Key News

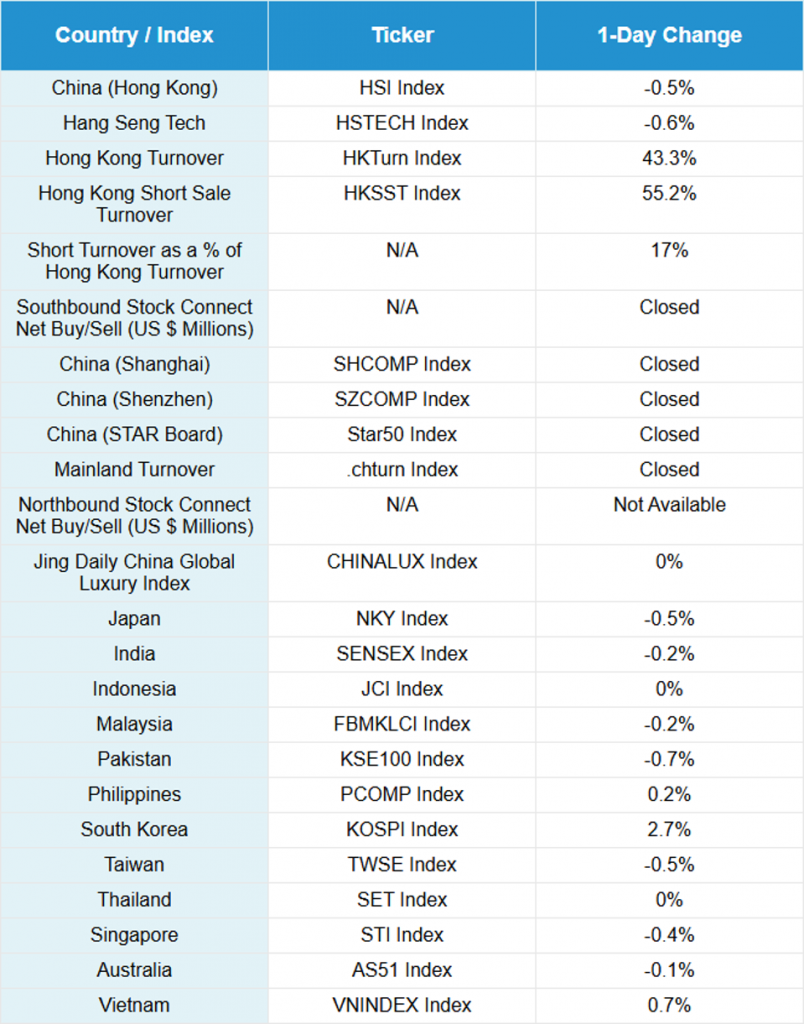

Asian equities were mixed but mostly lower overnight, though Vietnam saw gains on its upgrade to Emerging Market status by index provider FTSE Russell, while Pakistan and Hong Kong underperformed.

Hong Kong declined on low volumes due to the lack of flow from Mainland China, as Mainland markets remained closed for the “Golden Week” national holiday. Mainland markets will reopen tomorrow, so we should see some Southbound Connect flow come back. Hong Kong stocks followed Wall Street south on concerns of a potential AI bubble in the US. Note that markets did not recognize China as a significant AI player until late last year with the release of the DeepSeek large language model (LLM). So, we might see a pullback in China, too, but the valuations remain far lower than in the US.

Autos did well after Geely Automotive announced a share buyback. Gold names also outperformed after the central bank continued its nearly yearlong streak of adding gold to its balance sheet.

CF Pharmatech, a biotech company, listed shares publicly in Hong Kong for the first time today, rising a staggering 161%. It is amazing the feats that China’s biotech firms have accomplished in recent years, especially as the US Congress looked at a bill to restrict US drugmakers and healthcare providers from using China-based companies. The BIOSECURE Act was eventually tabled. At a conference this week, we heard about the significant pushback from US healthcare lobbyists on this bill and similar executive orders, which led to them being tabled.

Alibaba fell despite setting up an in-house robotics team within Qwen, the E-Commerce giant’s large language model department. China is far along in robotics development, though it is interesting to see a company such as Alibaba getting involved in the space, which is crowded with startups. Many of the robotics upstarts are located in Hangzhou, and our team just visited with some of them. Hangzhou is also the location of Alibaba’s headquarters, which we visited last year. As such, it makes sense that they are getting involved. One of China’s key advantages has always been the localization of supply chains, as in you can have the full supply chain for a product all located in one city. Hangzhou is an example.

About 1.16 million mainland visitors entered Hong Kong over the first 6 days of the Golden Week holidays, up 5% from last year. Nonetheless, Trip.com fell -1.96% on broad market weakness, though the substantial holiday travel numbers should benefit tourism and travel names. Perhaps they will be among the key Mainland buys when the market reopens.

People have been asking us whether there is another stimulus “bazooka” coming. Probably not, but we think the government will continue to do what it has been doing, which includes trade-in subsidies and local consumption vouchers. Also, the 15th Five Year Plan is currently being drafteed in Beijing. The release of this important policy blueprint could have a somewhat stimulative effect.

New Content

Read our latest article:

Are Commodity Executives The Best China Economists?

Please click here to read