The AI data-center buildout is all over the news, and for good reason: It’s quite literally upending the economy.

That’s set up plenty of opportunities for us income investors to cash in. But in a moment, we’re going to talk about one specific fund we need to sell yesterday. It yields a sharp 9.9% now. The problem? It’s nearly 2X overvalued!

It’s easy to see what’s catching investors’ attention on the data center front: Investment in AI’s computing backbone is on track to contribute more to US economic growth than the American consumer.

To say that this is incredible is an understatement. And it’s got investors scrambling to cash in. Many are going after utility stocks as the favored play here, and it’s easy to see why: AI’s bottomless power thirst is sending power demand—and prices—soaring.

In the most extreme cases, we’re seeing prices for electricity more than double—but even the least-affected cities, like Portland, Oregon, have seen “just” a 22% increase in the cost of electricity from 2020 to now, according to Bloomberg.

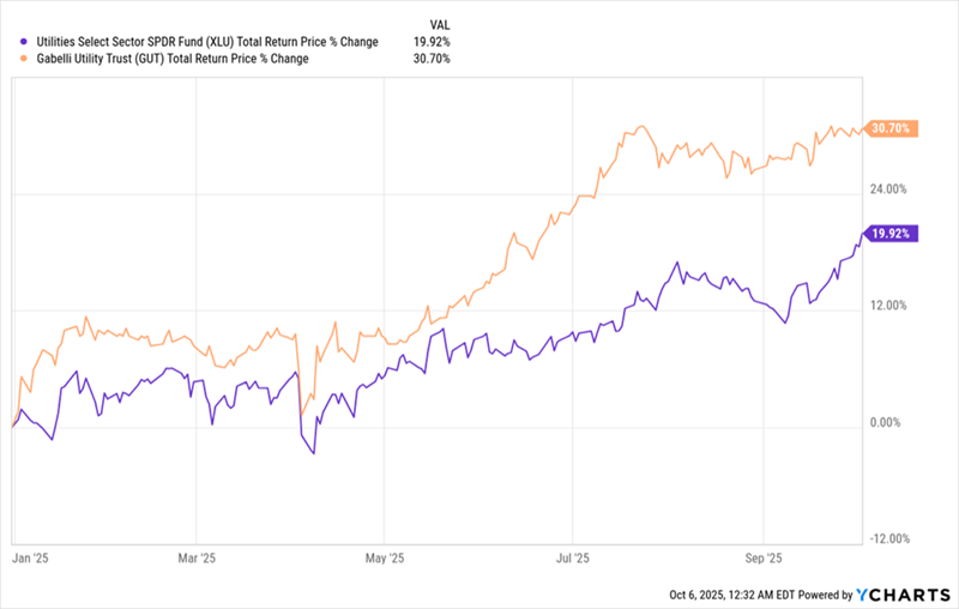

Many other cities are seeing even bigger increases, which, yes, is a windfall for utilities. Investors, of course, are well aware of this—they’ve sent utility stocks soaring. The benchmark ETF for the sector, the Utilities Select Sector SPDR Fund (XLU)—current yield: 2.7%—has soared 20% year to date as I write this.

That’s nearly twice its 10.9% average annualized return over the last decade, and the year isn’t even over yet!

1 Overvalued AI Play

But if you’re an income investor (and if you’re reading this, there’s a good chance you are), you might be tempted by another fund—a popular utility-focused closed-end fund (CEF) called the Gabelli Utility Trust (GUT), which sports an outsized 9.9% yield and a dividend that has held steady since the early 2010s.

GUT holds many of the blue chip “go-to” power generators, including NextEra Energy (NEE) and Duke Energy (DUK). Pipeline operators like ONEOK—which also stand to gain as AI drives up demand for gas-fired power—also make an appearance.

And as you can see below, GUT’s total return (in orange), based on its price on the open market, has trounced XLU (in purple) so far this year.

That’s great if you own GUT, of course. But if you’re considering a buy, it’s also the first signal that this fund might be overvalued. That’s because GUT’s outperformance is a recent—and temporary—phenomenon. Over the last decade, the fund has performed very close to the index fund.

This, however, isn’t the whole story, nor is it even the most important part. The chart above shows the total price returns for each fund.

But we need to bear in mind that with CEFs, the performance of the fund’s price on the market is different than that of its underlying portfolio—known in CEF-speak as the net asset value, or NAV. A CEF’s NAV is a clear indicator of management’s stock-picking skill, without the mood-driven moves affecting the fund’s market price.

When we look at GUT’s total NAV return (including dividends management has collected), we see that the fund is actually trailing the index.

GUT has actually been slightly underperforming over the last decade, which isn’t a terrible deal: This works out to a 9.4% annualized return, which is still very decent, especially for a “low-drama” asset class like utilities. But where the rubber really hits the road on whether a CEF is a buy is at its discount to NAV, or the deal we’re getting when we buy (at the market price, of course) over the NAV.

And here’s where any sense that GUT may be a buy now runs straight into a wall.

GUT is trading at a 90.2% premium to NAV—a number so absurd it deserves a moment of reflection. If you bought all of GUT’s assets on the open market, you’d be getting them for about half the price you’d pay to buy GUT itself. So why buy GUT?

Why indeed.

Until GUT’s premium evaporates, this is a must-avoid fund. Its yield is great, and its past performance is fine, but consider what happened when GUT reached its all-time-high premium of 125% in 2023.

In late 2023, a sudden selloff of GUT caused the premium to fall to “just” 50%, and investors suddenly had nearly 30% losses on their hands. The fund’s total return has since retraced some of that ground, but it’s still well off the highs it saw when it held that lofty 125% premium.

As for the current 90% premium, well, let me just say that AI fever has caused a massive bull run in all sorts of things, so it’s no surprise it would cause GUT to rise, too. But the real takeaway here is that the recent outperformance isn’t really due to GUT’s management or its portfolio—it is all to do with investors bidding up GUT specifically. That sets the fund up for another 2023-like fall.

Michael Foster is the Lead Research Analyst for Contrarian Outlook. For more great income ideas, click here for our latest report “Indestructible Income: 5 Bargain Funds with Steady 10% Dividends.”

Disclosure: none