At IHOP and Applebee’s, the problem is plain to see. Dine Brands Management eats first while the operators who built the brands struggle to stay afloat. Franchisees are cutting staff, running on fumes, and holding back repairs just to make rent. Yet in the boardroom, management awards itself bonuses, layers on new fees, and calls it progress. The workers are deprived of recognition by those who take credit for their efforts.

Now we see a real power play. According to The Edge’s PRWeb release, Dine Brands quietly reached out to our proposed board nominees behind closed doors without informing us or shareholders. That is not dialogue. That is manipulation. It confirms everything we have been saying about a management team that protects itself first and serves no one else.

It’s about accountability. It shows how greed at the top is destroying the company from within and why only structural reform can save it. The future belongs to the franchisees. It is time to make them outstanding again.

The Charter Of Inequity In Dine Brands Management: How Leadership Privileges Itself

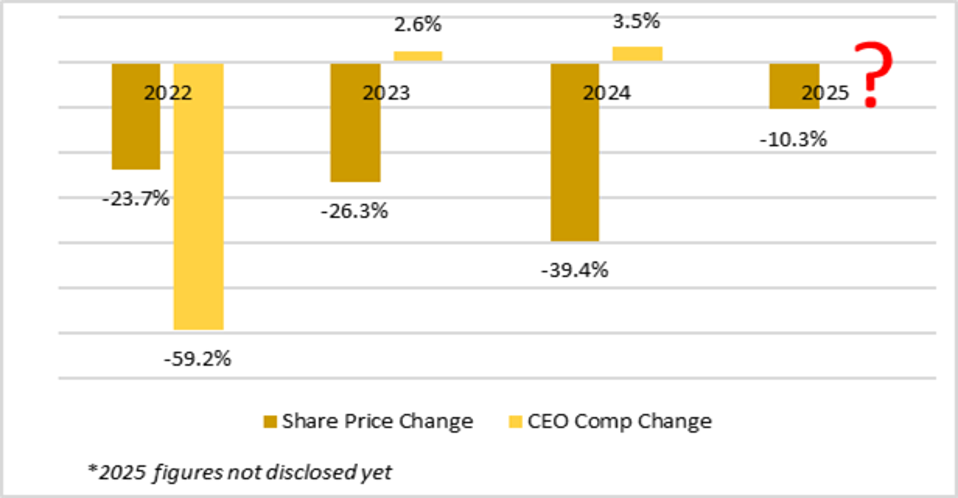

Every system shows you what it values based on its payments. At Dine Brands, the results are clear. Since 2021, shareholders have lost almost 70 percent of their investment value, yet executive compensation has increased. Management has insulated itself with bonuses, equity grants, and “retention” awards, while franchisees bear the full weight of inflation, weak traffic, and capital demands. It is not incompetence. It is by design.

The company’s recent attempt to quietly approach our proposed board nominees without notifying our shareholders confirms this. They are not looking for improvement. They are looking for control. This is how weak boards protect themselves: by pretending to listen while negotiating in secret to keep the system intact.

When leadership privileges itself above performance, decay is not an accident. It is policy. That is the culture Dine Brands has built, one where the people meant to serve the system have turned it into their meal ticket.

The Franchisee Squeeze: Who Actually Runs the Business

Roughly 95 percent of Applebee’s and IHOP restaurants are run by franchisees, yet their voices carry the least weight. The people who keep the doors open are treated as line items, not partners. Corporate dictates programs and forced promotions that may lift short-term traffic but crush local economics. A franchisee told me, “When the chain runs a value promo, I lose two dollars per ticket.” That is not growth. That is slow suffocation.

It is no surprise when you look at who is running the company. Only two of the nine board members have any real restaurant experience. How do you run a business like that? People who have never experienced the weight of a paycheck or a broken fryer on a Saturday night are making decisions.

When those in charge stop listening to the people who know the business, cash flow dries up, stores stop reinvesting, and same-store sales follow. This is not a franchise system anymore. It is a top-down tax on the very people who make the brand possible. Until that changes, the decline will continue.

The Financial Charade: How Shareholders Are Fooled

Dine Brands has built a financial illusion. Management highlights buybacks, adjusted margins, and “normalized” earnings to suggest stability. It is a show. The truth sits underneath. Deferred maintenance, weak technology investment, and rising store-level costs tell a very different story. Franchisees are being squeezed while headquarters packages the decline as progress.

Leverage has quietly crept higher, and debt servicing now consumes more of the cash flow that should be reinvested in the business. Instead of facing the structural weakness, management calls it an “investment phase.” That phrase hides what it really is, a patchwork of accounting adjustments masking years of underperformance.

The danger is not theoretical. If franchisees begin to default, scale contracts and the entire corporate model unravel. Fewer stores mean fewer royalties, less cash, and collapsing earnings. Shareholders are being sold a picture that looks fine from 30,000 feet but is cracking at the foundation. What Dine Brands calls strategy is financial theater, and when the curtain drops, there will be no mistaking who paid for the show.

Alignment Over Aggression

Activism is not about noise. It is about alignment. The Edge did not enter this campaign to fight. We stepped in to rebuild what leadership forgot: that value starts with the people who operate the business, not the ones who sit above it. Our goal is simple: restore balance between franchisees, shareholders, and management before the system breaks for good.

The Edge stands for structural integrity, not short-term optics. We defend franchisee upside, protect shareholder capital, and hold leadership accountable to performance, not privilege. This is how true reform happens, not through confrontation, but through alignment with the people who actually create value. Here’s how the system is fixed.

-

Board And Governance Reset

Real reform starts with leadership. Our nominees, Tom Lewison and Chris Marshall, bring what this board lacks: operational experience and financial discipline. Tom has built and run restaurants. Chris has managed capital through cycles. Together, they anchor credibility. The board must end secret outreach and backroom politics. Committees should be reconstituted to include franchisee voices and truly independent directors who answer to shareholders, not insiders. -

Operational Rebuild

The constant churn of forced promotions and gimmick discounts must stop. They may boost traffic for a week, but they destroy margins over time. Dine Brands needs to reinvest in its restaurant systems: kitchen display technology, ovens, analytics, and margin-tracking tools that help operators run better businesses. Simplifying menus and standardizing processes will strengthen efficiency and restore profitability at the store level. -

Capital Realignment

Cash must go back to growth, not only dividends. The company reviews payouts to preserve capital for reinvestment. High-cost debt must be refinanced or retired, and executive pay tied directly to franchise profitability instead of public relations goals. -

Protection And Disclosure

Transparency is non-negotiable. Franchisees deserve quarterly health reports showing margins and comparative benchmarks. Communication must be open and measurable. Finally, corporate-franchise fund flows must be audited and disclosed. This is how accountability begins.

What Happens if Dine Brands Management Keeps Feasting?

If Dine Brands continues to allow this system to cannibalize itself, It means the collapse will be sudden rather than gradual.t will be sudden and brutal. Franchisees will start closing units, one by one. Doors will shutter, revenue will contract, and private equity vultures will circle to buy the scraps of what was once a proud network of restaurants.

We have seen this movie before. TGI Fridays. Ruby Tuesday. Both were brands that outlived their leadership but not their arrogance. They ignored the operators, masked the decline with accounting tricks, and ended up as relics sold for parts. Dine Brands is heading down the same road unless reform takes hold now.

Shareholders need to understand the cost of inaction. This is not about underperformance. It is about survival. If the current leadership keeps feeding itself first, your equity will vanish. And for operators, the tragedy is worse: you will be blamed for a downfall that was engineered above your heads.

We kindly ask shareholders to refrain from applauding surface-level initiatives. Stop mistaking motion for progress. Demand accountability. Advocate for a board that values transparency over excessive spending and steers clear of superficial financial presentations. You deserve leadership that respects capital, not one that extracts it. The value of this company lies in performance, not promises.

To the franchisees: you are the heartbeat of Applebee’s and IHOP. You open the doors, train the teams, and keep the lights on. The Edge is your voice. This campaign will not stop until your interests sit at the center of every strategic decision.

This is the moment to align. Transparency, structural return, and franchisee-shareholder unity are the foundation of real reform. Together, we can rebuild Dine Brands into a company that serves those who earn its success, not those who consume it. Integrity is not a request anymore. It is the demand.

The Last Bite

“Management Eats First at IHOP and Applebee’s” is not a metaphor. It is the truth. The next chapter for Dine Brands will be one of two paths: systemic reform that restores balance or institutional decline that ends in collapse. The choice sits with shareholders and franchisees who still believe this brand can be saved.

At The Edge, we see value others miss and fix what management breaks. History is unforgiving to brands run by the few instead of being built by the many. The time to change the story is now.

The Edge reached out to Dine Brands Management and has yet to hear back. The Edge holds a 1% stock position in the company.