AppLovin (APP) stock has dropped by 21.2% in under a month, from $718.54 on 9/30/2025 to $565.94 now. Is this a dip worth buying? Purchasing during dips can be a practical strategy for quality stocks that have shown a pattern of recovering from downturns.

It appears that APP stock meets essential quality criteria. However, the concerning news is that the stock has experienced a median return of -44% over one year, and a 76% peak return after significant dips (>30% in 30 days) historically. To provide some context, APP offers a software platform that assists mobile app developers in enhancing app marketing and monetization through AppDiscovery, which aligns advertiser demand with publisher supply via auctions.

For information on stock fundamentals and evaluations: Read Buy or Sell AppLovin Stock to gain a complete understanding.

Recently, APP stock has seen significant declines, and we currently view it as appealing yet volatile. While this situation might appear to be an opportunity, relying on a single stock carries substantial risk. Conversely, there is significant merit in a broad diversified investment strategy. If you’re looking for potential gains with reduced volatility compared to holding an individual stock, consider the High Quality Portfolio (HQ) – HQ has surpassed its benchmark, which is a blend of S&P 500, Russell, and S&P midcap index, achieving returns of over 105% since it began. Effective risk management is crucial – think about the potential long-term performance of a diversified portfolio if you included 10% commodities, 10% gold, and 2% crypto along with HQ’s performance metrics.

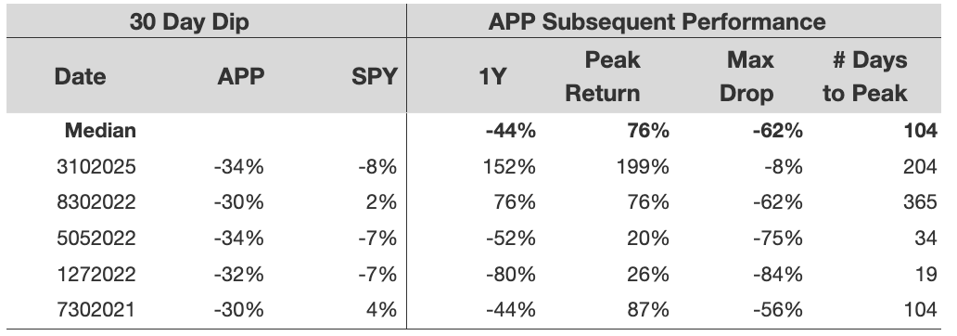

Historical Median Returns Following Dips

Historical Details on Dips

Since 1/1/2010, APP experienced 5 instances where the dip threshold of -30% within 30 days was reached

- 76% median peak return within one year following the dip event

- 104 days is the median time taken to achieve peak return after a dip event

- -62% median max drawdown within one year following the dip event

AppLovin Meets Essential Financial Quality Standards

Revenue growth, profitability, cash flow, and balance sheet integrity need thorough assessment to mitigate the risk of a dip indicating a worsening business condition.

Although dip buying may seem appealing, it requires careful consideration from various perspectives. This multi-faceted evaluation process is precisely how we create Trefis portfolio strategies. If you desire growth with a smoother experience compared to an individual stock, consider the High Quality portfolio, which has surpassed the S&P and achieved >91% returns since it began.