Key News

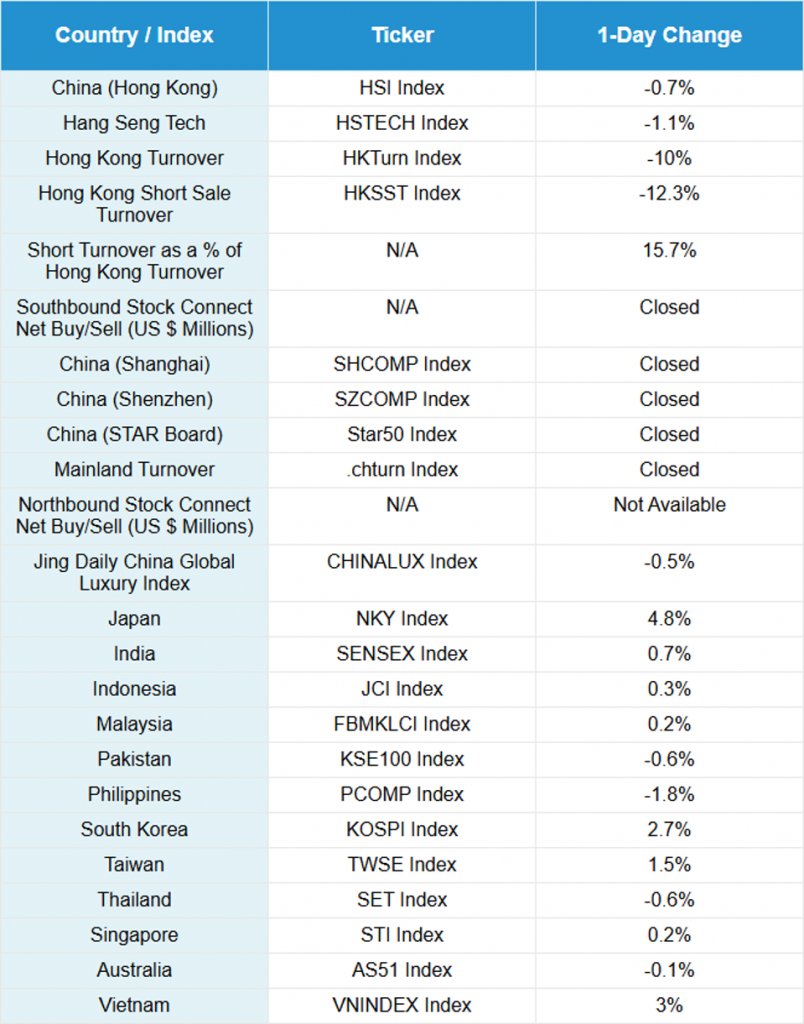

Asian markets were largely higher, led by Japan’s post-election exuberance and Vietnam, following its 8.23% GDP growth print and potential upgrade to Emerging Market by index provider FTSE Russell, expected on Wednesday.

Mainland China remains closed for the National Holiday, while South Korea was closed for Chuseok, which is Thanksgiving Day, and Taiwan was closed for the Mid-Autumn Festival.

Hong Kong’s volumes and breadth slumped even further than Friday, as the market was led lower by growth stocks, as Hong Kong traders remained poolside. The Hang Seng Index closed just below the 27,000 level, while the Hang Seng Tech Index closed above 6,500. Non-ferrous metals were one of the few bright spots, as gold continued to shine, led by Zijin Gold International, which was up +8.24%. Bucking the downdraft were insurance and semiconductors, which should benefit from today’s AMD and OpenAI announcement, and Tencent, which gained +0.59%.

Growth stocks and subsectors were off, led by Alibaba, which fell -2.49%, Meituan, which fell -0.47%, Xiaomi, which fell -2.09%, and Kuiashou, which fell -1.13%. Contemporary Amperex Technology (CATL) fell -2.29% on a broker downgrade to neutral.

Typhoon Matmo’s timing could not be worse as flights to and from the popular vacation destination Hainan Island were impacted. The storm appeared to weigh on tourism and travel stocks, while Macau was off on reports that high-end gaming numbers will be weak. MGM China fell -4.7% and Sands China fell -2.44%.

Yesterday, Mainland media reported that there were 299 million instances of the hard-to-decipher “cross-regional personnel flow,” which represents a 6.3% year-over-year (YoY) increase. Very quiet overnight!

When it comes to the US government shutdown, I have little insight. We have spent time in Washington, D.C., trying to inform Congress that delisting U.S.-listed Chinese stocks would not harm the Chinese government but would harm U.S. and global investors. Following our spring visit with a senior member of a congressperson’s staff, my takeaway was that whatever position one party takes or policy the other party implements, the other party will take the opposite position. The two sides really can’t stand each other, as the fringes of both parties make concessions difficult, and moderates don’t make it through the election primaries. On that happy note……

Hong Kong is closed tomorrow, so we will not be publishing China Last Night. Your inbox will be spared!

Live Webinar

Join us Tuesday, October 7, 2025 at 10 am EDT for:

Anthropic’s Surge & The Potential Benefits of Pre-IPO Exposure in AI ETFs

Please click here to register

New Content

Read our latest article:

Are Commodity Executives The Best China Economists?

Please click here to read