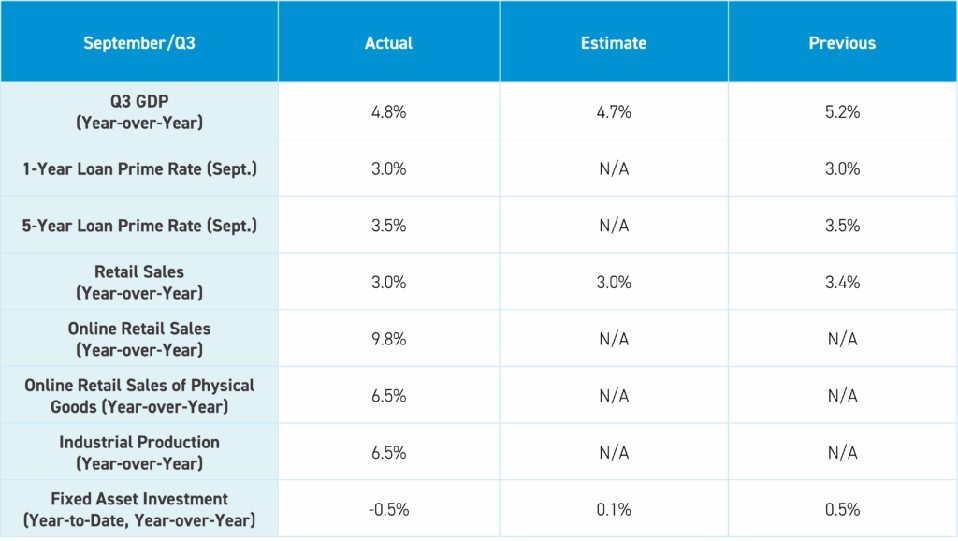

September Data Release

GDP data was a beat, though housing sales data weakness explains why China’s government should settle the trade war, so it can pivot to the real economic issues in China. New home prices fell -0.41% from August to September. Meanwhile, new home prices in first tier cities fell -0.3% month-over-month, led by Guangzhou, which saw prices fall -0.6%, and Shenzhen, which saw prices fall by -1.0%. Used home prices for September were also disappointing, falling -0.6% from August overall and -1.0% in first tier cities.

Key News

Asian equities were higher on easing US-China trade tensions less Malaysia and Vietnam while Singapore was closed for Diwali, the Hindu festival of lights.

There were several positives overnight, as President Trump’s comments were conciliatory and positive. China’s Ministry of Foreign Affairs spokesperson’s comments were, too. Treasury Secretary Bessent will meet Vice Premier He Lifeng this week in Malaysia, following a positive call on Friday, while Chinese trade negotiator Li Chenggang was removed from his post after Bessent called his August Washington DC meeting “unhinged”.

Growth stocks led Hong Kong higher, as Alibaba gained +4.86%, Tencent gained +3.21%, and Xiaomi gained +2.57%, as strong online retails sales likely helped Alibaba and JD.com.

Breadth was strong in both markets, though volumes were a touch light, as the Hang Seng Index closed just below 26,000. Hang Seng Tech Index was just below 6,000, while Shanghai and Shenzhen consolidated. A Mainland media headline reported that ETFs in China had ~$9 billion of inflow in September, as gold, bond, and stock funds were beneficiaries, as banks continue to cut deposit rates leading to a small reallocation to the stock market.

The Fourth Plenum kicked off with President Xi delivering the concisely-worded “Proposal of the Central Committee of the Communist Party of China on Formulating the 15th Five-Year Plan for National Economic and Social Development”. The Ministry of Industry and Information Technology (MIIT) held a conference focused on excess capacity in the cement industry.

Concidentaly, China’s crude steel production declined -4.6% year-over-year (YoY) to 73.49 million tons, brining the year-to-date (YTD) output down by -2.9% YoY. The next Five-Year Plan will heavily emphasize science and technology, though it will be interesting to see whether the anti-involution campaign will be included in the Plan. Fitch Ratings said the anti-involution campaign could improve the credit profile of the companies, as they benefit from “output rationalization”, i.e. curbing excess production.

Bloomberg is reporting mainland listed Sany Heavy Industry will list in Hong Kong, after raising $1.6 billion.

I’ve always respected the intellectual capital of sell side analysts and sales traders. JP Morgan hosts an institutional investor conference around the IMF and World Bank meetings, which includes a survey of the 300+ attendees’ views on markets and their allocations. I’m not going to give away their intellectual capital though their question on China allocations is absurdly low. The percentage of respondents who hold zero China is between 33% to 50%. The percentage of attendees who were overweight China is tiny!

China stocks bottomed in January of 2024, and they still hold zero China? This shows the amount of capital not participating in the rally due to the geopolitical and media narrative. I would argue this is predominantly a US institutional investor as I head back to the airport again to visit with institutional investors outside of the US. The re-rating of Chinese stocks is arguably in the early days based on this survey, China’s weight in MSCI indexes, and professional investor allocations, which we access via Copley Fund Research.

I am rooting for a successful Trump-Xi meeting in South Korea next week for many reasons.

Live Webinar

Join us Thursday, October 30th at 11 am EDT for:

Chomping Today’s Ghouls: Market Exuberance, Tariff Uncertainty, and USD De-Risking

Please click here to register

New Content

Read our latest article:

Labubu & Gen Z Spending: What China’s Designer Toy Craze Tells Us About the New Consumption Wave

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.12 versus 7.13 Friday

- CNY per EUR 8.30 versus 8.32 Friday

- Yield on 10-Year Government Bond 1.85% versus 1.82% Friday

- Yield on 10-Year China Development Bank Bond 1.93% versus 1.91% Friday

- Copper Price 0.59%

- Steel Price 0.39%