

Utilities and Energy

BHE should generally provide steady, growing earnings, as it primarily consists of regulated utilities and pipeline companies. In addition, BHE typically generates significant tax credits from its renewable energy generation. For this reason, Berkshire focuses on after-tax earnings, which is “how the energy businesses are managed and evaluated.”

BHE was negative on the headline numbers, with operating earnings falling 16.3% year over year. Berkshire set aside another $100 million in the third quarter of 2025 for wildfire loss accruals in its US utilities segment. Even excluding this accrual, the quarterly results were 10.6% below last year. The decrease in earnings from natural gas pipelines was primarily due to higher interest expense, lower margins, and lower other income. The other energy businesses saw earnings decline, primarily due to lower profits at Northern Powergrid.

Manufacturing, Service and Retailing (MSR)

Pretax earnings grew by 7.9% versus the same quarter last year. This segment comprises many diverse companies, so this analysis will focus on the best and worst performers and the themes within it.

Within the industrial segment, Marmon, “which consists of more than 100 autonomous manufacturing and service businesses, internally aggregated into twelve groups, and includes equipment leasing for the rail, intermodal tank container and mobile crane industries,” saw a 19.7% increase in pretax earnings. The improvement was primarily due to “Rail & Leasing, Transportation Products, Retail Solutions and Plumbing & Refrigeration groups.”

Elsewhere in the manufacturing segment, the building and consumer products groups accounted for further growth in pretax income. Within the building products segment, Clayton Homes reported higher revenue and pretax income due to “increases in financial services earnings.” Despite the better earnings in the building segment, Berkshire noted that some of their “building products businesses are experiencing slowing customer demand, as well as pricing pressures, attributable to prevailing general economic conditions and residential housing markets.”

Unfortunately, the improvement in consumer sector earnings was due to the recognition of US tax credits rather than a fundamental business improvement. The decline in consumer products earnings was primarily due to Forest River, Fruit of the Loom, Jazwares, and Duracell, while Brooks Sports posted better earnings.

The service group saw a 19.2% increase in pretax earnings for the quarter, primarily attributable to the aviation services and TTI.

The retailing group reported lower pretax earnings, down 1.9% for the quarter. The most critical portion of the retailing segment is Berkshire Hathaway Automotive (BHA), which owns over 80 auto dealerships. BHA reported 1.8% higher earnings than in the third quarter of 2024. Pretax profits for the remainder of the retailing group declined by 22.7%, due primarily to “sluggish customer demand.”

Pilot Travel Centers (PTC) is the largest operator of travel centers in North America under the Pilot and Flying J brands. On January 16, 2024, Berkshire acquired the final 20% and now owns 100% of the entity. PTC’s pretax earnings decreased 107.8% due to “lower wholesale fuel and in-store gross margins and higher selling, general and administrative expenses.” McLane’s pretax earnings were 19.3% higher thanks to “increases in the overall gross margin rates, partially offset by higher selling, general and administrative expenses.”

Non-Controlled Businesses & Other

This segment includes companies’ profits that must be accounted for under the equity method due to the size of ownership and influence on management. The after-tax equity method earnings have Berkshire’s proportionate share of profits attributable to its investments in Kraft Heinz (KHC), Occidental Petroleum (OXY), and Berkadia. Berkshire is Occidental Petroleum’s largest shareholder, with a 26.9% stake. More about the reasons for the Occidental investment is here.

The segment experienced a significant positive reversal in operating earnings for the quarter, primarily due to higher investment income and foreign currency exchange rate gains generated from bonds issued by Berkshire Hathaway and denominated in British Pounds, euros, and Japanese Yen. These foreign currency swings are not a concern as Berkshire has significant assets and earnings denominated in these foreign currencies. The interest income improved due to “increased investments in U.S. Treasury Bills, which derived largely from subsidiary dividends.” Investment gains from non-U.S. dollar investments generally offset some of these losses and vice versa, depending on currency exchange rates. Acquisition accounting expenses are also reflected in this segment. These expenses result from amortizing intangible assets associated with companies acquired by Berkshire. Finally, the loss in other earnings includes “unallocated general and administrative expenses, interest expense, income tax expense and interest income on certain intercompany loans.”

Investment Portfolio

Berkshire’s insurance company investment portfolio is currently 51% publicly traded stocks, with 45% in cash.

Berkshire was a net seller of $6.1 billion in publicly traded stocks in the third quarter, the twelfth straight quarter of Berkshire Hathaway’s net sales of stocks. Berkshire bought $6.4 billion of stocks while selling $12.5 billion. The upcoming 13F filing on November 14 with the SEC will provide more specific buy and sell details, but a clue in the current filing points to possible further trimming of Berkshire’s Apple (AAPL) position.

Summary And Scorecard

Berkshire’s stock price underperformed the S&P 500 in the third quarter, rising by 3.5% versus a total return of +8.1% from the S&P 500. Year-to-date through October 31, Berkshire’s price was +5.1%, while the S&P 500 had a total return of +12.3%.

Short-term results are generally not meaningful for Berkshire, which is managed with a focus on increasing long-term value rather than meeting quarterly hurdles. This ability to exploit time arbitrage has served the company and its shareholders well over the years. The goal in reviewing the results is to assess whether the segments are generally operating as expected and to consider Warren Buffett’s capital allocation decisions.

Previously, Buffett provided a handy blueprint for Berkshire’s management goals. The first goal would be to “increase operating earnings.” Secondly, success in the “decrease shares outstanding” goal would boost operating earnings per share faster. Lastly, “hope for an occasional big opportunity,” allowing for a sizable cash investment at an attractive expected return. This analysis will use Buffett’s blueprint as a lens through which to evaluate how Berkshire is performing.

Increase operating earnings: Trailing 12-month operating earnings were an impressive 17.9% higher than last year’s same quarter. Buffett says that operating earnings are the “most descriptive” way to view Berkshire, as they remove the short-term volatility of market fluctuations from net earnings.

Decrease shares outstanding: Particularly since 2018, a significant capital allocation decision has been made to increase share repurchases. When Berkshire Hathaway actively repurchases shares, it signals when Buffett believes its share price is below his intrinsic value estimate. If he is correct, the purchases are a value-creator for the remaining shareholders. Berkshire has stated that it would not repurchase stock if doing so would cause cash levels to fall below $30 billion, so the firm’s safety will not be compromised. Berkshire has not repurchased stock for the last six quarters.

Until an announcement in mid-2018, Berkshire had repurchased stock only when the stock traded at less than 1.2 times the price-to-book (P/B) ratio. While that constraint is now relaxed, it remains a good indicator of the general range of when aggressive repurchases are likely to occur. Berkshire’s price-to-book ratio remained elevated during the quarter, so share repurchases were suspended. Berkshire only intends to repurchase shares when the “repurchase price is below Berkshire’s intrinsic value, conservatively determined.” The price-to-book ratio remains a reasonable proxy for gauging Berkshire’s intrinsic value. The stock repurchases in the first quarter of 2024 were likely done at around 1.4 to 1.5 times book value. Berkshire’s stock traded between 1.5 and 1.64 times book in the third quarter, so it flirted with a level where some repurchases could be seen. With the recent decline in the shares, the valuation is nearing a level where repurchases might restart. Still, Warren Buffett’s judgment about its intrinsic value relative to other uses of capital can differ from the simple price-to-book ratio.

A longer-term view of the positive impact of Berkshire’s share repurchases is illuminating. Since the start of more aggressive share repurchases in 2018, Berkshire’s operating earnings have grown at a 17.0% compound growth rate, while operating earnings per share have done 2.1 percentage points better at 19.1%. Eagle-eyed readers might notice that operating earnings growth oddly exceeded operating earnings per share growth over the last year. Berkshire issued shares to purchase the remaining stake in Berkshire Hathaway Energy (BHE) in October 2024

Hope for an occasional big opportunity: Berkshire has a fortress balance sheet with cash and equivalents of $381.7 billion. Cash as a percentage of Berkshire Hathaway’s size is at the highest on record, at 31.1%. Though this analysis quotes the cash levels listed on the balance sheet at the end of the quarter, there was an accounts payable of $23.2 billion for the purchase of Treasury Bills, so the total cash should be considered to be slightly lower at $358.4 billion. In any case, the narrative remains unchanged. This cash hoard provides flexibility to take advantage of opportunities, including repurchasing its stock if the price declines to attractive levels.

Share repurchases had been off the table at the elevated valuations, but an additional lever for Buffett to create value might soon return. Shareholders should take comfort in knowing that the firm is well-positioned to withstand and emerge stronger from any tariff shocks, recession, or market downturn, thanks to its financial resilience, which enables it to capitalize on opportunities during a crisis.

On October 2, Berkshire announced the relatively small acquisition of OxyChem from Occidental Petroleum (OXY) for $9.7 billion.

Buffett announced at the end of the annual meeting in May that he planned to step down as CEO at the end of the year. Greg Abel will assume the CEO role and have the “final word on operations or capital deployment.” Notably, Buffett will remain Chairman to provide any needed guidance and intends to retain all his shares in the company. The Wall Street Journal recently reported that Buffett will also turn over the authorship of the February annual letter to Greg Abel or take questions at the annual meeting in May. However, he plans to still publish his Thanksgiving letter on November 10.

Some are attributing the relative weakness in Berkshire’s share price to Buffett’s announcement of leaving the CEO role, but the proximate cause likely lies elsewhere. Investors flocked to Berkshire stock as a haven when the odds of recession soared with the tariff threat. As the fear of recession receded, some investors re-allocated to other stocks, and Berkshire’s valuation had become stretched in May.

Summary Conclusions

Berkshire’s quarterly operating earnings soared year-over-year. While operating earnings were flattered by a significant foreign currency gain, even excluding that unsustainable tailwind, operating profits still grew by an impressive 17% year-over-year. Among the significant businesses, the only disappointment was Berkshire Hathaway Energy (BHE). For the third quarter, BHE accrued another $100 billion toward wildfire litigation and had a significantly lower income tax benefit. Insurance underwriting, the railroad, and the manufacturing, service & retail segment were the primary forces behind the better results. The manufacturing, service, and retailing segment was surprising, with 7.9% year-over-year operating earnings growth, primarily driven by the manufacturing businesses. The insurance underwriting results show that one of Berkshire’s crown jewels, GEICO, is back in profitable growth mode with policies in force continuing to rise.