It’s hard to beat the S&P 500. Its heavy allocation to the large-cap technology companies driving the artificial intelligence boom seems to make new highs every week. If your core equity allocation is to the S&P 500, you can take comfort in knowing that you have not missed out on the equity rally over the last few years.

However, many S&P 500 investors are nervous about lofty valuations and whether the 40% concentration in just ten holdings provides adequate diversification. One strategy is to add exposure to more value-oriented, less expensive segments of the market that tend to hold up better when the tide shifts. Defensive investors should consider adding consumer staples stocks to their portfolio.

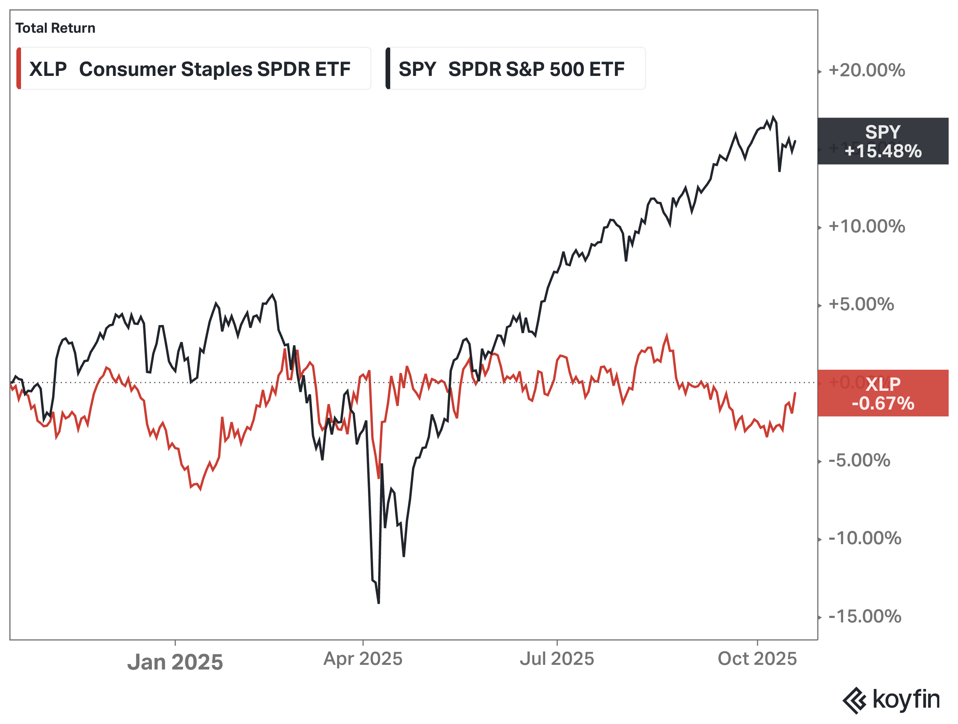

Consumer Staples Have Lagged The Broader Market

Over the past year, the Consumer Staples Select Sector SPDR Fund (XLP) has significantly underperformed the SPDR S&P 500 ETF Trust (SPY), with a total return of -0.7% versus 15.5% for the S&P 500. In a market dominated by optimism, growth, and AI enthusiasm, defensive sectors like consumer staples have been left behind.

The stocks in XLP are household names. Walmart, Costco, Procter & Gamble and Coca-Cola comprise approximately 35% of the portfolio. Regardless of what happens to technology stocks or the overall economy, these companies should still see demand for their products.

Using 2022 as a template, when the total return for the S&P 500 was -18.5%, the consumer staples sector fell less than 1%. Historically, investors tend to flock to value and quality stocks like those in the staples sector when they get scared.

Consumer Staples Are Out Of Favor

Earlier in the year, staples benefited from a bid for safety as investors hedged against tariff-related volatility. But as those fears faded and risk appetite returned, capital rotated into cyclical and high-growth sectors. With momentum favoring growth stocks, investors have had little incentive to own anything defensive in their portfolio.

Fundamentals in the consumer staples sector have not helped. Elevated inflation has squeezed input costs and pressured margins, and tariff uncertainty continues to hang over global supply chains. Consumer staples, alongside energy and materials, were one of only three U.S. sectors with negative year-over-year earnings growth last quarter.

Consumer Staples Stocks Are Relatively Inexpensive

However, that underperformance has created an opportunity. Aside from the defensive qualities, staples look more interesting from a relative-value perspective. XLP trades at roughly 20 times forward earnings and offers a 2.7% dividend yield, more than double that of the S&P 500. The sector is trading at its lowest relative valuation in the past five years compared to the market.

Several catalysts could push investors back toward defensive sectors. A valuation correction in mega-cap tech, economic weakness stemming from tariff escalation, and the impact of a prolonged government shutdown could all trigger a move into staples. If inflation stays moderate and input costs ease, margins for consumer goods producers should improve, helping position the sector for relative outperformance even if the broader market stalls.

Adding more diversification to S&P 500 exposure has not paid off during the latest bull market run. But if you are nervous about the broader market’s ability to sustain its outperformance, the setup for consumer staples is compelling. Staples may not lead the next bull market, but they may protect your portfolio if stocks move in the opposite direction.