October 21 marks the start of the 2025-2026 NBA season. 30 teams will duke it out over the next eight months in hopes of ultimately hoisting the championship trophy. At least one player might feel as though he has already won big this season when it comes to the jock tax. Cooper Flagg was selected 1st by the Dallas Mavericks in the NBA Draft this past June. The Mavericks having the first overall pick was unexpected, as they had a mere 1.8% chance of selecting first in the draft, far less likely than teams like the Charlotte Hornets, Utah Jazz, and Washington Wizards (each with a 14% chance as reported by ESPN).

While there may be several reasons why Flagg is excited to be a member of the Dallas Mavericks, income taxes are likely one of them, as those who play for Texas-based teams are afforded a 0% state income tax rate on many of their games. I estimate that Flagg realizes millions of dollars in benefits due to paying lower state income taxes in Texas than in higher-taxed jurisdictions. This article breaks down the NBA’s formulaic scheduling, how it relates to the jock tax, and how teams’ players face varying state income taxes.

The NBA Scheduling Formula And The Jock Tax

Like many sports leagues, the NBA follows a formula when creating its schedule, according to NBAStuffer.com. All teams play a total of 16 games against divisional opponents. For example, the Miami Heat are in the NBA’s Southeast Division. They will play four games against their other divisional opponents: Charlotte Hornets, Atlanta Hawks, Orlando Magic, and Washington Wizards. This scheduling format allows all divisional teams to play each other twice in each city.

Furthermore, the teams will play their remaining ten conference opponents for a total of 36 games. This allows, at a minimum, a home-and-home game setup where they play each team at least once in each city, and, on a rotational basis, the teams will play in each city twice.

Lastly, the formulaic schedule allows for a home-and-home scheduling setup for the 15 teams in the other conference. Thus, in any given year, for a team like the Miami Heat, they will play 41 games at their home arena in Miami, FL, and 41 games away from home, with a skewness for teams in their own division and conference.

The reason for understanding and determining where the games will be played is that the location of the games carries a significant tax implication. While the majority of NBA players will be subject to the top Federal income tax rate of 37% regardless of where their games are played, there can be substantial variation in how much tax they have to pay at the state level.

The so-called “Jock Tax” requires players to apportion their salary income across the different jurisdictions where they play, as reported by H&R Block. For instance, a key piece of the jock tax is where the games are being played. This means that players for a team like the Miami Heat will play at least 41 games in the state of Florida, which has a 0% state income tax rate. In contrast, players for a team like the Los Angeles Lakers will play at least 41 games in the state of California, which imposes a 13.30% state income tax rate.

As I reported previously in Forbes, the jock tax can have a significant impact on the variation in income tax rates that NFL players face. With NBA players’ salaries in the hundreds of millions of dollars, this difference in state income tax liability can be tremendous.

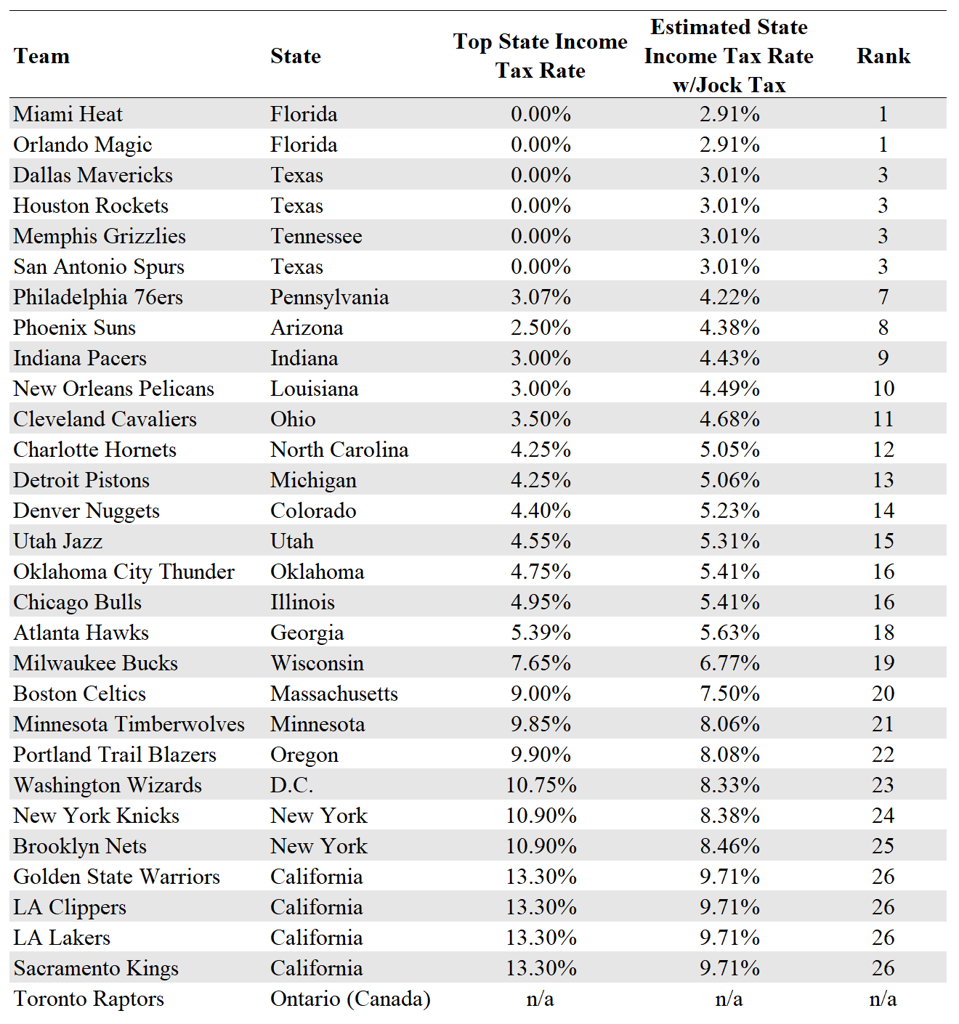

The Jock Tax Breakdown By Team

Determining the exact tax liability for each player on an annual basis requires a tremendous amount of player-specific data, such as where the player lives, how much time they spend in their home state versus their team state, how many practice days they have before and after each game, and where those practices take place, among other things. However, given the NBA’s formulaic schedule, it is possible to compute the relative jock tax for each team and show how it can vary substantially.

Note that for this calculation, I do not consider practice days, and I assume that all players live in the jurisdiction to which they play their home games. Also, for games played in Toronto, I use the player’s home team’s state jurisdiction. Consequently, I am not able to form a reliable estimate for the Toronto Raptors themselves because the tax liability will depend heavily on the players’ individual residence state.

3 Key Takeaways From The Jock Tax Team Breakdown:

(1) Florida, Texas, And Tennessee Teams Continue To Face The Lowest Jock Tax Percentages

Three of the nine states that do not levy an income tax also have NBA teams: Florida, Texas, and Tennessee. Teams that play in these jurisdictions provide a substantial tax advantage to their players since the apportioned income is taxed at a 0% state income tax rate.

The impact does not end there; teams in these jurisdictions also happen to play one another more on average. For instance, the NBA Southwest Division has three teams from within Texas (Dallas Mavericks, Houston Rockets, and San Antonio Spurs), one within Tennessee (Memphis Grizzlies), and one within Louisiana (New Orleans Pelicans), which has a relatively low state income tax rate (3.00%).

For the Texas and Tennessee teams, the average estimated state income tax rate after factoring in the jock tax is 3.01%. This percentage drops to 2.91% for the Florida teams, suggesting a relatively lower jock tax apportionment for the Florida teams.

(2) The Jock Tax Burdens Are Heaviest In California, New York, And Washington, D.C.

Given a top state income tax rate of 13.30%, 10.90%, and 10.75% for California, New York, and Washington D.C., respectively, players playing for one of these many teams (Los Angeles Clippers, Los Angeles Lakers, Golden State Warriors, Sacramento Kings, New York Knicks, Brooklyn Nets, and Washington Wizards) face among the highest state income tax liabilities due to the jock tax.

I estimate that the players in California face almost a 9.71% state income tax rate after factoring in their away games. This means that for every $1,000,000 an NBA player makes, the player in California will pay almost $70,000 more in state income taxes than a player in Florida.

While the tax burdens are highest for these California athletes, the presence of the formulaic schedule has unintended effects on certain teams. For instance, the Phoenix Suns play their home games in Arizona, which boasts a 2.50% state income tax rate. However, since the Suns play a significant number of games against their divisional opponents in California, their players’ state income tax rate across all games is estimated at 4.38%.

In fact, with the Western Conference having teams in many high-income tax jurisdictions, like California, Oregon, and Minnesota, players in this conference, on average, face higher state income tax burdens than those in the Eastern Conference.

(3) The Jock Tax Can Be Impacted By Income Tax Rate Progression

While the calculations assume flat tax rates at the rate, many states impose progressive income tax rates. For instance, the top 13.30% in California only begin to apply for income over $1,000,000. For athletes playing their home games in these jurisdictions, it is likely that they will pay the top state income taxes on most of their income this year. However, for opposing players who only visit that state once or twice, they may not be subject to those top states’ income tax rates, exacerbating the divide in income tax liability due to the jock tax for players in low versus high state income tax rates.

Even though the Dallas Mavericks enter the season with only the 10th-best odds to win the 2025-2026 NBA Title (currently 25 to 1 odds), Flagg, who signed a $62.7 million contract over four years, as reported by CBS Sports, may feel like he was the big winner due to having to pay a significantly lower jock tax. In particular, my estimations suggest his state income tax liability over the life of his contract is around two million dollars. Meanwhile, they would have been over five million dollars had he been drafted by the Washington Wizards. This difference underscores the importance of the jock tax when determining players’ salaries and highlights the significant positive effect that it currently has on players on teams in no-state income tax states like Texas, Florida, and Tennessee. Despite the significant difference in tax liability, as reported by Forbes, low taxes do not necessarily mean more team success. However, being able to pay your players more by way of higher after-tax income may not hurt those chances.