The federal government shut down…key jobs data went MIA…but stock and precious metals markets melted up anyway. Why aren’t political and geopolitical developments derailing this year’s bull run? Find out from a select group of MoneyShow market experts!

In this episode of the MoneyShow MoneyMasters Podcast, senior alternatives investment strategist Tony Davidow of the Franklin Templeton Institute and managing director Scott Zelniker of UBS-The Zelniker Dorfman Carr & Heritage Group share their insights on the current stock market rally after two years of exceptional gains.

They discuss whether the strong momentum can continue and explore key market drivers, including the Fed’s rate cuts, the ongoing technology revolution, and the resilience of US equities despite geopolitical and trade risks.

Tony also delves into the growing significance of private markets, revealing why private equity, private credit, and real estate debt could be the best opportunities in the years ahead. Plus, they explain why investors should reconsider traditional office real estate and consider diversified approaches in both public and private assets.

Whether you’re navigating the complexities of valuation or looking for actionable investment themes for 2026, this episode offers expert perspectives on balancing optimism with caution in today’s evolving market landscape.

Reminder: Tony and Scott will be speaking at the 2025 MoneyShow Masters Symposium Sarasota, scheduled for Dec. 1-3 at the Ritz-Carlton Sarasota. Click here to register.

Edward Yardeni Yardeni QuickTakes

he SPDR S&P 500 ETF (SPY) recently closed at 666. So, what does that mean? Meanwhile, we’re getting confirmation of the recent weakness in the official payroll numbers.

Might the 666 close be signaling a market top this time? If so, then we can see that happening for the Magnificent Seven, as investors struggle to fathom whether all their spending on Artificial Intelligence (AI) infrastructure will ever be profitable. Meanwhile, the S&P 493 should continue rising on solid earnings. On balance, the S&P 500 should end the year at a new high of around 6,800.

(Editor’s Note: Ed is speaking at the 2025 MoneyShow Masters Symposium Sarasota, scheduled for Dec. 1-3. Click HERE to register.)

As for the job market, among the most real-time indicators are the three jobs availability series included in the Consumer Confidence Index (CCI) survey. In September, the “jobs-plentiful” series fell to 26.9%, while the “jobs-hard-to-get” series rose to 19.1%.

The “jobs-hard-to-get” series is highly correlated with the unemployment rate and suggests that it might have risen in September from August’s 4.3%. However, while the former indicates that the duration of unemployment may be increasing, weekly initial unemployment claims data indicates that layoffs remain low.

There is also a good correlation between the CCI’s jobs availability spread and the job openings series in the JOLTS report. The latter just came out for August, and might be heading lower in September, according to the jobs availability spread.

The pace of hires was a solid 5.1 million during August though. During economic expansions, this series typically exceeds the pace of separations attributable to layoffs and quits. During August, they were identical.

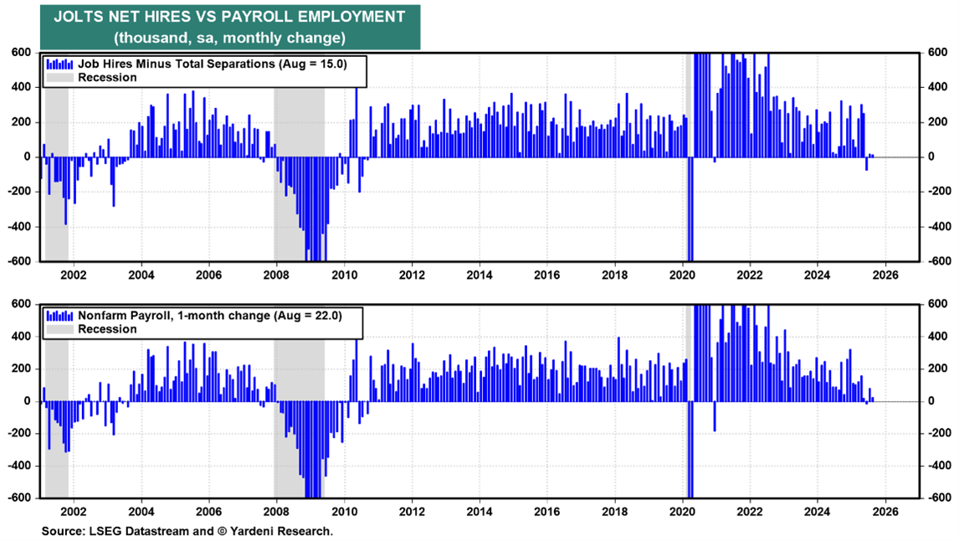

The spread between hires and separations is another way to measure the monthly change in payroll employment. This series is confirming the recent weakness in the official payroll numbers. We attribute the weak labor market data to a shortage of workers with the skills needed by employers, who are responding by doing what they can to boost productivity.

Lance Roberts Bull Bear Report

We have become numb to the prospect of government shutdowns because they occur so frequently. Most often, continuing resolution bills are agreed upon before a shutdown anyway, thus enabling the government to continue operating. And from a stock market perspective, the 21 actual shutdowns have had a negligible effect.

In all but three of the last 47 years, a continuing resolution bill has provided “temporary” funding. The year 1997 was the last one that Congress actually agreed upon a budget. Meanwhile, the graph here (courtesy of Statista) illustrates the 21 instances of government shutdowns that have occurred since 1976.

While a government shutdown may have negative consequences for government workers and employees working in industries closely tied to the government, the economic impact is likely to be minimal. This is especially true if the shutdown only lasts a few days.

As for markets, on average, the S&P 500 Index (^SPX) has GAINED 0.5% during shutdowns since 1976. The most recent, in December 2018, was the longest on record. Yet it also had the highest stock market return at 6.9%.

Of the 21 instances, the maximum loss over the shutdown period was 3.4% (Oct. 10, 1976). Moreover, 71% of the cases posted a positive return. Bottom line: Investors should not fear shutdowns.