Google stock (NASDAQ: GOOG) has a history of notable rallies. The stock increased by over 30% in less than two months during critical years such as 2010 and 2024, and even achieved a rare rally exceeding 50% in 2025 as investors became more optimistic about the company’s prospects in the generative AI era.

This kind of momentum underscores the possibility for swift gains. If the past is any indication, certain catalysts may propel Alphabet shares to new impressive heights, benefiting investors who take advantage of these significant upswings.

Triggers That Could Boost The Stock

- AI Monetization. AI projects like Gemini and AI Overviews are projected to generate over $2 billion in revenue, reflecting a 50% year-over-year increase. Google Cloud AI-driven revenue rose by 32%, amounting to $13.6 billion in Q2 2025.

- Cloud Profitability. Revenues from Google Cloud surged 32% to $13.6 billion in Q2 2025. Operating income more than doubled, reaching $2.83 billion, which improved its margin to 20.7%, indicating scalable efficiency.

- YouTube Expansion. YouTube’s ad revenue grew by 13% year-over-year to $9.8 billion in Q2 2025, exceeding projections. It commands over 12% of U.S. TV viewership, illustrating strong engagement and shifts in advertising.

Single stock investments can be risky, but there is immense value in a more broadly diversified approach. If you are looking for an upside with reduced volatility compared to holding a single stock, consider the High Quality Portfolio (HQ) – HQ has outperformed its benchmark – a combination of S&P 500, Russell, and S&P midcap index, achieving returns that exceed 105% since its inception. Effective risk management is crucial – consider what long-term portfolio performance could look like if you combined 10% commodities, 10% gold, and 2% crypto with HQ’s performance metrics.

How Do Financials Look Right Now

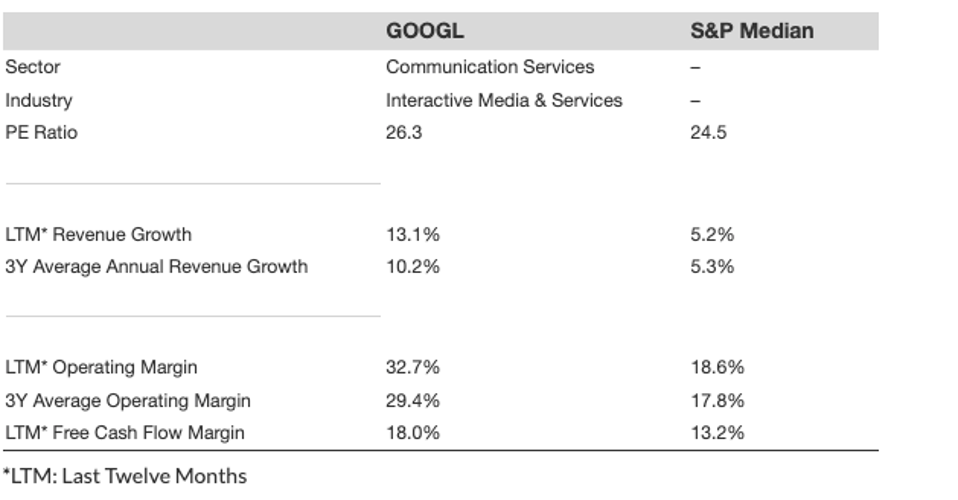

It is certainly beneficial if the fundamentals are strong. For in-depth information on GOOGL, read Buy or Sell GOOGL Stock. Below are some key figures.

- Revenue Growth: 13.1% LTM and 10.2% last 3-year average.

- Cash Generation: Nearly 18.0% free cash flow margin and 32.7% operating margin LTM.

- Valuation: Alphabet (Google) stock trades at a P/E multiple of 26.3

- Opportunity vs S&P: Compared to the S&P, it offers a higher valuation, greater revenue growth, and improved margins

But How Does The Stock Do In Bad Times?

When considering the risk for GOOGL, it is useful to examine how much it declined during significant market downturns. The most substantial decline occurred during the Global Financial Crisis, which saw a decrease of approximately 65%. The Inflation Shock in 2022 also caused shares to fall by about 44%. The Covid pandemic led to a drop of nearly 31%, and even the correction in 2018 was significant, with a 23% decline. These figures illustrate that while GOOGL performs well on fundamentals, it is not insulated when markets become unfavorable. Drawdowns of this magnitude are essential to consider, even for major companies.

The Trefis High Quality (HQ) Portfolio, comprising 30 stocks, has a history of comfortably outperforming its benchmark, which includes all three – the S&P 500, S&P mid-cap, and Russell 2000 indices. What accounts for this? Collectively, HQ Portfolio stocks have yielded better returns with lower risk compared to the benchmark index, resulting in a smoother investment experience, as evident in HQ Portfolio performance metrics.