Week in Review

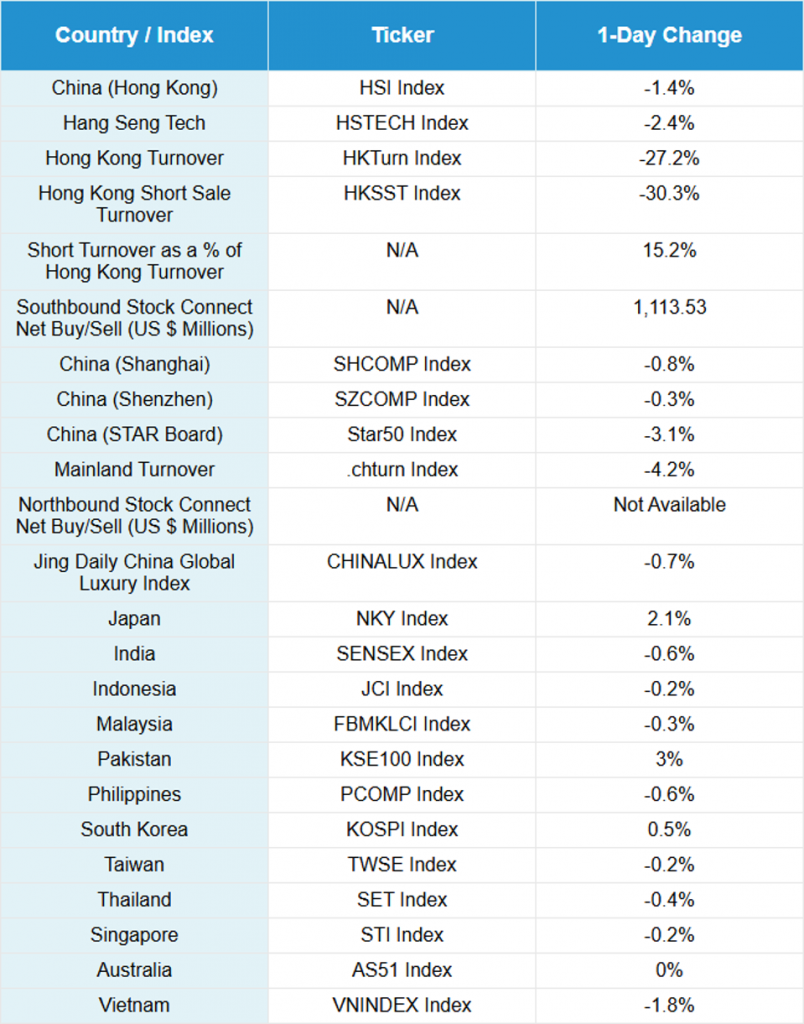

- Asian equities were mostly lower for the week as Japan and Korea outperformed, while Mainland China’s STAR Board and Vietnam underperformed.

- Presidents Trump and Xi met held a closed-door meeting in South Korea on Thursday, which resulted in the suspension of multiple tariffs and export controls for one year and the resumption of China’s purchases of US soybeans.

- The draft of China’s 15th Five-Year Plan was released on Tuesday and included special emphasis on artificial intelligence technology and self-reliance.

- Earnings season for Mainland-listed companies has begun, with notable reports this week from Luxshare, which increased net profit by 32% in the third quarter year-over-year (YoY), and Foxconn Industrial Internet, which announced a third quarter net profit surge of 62% YoY.

Key News

Asian equities were mixed, as Japan and South Korea outperformed, while Mainland China and Hong Kong underperformed.

“Buy the rumor and sell the news” appears to have been a factor in Hong Kong’s weakness, as the Trump-Xi truce underwhelms, meeting the base case in the short-term. US Trade Representative Greer’s comments on continuing China’s adherence garnered attention from the perpetually negative Western media. Reuters published an articled titled “After trade truce, China becomes a bit more investible” that was aligned with our view that US institutions have remained on the China investing sidelines, due to the geopolitical headwinds. China’s media noted Trump’s use of the term “G2” in describing the US and China. Defense Secretary Pete Hegseth also met with his Chinese counterpart Dong Jun in Kuala Lumpur.

October’s “official” purchasing managers’ indexes (PMIs) were mixed, as Manufacturing declined month-over-month (MoM) to 49.0 versus September’s 49.8 and expectations of 49.6, led lower by production and new orders. The Non-Manufacturing PMI was unchanged month-over-month at 50.1, which met expectations with business activity rebounding while construction was a drag. Readings above 50 indicate expansion, while readings below 50 indicate contraction. The release did not help sentiment, as the government’s focus on the new Five-Year Plan might have been a distraction from implementing stimulus and/or cutting rates today.

All things growth were hit, as the Australian saying goes: “the tall poppy gets cut”. Internet, technology hardware, semiconductors, autos, electric vehicles, and electric vehicle batteries were all lower. Hong Kong’s volumes were weak, as the Hang Seng closed below the 26,000 level and the Hang Seng Tech Index closed below the 6,000 level.

The only positive sector in Hong Kong was healthcare, as biotech company 3SBio gained +11.27%, as Pfizer tests the company’s lung and colorectal cancer drugs. Biotech peer Innovent gained +7.81%, as results from their work with US pharmaceutical giant Eli Lilly are expected next week. Biotech and green energy aren’t recognized as AI plays, though I suspect they are.

Mainland investors feared not, buying $1.11 billion worth of Hong Kong-listed stocks and ETFs via Southbound Stock Connect today. There was a very similar, possibly identical, situation in Mainland China, though not quite as severe: technology hardware, semiconductors, non-ferrous metals, and insurance were all off.

Several government agency heads published articles on how their departments would implement the draft 15th 5-Year Plan, including an article from the People’s Bank of China titled “Building a scientific and prudent monetary policy system and covering a comprehensive macro–Prudential Management System”. The Ministry of Finance (MoF) said it would “play the role of active fiscal policy” in a paper. The Ministry of Commerce (MoC) spoke about “Expanding high-level opening up”. Finally, the Ministry of Housing and Urban-Rural Development published “Promoting the High-quality Development of Real Estate”.

The MoF’s piece jumped out. Its plan is to “First, comprehensively expand domestic demand and support the construction of a strong domestic market” and “Second, we will support high-level self-reliance in science and technology to promote the rapid development of new quality productive forces.”

Wu Qing, the Chaiman of the China Securities Regulatory Commission (CSRC), China’s SEC, wrote an article on how the financial regulator’s capital markets portions are now geared to financing science and technology companies, raising the quality of listed companies, and attracting foreign capital.

Education technology and tutoring company TAL Education reported third quarter financial results before the US open yesterday. The results speak for themselves! It is worth noting that the stock is 83% below its all-time high even after yesterday’s 7.23% rally. The highlights are as follows.

- Net Revenues increased +39.1% YoY to $861.4 million from $619.4 million versus analyst expectations of $830 million.

- Non-GAAP Net Income increased +82.7% YoY to $135.8 million from $74.3 million versus analyst expectations of $97 million.

- Non-GAAP Earnings per Share (EPS) increased +94.6% YoY to $0.24 from $0.12 versus analyst expectations of $0.16.

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.12 versus 7.11 yesterday

- CNY per EUR 8.22 versus 8.22 yesterday

- Yield on 10-Year Government Bond 1.80% versus 1.81% yesterday

- Yield on 10-Year China Development Bank Bond 1.87% versus 1.88% yesterday

- Copper Price -1.45%

- Steel Price -0.38%