META’s stock has seen a solid 43% rise in the last six months. This growth is primarily fueled by a mix of factors, including upbeat quarterly performance and significant AI investments that boosted the core advertising business, leading to a rise in ad impressions and ad prices.

Furthermore, rising user engagement across its apps contributed to investor optimism, all while the company returned capital to shareholders via $9.76 billion in share repurchases and $1.33 billion in dividend payments in Q2 alone.

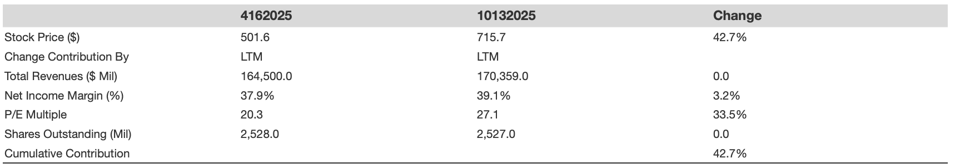

From a quantitative perspective, the 43% surge in Meta Platforms stock in the last six months was largely driven by a 33.5% change in the company’s P/E Multiple. While there is more to this narrative than mere numbers, let’s first dissect the stock price movement into its contributing factors.

Investing in a single stock can be fraught with risk, but there is substantial benefit to a more diversified strategy, like the one we employ with Trefis High Quality Portfolio. Additionally, think about the potential long-term performance for your portfolio if you integrated 10% commodities, 10% gold, and 2% crypto alongside equities. Separately, see – What’s Happening With RGTI Stock?

Returning to the “change”: The alterations in fundamental aspects like valuation, revenue, and margins carry with them a narrative related to business and investor sentiment. Below, we have pinpointed significant developments that impacted the stock price movements for META stock. As a quick background: META offers products that allow users to connect and share through various devices, including mobile phones, PCs, VR headsets, wearables, and augmented reality, promoting connectivity anytime and anywhere.

Here Is Why Meta Platforms’ Stock Moved

- The second quarter 2025 earnings and revenue greatly exceeded Wall Street expectations, with revenue rising 22% year-over-year to $47.5 billion and EPS hitting $7.14, marking the 10th straight profit exceeding estimates, and the 12th continuous revenue exceedance.

- Bold investments in artificial intelligence infrastructure, including ambitions to expand computing capacity to over 2 million GPUs by FY26 and forecast capital expenditures of $66-72 billion for 2025, stirred optimism for long-term growth.

- Advertising revenue saw significant growth of 21% year-over-year in Q2 2025, fueled by AI-driven ad efficiency, enhanced targeting, and increased user engagement throughout its Family of Apps, including WhatsApp and Threads.

- Regulatory pressures surfaced, particularly Meta’s decision to prohibit political, electoral, and social issue advertisements on its platforms in the EU starting October 2025 due to new EU Transparency and Targeting of Political Advertising regulations, which introduce operational hurdles and legal ambiguities.

- The Reality Labs division continued to register considerable operating losses, around $4.5 billion in Q2 2025, remaining a financial burden despite the ongoing dedication to innovation in virtual and augmented reality.

Our Current Assessment Of META Stock

Opinion: Currently, we view META stock as fairly valued. Why is that the case? Take a look at the full narrative. Read Buy or Sell META Stock to understand what informs our current viewpoint.

Risk: Nonetheless, META is not immune to significant declines. It dropped approximately 43% during the 2018 correction, 35% amid the Covid pandemic, and sustained a heavier blow of 77% during the inflation crisis. Despite all the positives surrounding the stock, real risks remain. When markets sour, META can still experience serious downturns.

Consistently selecting winners is a challenging endeavor, particularly given the volatility linked to a single stock. Instead, the Trefis High Quality (HQ) Portfolio, comprising 30 stocks, has a proven record of surpassing the S&P 500 during the past 4-year period. Why is this the case? As a collective, HQ Portfolio stocks delivered superior returns with less risk compared to the benchmark index; resulting in a steadier performance, as evidenced in HQ Portfolio performance metrics.