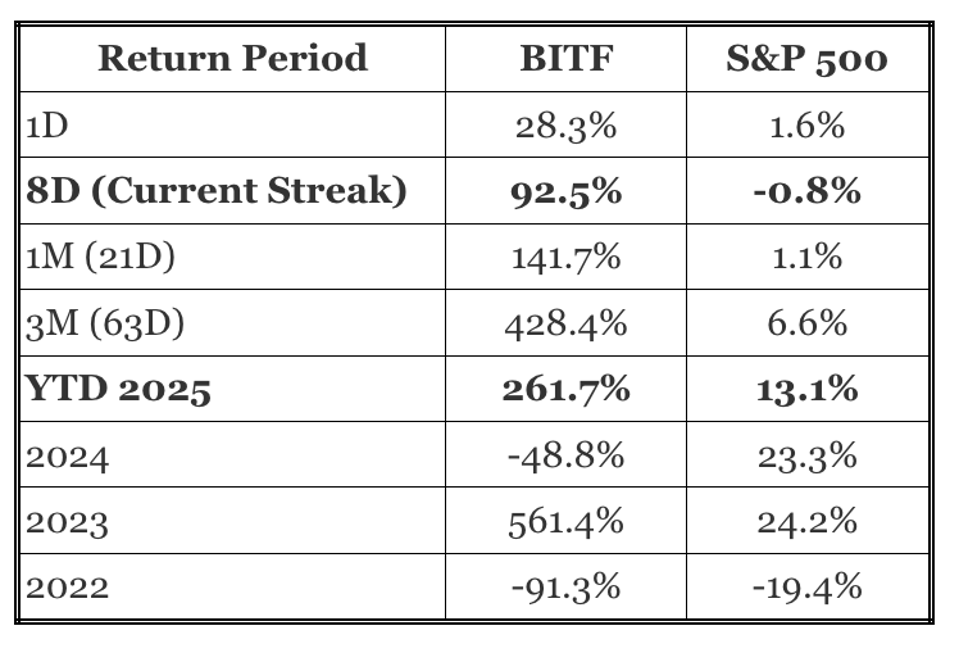

Bitfarms stock (NASDAQ: BITF) is currently on an impressive 8-day winning streak, driving a massive 93% total return and boosting the company’s market capitalization to approximately $3.0 billion—an increase of nearly $2.8 billion during the rally. This phenomenal rise makes its 261.7% year-to-date return dwarf the S&P 500’s 13.1%.

The primary driver for this investor enthusiasm is Bitfarms’ strategic pivot toward providing High-Performance Computing (HPC) and AI infrastructure services. By leveraging its existing data center and energy assets for the high-demand AI sector, the company is attracting significant new interest beyond its traditional business of cryptocurrency mining (validating Bitcoin transactions) and its minor segment of electrician services in Quebec, Canada.

BITF stock has seen considerable growth recently, making it currently appear risky. While this might seem like a warning, there are substantial risks associated with relying on a single stock. Nevertheless, there is immense value in the diversified approach we adopt with the Trefis High Quality Portfolio. It has comfortably outperformed its benchmark—a combination of the S&P 500, Russell, and S&P MidCap indexes—and has achieved returns exceeding 105% since its inception. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics. Separately, see – What’s Happening With RGTI Stock?

Comparing BITF Stock Returns With The S&P 500

The table below highlights the return for BITF stock compared to the S&P 500 index over various periods, including the current streak:

What is the point? Momentum often signals increasing confidence. A multi-day win streak can indicate a rise in investor confidence or trigger further buying. Observing such patterns can help you capitalize on this momentum or get ready for a strategically timed entry if the momentum is lost.

Gains and Losses Streaks: S&P 500 Constituents

Currently, there are 8 S&P constituents with 3 or more consecutive days of gains and 77 constituents that have experienced 3 or more consecutive days of losses.

Key Financials for Bitfarms (BITF)

While BITF stock appears appealing due to its winning streak, investing in a single stock without comprehensive analysis can be perilous. Consider the Trefis Reinforced Value (RV) Portfolio, which has outperformed its all-cap stocks benchmark (combination of the S&P 500, S&P mid-cap, and Russell 2000 benchmark indices) to produce strong returns for investors. Why is that? The quarterly rebalanced mix of large-, mid-, and small-cap RV Portfolio stocks provided a responsive way to make the most of upbeat market conditions while limiting losses when markets head south, as detailed in RV Portfolio performance metrics.