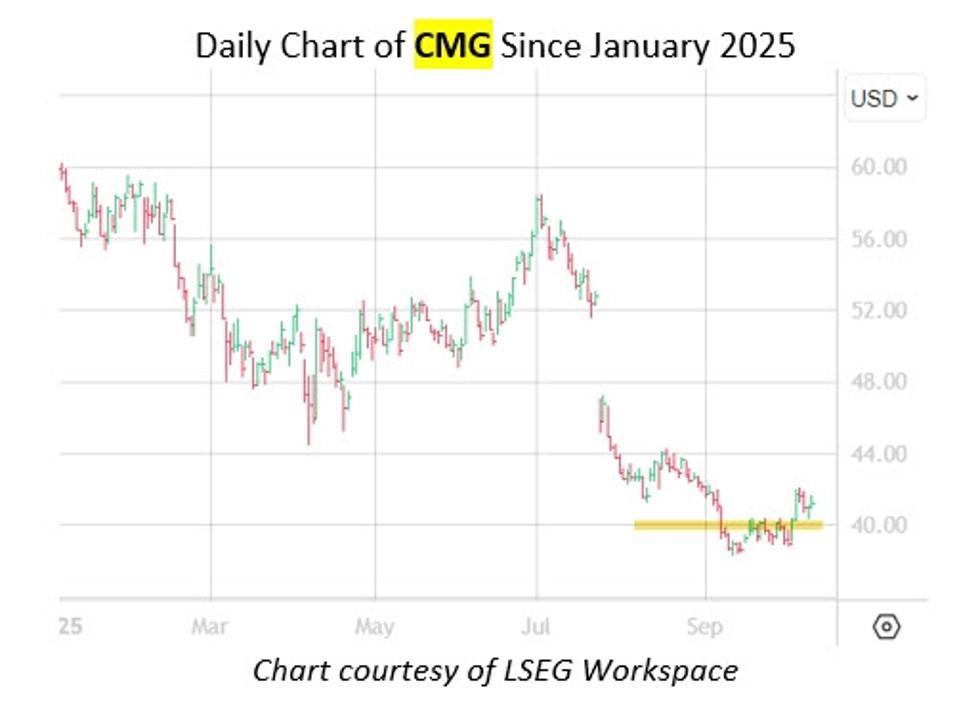

Schaeffer’s Senior Quantitative Analyst Rocky White compiled a list of the worst 25 stocks to own in October, with data going back 10 years. Right at the top of the list is Chipotle Mexican Grill Inc (CMG), marking a monthly loss in eight of the past 10 Octobers. Averaging a return of -4.7%, a pullback of this magnitude from the equity’s current perch at $41.20 would put the shares at $39.26, back below recent pressure at the $40 level.

CMG has been struggling on the charts, falling as low as $20 in July, after suffering its worst bear gap since 2017. Finishing every month of the third quarter lower, the shares now sport a 31% year-to-date deficit.

The food chain giant looks ripe for downgrades, too. Of the 32 analysts in coverage, 25 brokerages sport a “buy” or better recommendation. Should these bulls begin to drop off, more headwinds could be on the way for CMG.

Long-term options traders have been more bullish than usual toward the security of late. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), CMG’s 10-day call/put volume ratio of 6.57 ranks higher than 92% of readings from the past year.

Echoing this, short-term traders sport a call-bias. This is per the security’s Schaeffer’s put/call open interest ratio (SOIR) of 0.76, which sits in the 25th percentile of readings from the past 12 months. Should this bullish sentiment begin to unwind, it could trigger more downturn for the food stock.