This Friday marks seventeen years since Satoshi Nakamoto — the pseudonymous author of the Bitcoin whitepaper — published a vision for digital money that required no financial intermediaries.

Today, that revolution seems to have come full circle: Wall Street now holds the keys.

From BlackRock’s Bitcoin ETFs to JPMorgan’s decision to accept Bitcoin and Ether as collateral, the very institutions Bitcoin was meant to bypass have become its custodians, champions, and beneficiaries.

Seventeen years on, the institutions Bitcoin was meant to bypass have become its biggest champions — and perhaps its greatest test.

From Economic Rebellion To Regulatory Recognition

This irony captures a deeper truth about how revolutions evolve — and why this moment matters.

First they ignore you, then they laugh at you, then they fight you, then you win.

The pattern Gandhi once described — often repeated in technological revolutions — is visible again. Bankers laughed, regulators fought, and now Wall Street embraces what it once dismissed.

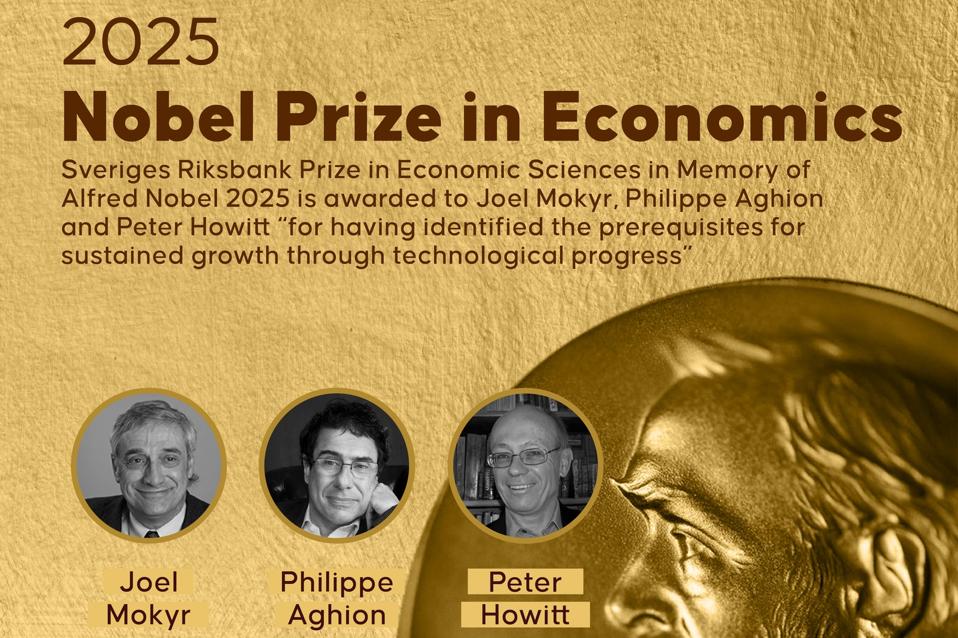

Earlier this month, the Nobel Prize in Economics was awarded to Joel Mokyr, Philippe Aghion, and Peter Howitt for their complementary work on creative destruction and the culture of growth. Their research explains how progress depends on a society’s willingness to allow old institutions, technologies, and habits to be replaced by new and more efficient ones.

Coined by Joseph Schumpeter, creative destruction is not merely about innovation — it’s about the courage to dismantle what no longer works. Mokyr links sustained growth to a culture that celebrates curiosity and experimentation, while Aghion and Howitt show how innovation advances by continually replacing the old with the new — disruptive in the short run but essential for long-term progress.

Bitcoin’s Creative Evolution

Bitcoin’s and crypto’s story fits that pattern almost perfectly. What began as a rebellion against financial institutions is now being absorbed by them. Jamie Dimon, who once called Bitcoin a “fraud” with “no intrinsic value,” now leads a bank accepting it as collateral. The U.S. SEC, which fought crypto as recently as last year, has since taken a historic turn — embracing it and publicly considering crypto standards as a regulatory bridge to a trillion-dollar market.

As these institutions adapt, they are proving Mokyr’s point: progress rarely unfolds in a straight line but through resistance, absorption, and ultimately, cultural transformation — the very process that reshapes the institutions governing society.

From Crypto Code To Cypherpunk Culture

The milestone is real, but the mission is unfinished. Bitcoin’s institutional embrace marks progress, yet its core promise — self-custody, open networks, and user sovereignty — is still being fought for on cultural frontlines. Around the world, Bitcoin-native builders and communities are shaping that culture from the ground up.

The energy at such gatherings is more than technological — it’s cultural and communal. The fight is no longer about code alone, but about preserving personal choice and freedom in a world of intermediation, growing concentration and surveillance. As Mokyr would put it, the transition from technology to culture to institutions is still underway. The question now is whether society will finish what Satoshi started — not by writing new code, but by choosing the values that will define the next era of money and freedom.

The Fight Is On For Bitcoin’s Future

In Los Angeles this month at a Bitcoin focused event, MIT’s Christian Catalini (a fellow Forbes contributor) made the case that open networks and interoperability are the foundation of the next era of payments. Catalini argued that the future of money depends on shared infrastructure, not walled gardens — and that the battle for openness is ultimately cultural, not technical. Education and community will decide whether innovation remains free or becomes captured by incumbents.

A similar pattern emerged in Prague, where Trezor’s Trust by Design gathering framed self-custody as a continuation of Europe’s long struggle for personal freedom. Speakers drew historical parallels between digital sovereignty and the hard-won lessons of self-reliance — reminding participants that freedom isn’t a product feature; it’s a mindset.

And in Lugano, Switzerland, the Plan ₿ Forum brought together policymakers, entrepreneurs, and technologists around a shared conviction that Bitcoin’s founding principles — transparency, openness, and individual choice — must extend beyond financial markets to the way societies govern themselves. As one participant put it, “What started as Plan B is fast becoming Plan A.”

These are not isolated events. Across podcasts, online communities, and social media, a broader campaign is underway to win hearts and minds — to remind people that a revolution cannot succeed unless individuals believe in its value and act on it.

These gatherings amount to a form of cultural engineering — the community building of the rebels. As Mokyr would argue, once a technology is invented, its diffusion depends on culture: the willingness of people to adopt new norms and reject the comfort of old ones.

The Bitcoin movement is now testing that threshold. It has conquered the balance sheets of global institutions, but not yet the habits of individuals. Until ordinary people feel both the need and the confidence to hold their own keys, support open-source innovation, and trust public networks, the revolution remains incomplete.

Revolution In Transition

Seventeen years on, we are no longer debating whether the technology works — we are deciding what kind of society we want it to serve. The choice, lies with us.

The phrase “Houston, we have a problem” from Apollo 13 has become shorthand for crisis, but the mission it referred to did not fail — it adapted. The astronauts solved their problem through ingenuity, trust, and collaboration, turning disaster into discovery.

In the same way, Satoshi’s revolution is not in crisis but in transition. The challenge is not technical; it is cultural. Whether Bitcoin fulfills its founding promise or becomes another layer of financial intermediation will depend on our collective choice — on whether society, like those astronauts, decides to return to first principles and finish what was started.

Independence and freedom from financial intermediaries aren’t granted by the institutions that profit from dependence; they’re acts of will — conscious choices made by users.

Freedom isn’t given — it’s chosen. It’s shaped by our culture, grounded in our values, and sustained by our choices.

The fight goes on.