President Trump has said that he wants to give soybean farmers $10 billion. The gesture is to make up for the money they lost when China cut grain imports as part of their response to increased tariffs. But what does it really mean?

That $10 billion of the $364.6 billion that U.S. consumer and business taxpayers laid out for import surcharges in the first half of 2025 would go to supporting farmers with no mention of other exporters, businesses, and individuals have also been financially penalized for the trade strategy. Can we know how much has been cut out of the economy and how it compares to what everyone has, knowingly or not, had to kick in?

The Soybean Problem

When Trump sharply increased tariffs, he targeted China more than any other country, initially setting rates at 145% of invoiced product costs, as The New York Times reported.

Agriculture represents about 5.5% of the U.S. economy or $1.537 trillion (2023 figures), according to the U.S. Department of Agriculture. Technically, farms contribute $222.3 billion of this amount, or 0.8% of U.S. GDP.

The farm numbers are deceiving because of the number of industries that depend on farms: “food and beverage manufacturing; food and beverage stores; food services and eating/drinking places; textiles, apparel, and leather products; and forestry and fishing.” Also, without farms, much of the rest of the agricultural sector would suddenly have far fewer customers.

Soybeans are the largest of the three giant crop products in the U.S., along with corn and wheat, and are a major export product, as the USDA’s Foreign Agricultural Service says. In 2024, the total export value was $24.47 billion, down from the three-year average of $28.85 billion.

China has been the country’s third-largest agricultural export market, with a three-year average purchase of $30.43 billion and $24.41 billion in 2024. Exported soybean sales in 2024 to China were $12.65 billion, which was 51.7% of all soybean exports.

Because of the trade fight and the administration’s tariff strategy, there have been zero soybean sales to China so far this year, according to the Foreign Agricultural Service.

“This theory of short-term pain for gain down the road — that’s just not working, and it won’t work,” Ed Hodgson, who farms 1,500 acres of land in Rice County, Kansas, told MarketWatch.

Other Sales Are Gone

This isn’t the only loss of exports to China. They started during the early part of the first Trump administration and continued to some degree through the Biden administration, as the former president largely left the elevated tariff levels in place.

Forbes contributor Ken Roberts wrote in June that the total of lost export sales due to Trump tariff strategies over seven years was between $160 and $201 billion.

Soybean exports have been down, although not nonexistent the entire period. However, they aren’t close to the total losses, and Congress would likely need to authorize any reimbursement.

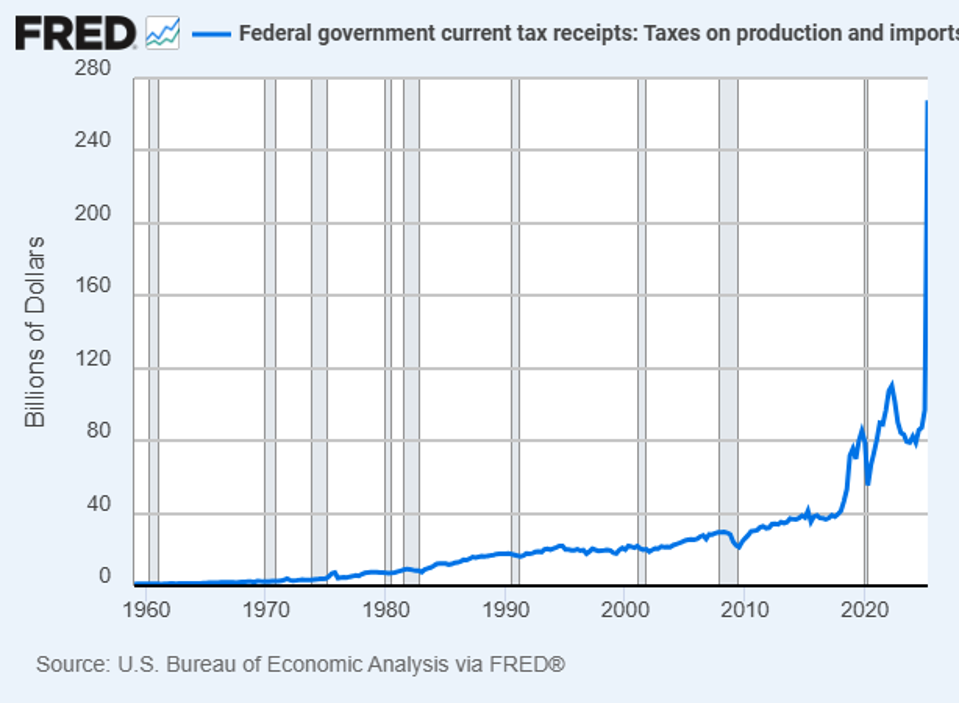

As for where the funding cash could come from, the answer is from taxpayers, both consumers and businesses. That means — one way or the other — you. Below is a graph from the Federal Reserve Bank of St. Louis showing customs duties paid per quarter.

In the first quarter of 2025, customs duties paid were $96.97 billion. In the second quarter, they were $267.68 billion.

For some reference, the average quarterly duties paid from 1959 through 2017 were $15.18 billion. From 2018, when Trump started implementing higher tariffs in his first term, and through 2024, as Biden didn’t significantly change Trump’s tariffs, the quarterly average was $79.47 billion.

The enormous amount of tariffs paid in the first half of 2025 was about 0.8% of GDP for the same period. As tariffs hadn’t ramped up in the first quarter, two quarters like the second would have been $535.36 billion, or 1.1% of GDP.

That is just for size because it doesn’t reduce GDP, it just shifts more money into federal government coffers because, as everyone should remember, tariffs are regressive taxes. The claims that exporters in other countries would pay them wasn’t entirely fiction. Many overseas sellers lowered their prices to reduce the tariffs that would be collected, which means they made less money, not that they paid the actual tariffs in discussion here.

U.S. importers have been in a different position. They might have covered some of the tariff costs out of their profits, not passing all onto businesses and consumers. Still, whether the importers or the increased prices to customers, the tariff receipts are money paid to the federal government, like any other taxes paid. The $10 billion that might be paid to some farmers

These losses might well continue. During Trump’s first term, China hiked tariffs on soybeans. Buyers in the country turned to Brazil, another major soybean producer. It was a major change as buyers become unlikely to see the U.S. out of convenience as their only supplier.

The same will happen with other types of U.S. exports, no matter how many people in the administration claim they are winning. How much of the collected tariffs in the future would need to be sent to domestic companies to make up for markets undermined the government has undermined?