Deckers Outdoor (DECK) stock should be on your radar. Here’s why – it is currently trading in the support range ($82.59 – $91.29), levels from which it has rebounded significantly in the past. Over the past decade, Deckers Outdoor stock attracted buying interest at this level three times and subsequently achieved an average peak return of 59.2%.

But is the price movement sufficient on its own? It certainly helps if the fundamentals are solid. For DECK, read Buy or Sell DECK Stock to evaluate how compelling this buying opportunity may be.

Investing in a single stock can be risky, yet there is significant value in a more diversified approach that we employ with Trefis High Quality Portfolio. Additionally, consider what your portfolio’s long-term performance might look like if you included 10% commodities, 10% gold, and 2% crypto alongside equities.

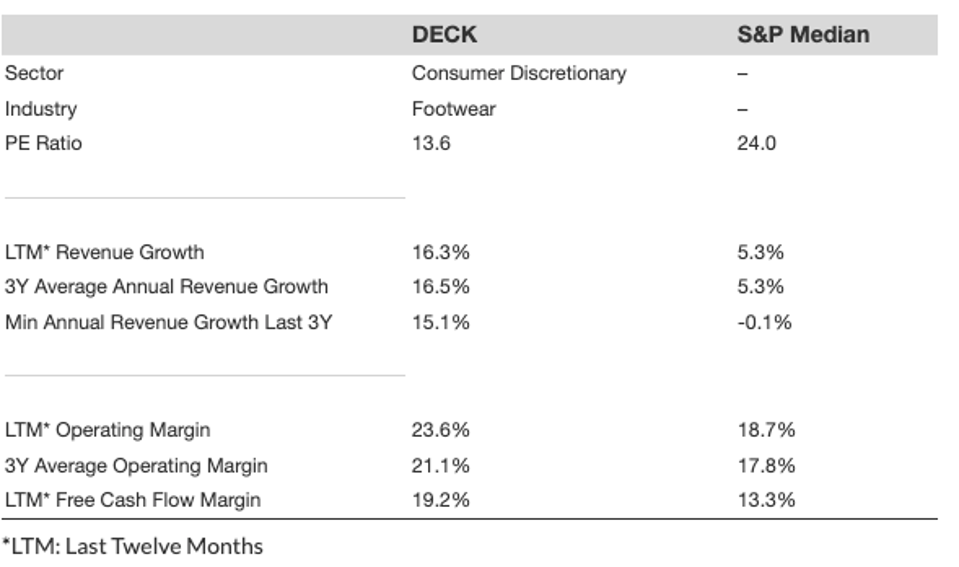

Here are some quick data points for Deckers Outdoor that should aid decision-making:

- Revenue Growth: 16.3% LTM and 16.5% average over the last 3 years.

- Cash Generation: Nearly 19.2% free cash flow margin and 23.6% operating margin LTM.

- Recent Revenue Shocks: The lowest annual revenue growth for DECK in the last 3 years stood at 15.1%.

- Valuation: DECK stock trades at a PE ratio of 13.6

- Opportunity vs S&P: Compared to S&P, you benefit from lower valuation, higher revenue growth, and improved margins

While the stock has declined this year due to mixed earnings and margin pressures from rising tariffs and higher selling expenses, there are several positives, including strong brand momentum from the high-growth Hoka and Ugg footwear lines, expanding international opportunities, and a solid financial foundation. Over the last quarter, Ugg sales rose 10.1% and Hoka sales grew 11.1% to $634.1 million.

For a quick background, Deckers Outdoor offers footwear, apparel, and accessories for casual and high-performance use, distributing through department stores, specialty retailers, and operating 140 retail locations worldwide as of March 2021.

What Is Stock-Specific Risk If The Market Crashes?

However, DECK is not exempt from significant declines. It decreased by 44% during the Dot-Com crash and suffered a staggering 77% drop during the Global Financial Crisis. Even the 2018 correction resulted in a decline of over 26%. The Covid sell-off cut approximately 55%, and the inflation shock reduced it by nearly 49%. Strong fundamentals are important, but when turmoil strikes, DECK is no exception.

Yet the risk is not confined to major market crashes. Stocks can decline even when markets are performing well – consider occurrences like earnings reports, business updates, or outlook adjustments. Read DECK Dip Buyer Analyses to learn how the stock has bounced back from sharp declines in the past.

The Trefis High Quality (HQ) Portfolio, comprising 30 stocks, has a history of successfully outperforming its benchmark, which encompasses all three – the S&P 500, S&P mid-cap, and Russell 2000 indices. What accounts for this? Collectively, HQ Portfolio stocks have delivered superior returns with lower risk compared to the benchmark index; offering a smoother investment experience, as shown in HQ Portfolio performance metrics.