All portfolios include child labor: no detection and no evidence of remediation are red flags. In the second of three articles in a series, we present open source tools that are practical, evidence-based, and simple enough to use across all investment portfolios of asset managers. And we supplement these with more complex tools to use when there is greater risk.

Child labor is a large and growing problem in the United States. With child labor violations in the US up 79% year-over-year following an 140% increase over the past decade, detecting and mitigating child labor violations is material for all investors. This is the second article in a series on child and forced labor due diligence and monitoring. The series draws from guides for asset owners and asset managers that Kathy Hahn and Juho Rana Kim from Casey Family Programs, Jerome McCluskey of Latham & Watkins, and I co-authored following consultations with and/or contributions from over 100 experts, ranging from Save the Children to Neuberger Berman and from UNICEF USA and its Impact Fund for Children to BlackRock.

The One-Page Child and Forced Labor Due Diligence Guide for Asset Managers

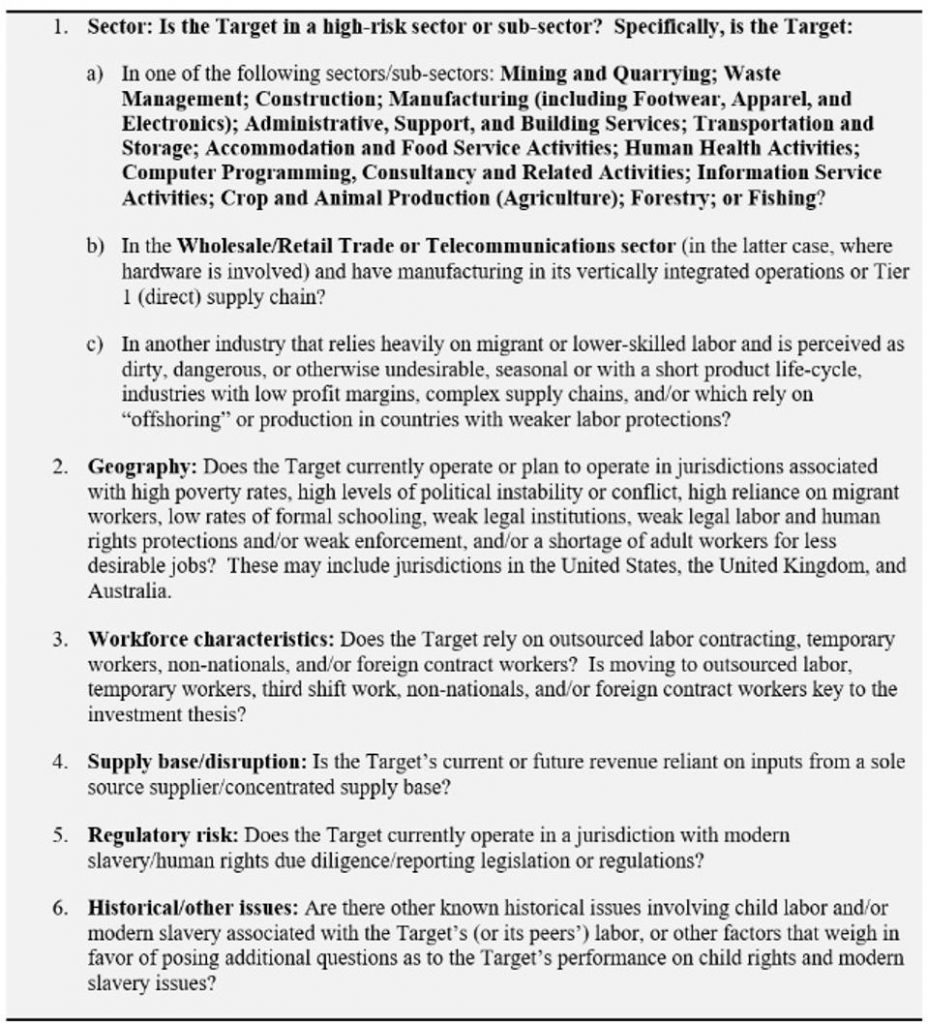

This one-page child and forced labor due diligence guide for asset managers consists of six due diligence questions for asset managers to use when underwriting portfolio companies. If the answers to all of the questions immediately below are no, the process is complete. If the answer to any of the questions below is yes, asset managers would proceed with the longer questionnaire that follows further below. Alternatively, questions may be adapted and put to management or the compliance team of a target on a legal due diligence call. This guide is designed to be intuitive enough for any team member to use and brief enough for investment team members to hang in their cubicles as a reference to use while underwriting and monitoring portfolio companies.

Questions for All Prospective Portfolio Companies

The Asset Manager Standard and Detailed Questionnaires for Child and Forced Labor

The following tables present a four-page child and forced labor due diligence questionnaire for asset managers to use with higher risk portfolio companies. If answers to any of the questions in the Standard Questionnaire immediately below are unclear or suggest a higher level of risk, parts or all of the Detailed Questionnaire should be applied based on the responses to the Standard Questions.

As Human Rights Watch Senior Researcher Jim Wormington notes, optimal use of the Detailed Questionnaire would require in-house sector expertise, external partners, or both, and asset managers should consider resource requirements. Asset managers would naturally vary the number of questions from the Detailed Questionnaire that they ask based on position size, whether the position is a controlling interest, potential risks involved, and what change they are trying to drive in their portfolio and/or across the industry.

Standard Questionnaire for ESG Assessment

Where the answer to any of the above questions is unclear or suggests a higher level of risk, please use parts or all of the below Detailed Questionnaire based on the responses to the Standard Questionnaire.

Detailed Questionnaire

The next article and final in this series presents a longer list of due diligence questions for asset owners to use if answers to any of the three Heightened Risk Scenario questions from the first article in this series is unclear or suggests a higher level of risk.

Note: Special thanks to the organizations with team members who generously took the time to contribute to this work, listed here. The views of this series of articles should not be construed as reflecting the views of these organizations.