There are only two types of investors: those who have unlawful child labor in their portfolios, and those who do not yet know that they have unlawful child labor in their portfolios. So we present open source tools that are practical, evidence-based, and simple enough to use across all investment portfolios.

The conventional wisdom is that eradicating child labor is an issue for impact investors and faith-based investors. The conventional wisdom is wrong. Unlawful child labor violations are both pervasive across investment portfolios and growing. The United Nations Children’s Fund (UNICEF) and International Labor Organization (ILO) estimate that approximately 138 million children engaged in child labor in 2024, with about 54 million of them in hazardous work. This article is the first in a series on how all investors can efficiently detect and address unlawful child and forced labor in their portfolios.

The most common public equities benchmarks are MSCI All Country World Index (ACWI) for global equities and S&P 500 for US equities. Since 11 companies named in a New York Times investigation on migrant child labor in the supply chains of various companies are constituents of the MSCI ACWI and 8 of them are also constituents of the S&P500, companies with a history of child labor violations in their supply chains are all pervasive and in nearly every investment portfolio.

Child labor violations in the US are up another 79% year-over-year. This follows New York Times reporters finding child labor violations in all 50 states and in the supply chains of companies ranging from General Mills to General Motors and from Amazon to Berkshire Hathaway in 2023, at which point child labor violations were up by 140% over the past decade.

Because combatting unlawful child labor is an area of bipartisan agreement, there is the potential for vast, deep and powerful collaboration among stakeholders. To illustrate the broad opposition to exploiting children, in the spring, U.S. Senators Cory Booker (D-NJ) and Josh Hawley (R-MO) reintroduced the Preventing Child Labor Exploitation in Federal Contracting Act, which passed out of the U.S. Senate Homeland Security and Governmental Affairs Committee with strong bipartisan support last year, but has not yet been enacted into law.

Accordingly, Latham & Watkins LLP Partner Jerome McCluskey, Casey Family Programs Director of Investments Kathy Hahn and Investments Associate Juho Rana Kim, and I spent over a year syndicating the insights from hundreds of pages of resources on child and forced labor into due diligence and monitoring guides for institutional asset owners and institutional asset managers. We then honed the guides through consultations with over 100 experts from across law firms, civil society, multilateral institutions, regulators, and investors.

Our goal was to create open source tools for investors that are practical, evidence-based, and simple enough to use across all investment portfolios. We share the first of these tools today and the rest through a series of articles over the next couple of weeks. Our hope is that investors will use them to identify, eliminate, and remediate unlawful child labor in their portfolios, take the time to share feedback with us, and experiment with other approaches that enhance the wellbeing of and fairness to children in their investment portfolios.

The Asset Owner Guide to Eliminating Child and Forced Labor from Investment Portfolios

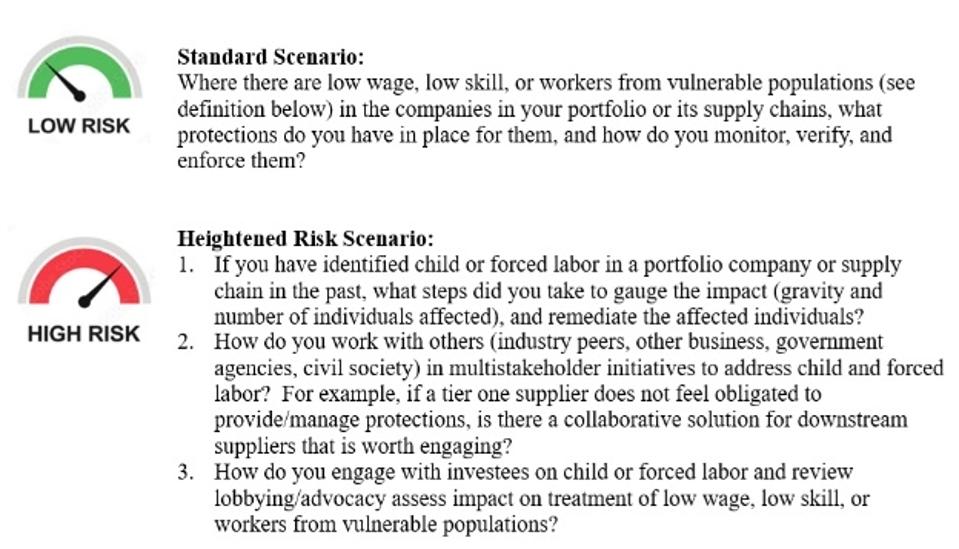

The first tool is a one-page child and forced labor due diligence guide for asset owners considering an investment with asset managers. It helps asset owners gauge whether prospective investments have a heightened risk of child and forced labor. It also provides one due diligence question for low-risk investments and three questions for high-risk investment. It is designed to be intuitive enough for any team member to use and brief enough for investment team members to hang in their cubicles as a reference to use while underwriting and monitoring asset managers.

Child and Forced Labor Due Diligence Questions for Limited Partners

Indicators of Heightened Risk Scenarios

The next article in this series presents a due diligence guide for asset managers.

Note: Special thanks to the organizations with team members who generously took the time to contribute to this work, namely ABRY Partners, Actis, Agilitas, Albourne, AllianceBernstein, Annie Casey Foundation, Apollo, Ariel Investments, Artisan Partners, Astorg, Baillie Gifford, Blackstone, Brookfield, Brown Capital Management, Building Service 32BJ Funds, Casey Family Programs, Church Pension Group, Doris Duke Foundation, Emerging Market Partners, Francisco Partners, Girls Who Invest, Goldman Sachs, GoodWeave International, Granger Management LLC, Heartland Initiative, Human Rights Watch, Interfaith Center on Corporate Responsibility, ISS Stoxx, JNJ, JPMorgan, Latham & Watkins, Linsell Train, Lingotto Innovation, Mercy Investment Services, Mirae Asset Ventures, Mosaic at Lingotto, Neuberger Berman, the New York City Comptroller, Ninety One, Oxfam America, PIMCO, Sands Capital Save the Children, Service Employees International Union, Siguler Guff, Social Finance, Trinity Church NYC, UNICEF USA, Verite, Westfuller Advisors, Wespath. The views of this series of articles should not be construed as reflecting the views of these organizations.