We see little reason for concern around Meta’s stock given the company’s exceptionally strong operating performance, robust financial health, and continued leadership in digital advertising. Meta’s transformation into an AI-driven advertising powerhouse—anchored by Instagram’s growing dominance and massive infrastructure investments—underpins our confidence. Overall, while the stock trades at a premium valuation, we view it as fairly priced given its strength and momentum.

Below is our evaluation:

Investing in a single stock can carry risks, but there is significant merit to a more broadly diversified strategy like the one we employ with Trefis High Quality Portfolio. Trefis collaborates with Empirical Asset Management – a wealth manager located in the Boston area – whose asset allocation strategies produced positive returns during the 2008-09 period when the S&P experienced losses exceeding 40%. Empirical has integrated the Trefis HQ Portfolio into this asset allocation model to deliver better returns with reduced risk when compared to the benchmark index; resulting in less volatility, as seen in the HQ Portfolio performance metrics.

Let’s delve into details on each of the assessed factors but first, for a brief background: With $1.9 Tril in market capitalization, Meta Platforms offers products and technologies that facilitate connections and sharing among people through devices, including mobile, VR, wearables, and in-home solutions, enhancing both augmented and virtual reality experiences.

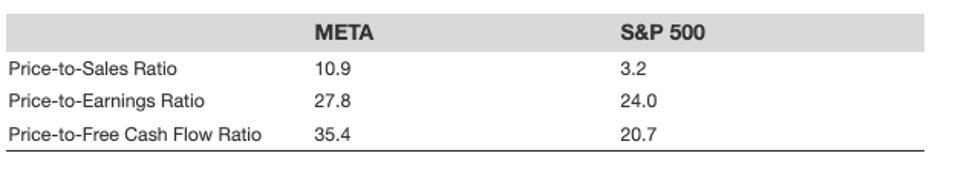

[1] Valuation Appears High

This table shows how META is valued compared to the broader market. For further details see: META Valuation Ratios

[2] Growth Is Robust

- Meta Platforms has experienced its revenue grow at an average rate of 13.0% over the past 3 years

- Its revenues have grown 19% from $143 Bil to $170 Bil over the last 12 months

- Additionally, its quarterly revenues increased by 16.1% to $42 Bil in the most recent quarter, up from $36 Bil a year earlier.

This table illustrates how META is growing in relation to the broader market. For further details see: META Revenue Comparison

[3] Profitability Seems Very Strong

- META’s operating income over the last 12 months was $73 Bil, which translates to an operating margin of 42.9%

- With a cash flow margin of 56.4%, it generated nearly $96 Bil in operating cash flow during this period

- During the same timeframe, META reported nearly $67 Bil in net income, indicating a net margin of approximately 39.1%

This table highlights META’s profitability compared to the broader market. For further details see: META Operating Income Comparison

[4] Financial Stability Is Very Strong

- META’s Debt stood at $50 Bil at the conclusion of the most recent quarter, whereas its current Market Cap is $1.9 Tril. This indicates a Debt-to-Equity Ratio of 2.7%

- META’s Cash (including equivalents) constitutes $70 Bil out of $280 Bil in total Assets. This results in a Cash-to-Assets Ratio of 25.1%

[5] Resilience During Downturns Is Moderate

META experienced an impact slightly better than the S&P 500 index during various economic downturns. We assess this based on (a) the extent of the stock’s decline and, (b) the speed of its recovery.

2022 Inflation Shock

- META stock dropped 76.7% from a peak of $382.18 on 7 September 2021 to $88.91 on 3 November 2022, compared to a peak-to-trough decrease of 25.4% for the S&P 500.

- However, the stock completely recovered to its pre-crisis peak by 19 January 2024

- Since then, the stock rose to a high of $790.00 on 12 August 2025, and is currently trading at $732.17

2020 Covid Pandemic

- META stock saw a decline of 34.6% from a peak of $223.23 on 29 January 2020 to $146.01 on 16 March 2020 compared to a peak-to-trough drop of 33.9% for the S&P 500.

- Nonetheless, the stock fully recovered to its pre-crisis level by 20 May 2020

However, the risks are not confined to major market crashes. Stocks can decline even during favorable market conditions – consider events such as earnings announcements, business updates, and changes in outlook. Read META Dip Buy Analyses to explore how the stock has rebounded from significant dips in the past.

The Trefis High Quality (HQ) Portfolio, comprising 30 stocks, has a proven history of outperforming its benchmarks, which include all three indices – S&P 500, Russell, and S&P midcap. What accounts for this? Collectively, HQ Portfolio stocks have delivered superior returns with lower risk as compared to the benchmark index, resulting in smoother performance, as reflected in the HQ Portfolio performance metrics.