Key News

Asian equities were mostly higher overnight, supported by easing trade tensions between the United States and China and positive sentiment from President Trump, who is in the region. Hong Kong was closed for Chung Yeung Day, which is also known as “Tomb Sweeping Day” and is when families honor their ancestors.

President Trump made optimistic comments regarding his meeting with President Xi, which is scheduled for tomorrow. China’s Foreign Ministry confirmed the meeting, which will likely provide a constructive tailwind for markets.

US Agriculture Secretary Brooke Rollins announced via X that China has already placed a new order for US soybeans. Market expectations focus on deals and concessions concerning chips and fentanyl. However, there has been additional speculation of a potential deals for Boeing airplanes in exchange for US access to rare earths. Meanwhile, a state visit in 2026 could also be on the table. President Trump is the only leader in Washington, DC, engaged in direct dialogue with China, or so it would appear.

The main catalyst for the market yesterday was the release of the draft 15th Five-Year Plan, which emphasizes artificial intelligence (AI) and technology. Also lifting spirits were strong Q3 financial results from multiple companies and supportive comments on financial sector opening from Vice Premier He Lifeng .The Vice Premier’s comments lifted insurance and brokerage stocks, in particular. The automotive, software, pharmaceutical, and non-ferrous metals subsectors all outperformed.

Technology hardware stocks also had a strong session, benefitting from positive trade developments. Foxconn Industrial Internet rose +9.2% ahead of its Q3 results and, later on in the session, reported a +62% increase in net profit, beating analyst expectations. The semiconductor sector declined overall, though. A potential increase in the use of Nvidia chips resulting from a sweeping trade deal weighed on Cambricon, which fell -1.19%, and Giga Device Semiconductor, which fell -2.35%.

Sungrow Power Supply, which manufactures photovoltaic inverters and power conversion machines surged +15% before releasing impressive third quarter results after the market close. The company’s revenue for the third quarter increased +21% year-over-year (YoY) to CNY 22.9 billion ($3.2 billion), and net income rose +57% YoY to CNY 4.15 billion ($579 million). The positive results lifted the solar sector overall. LONGi Green Energy gained +10% ahead of its third quarter results, which are due tomorrow, though its revenue is only expected to increase +2% YoY and the company continues to operate at a loss. The upcoming results will reveal whether anti-involution efforts in the solar industry have been effective.

Appliance maker Midea saw net profit increase by +8.95%.

Liquor giant Kweichow Moutai reported net profit growth of +0.48%.

If electricity is indeed central to the AI race, China’s substantial investments in green technology appear likely to outpace the US’ nuclear revival, which may take more than a decade to realize. China has the most nuclear power plants under construction of any country in the world.

A Mainland media source reported that global investors are reducing exposure to India in favor of China. India’s average allocation within global emerging market funds fell to 17%, its lowest since November 2023, from a peak of 21% in September of 2024. The largest withdrawals from Indian markets were by US, European, and Japanese mutual funds.

Live Webinar

Join us Thursday, October 30th at 11 am EDT for:

Chomping Today’s Ghouls: Market Exuberance, Tariff Uncertainty, and USD De-Risking

Please click here to register

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

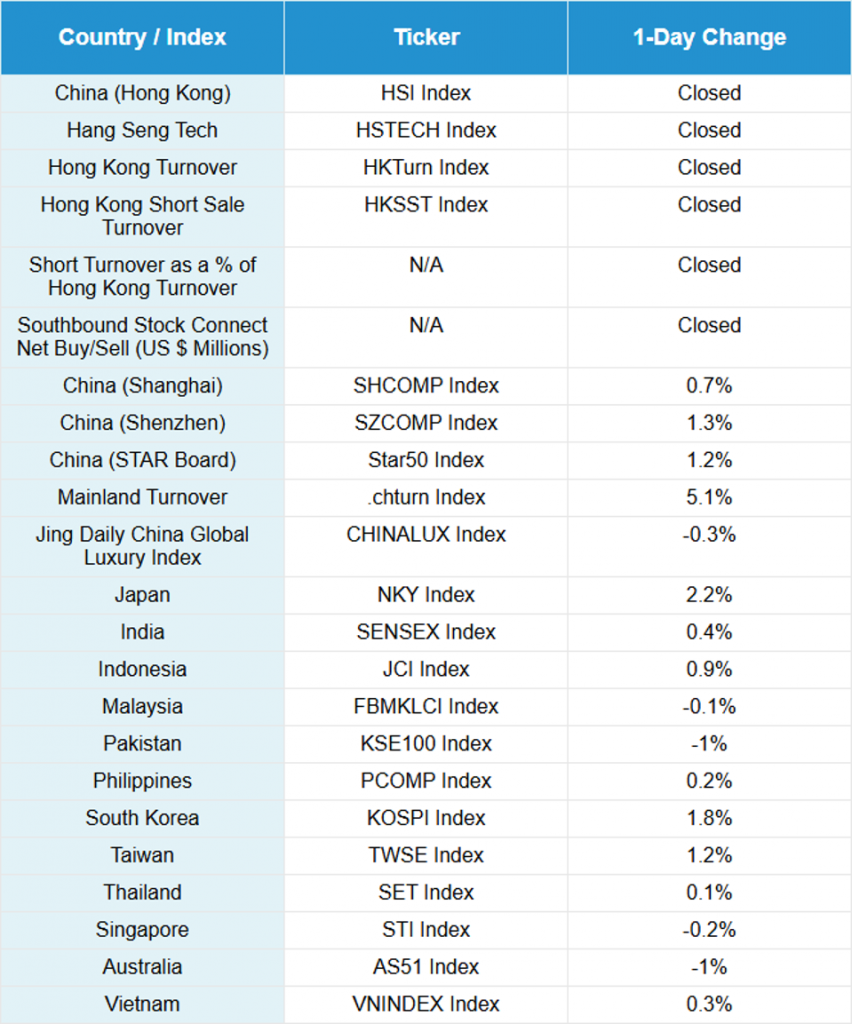

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.09 versus 7.09 yesterday

- CNY per EUR 8.25 versus 8.27 yesterday

- Yield on 10-Year Government Bond 1.82% versus 1.82% yesterday

- Yield on 10-Year China Development Bank Bond 1.89% versus 1.88% yesterday

- Copper Price +0.41%

- Steel Price +0.52%