Key News

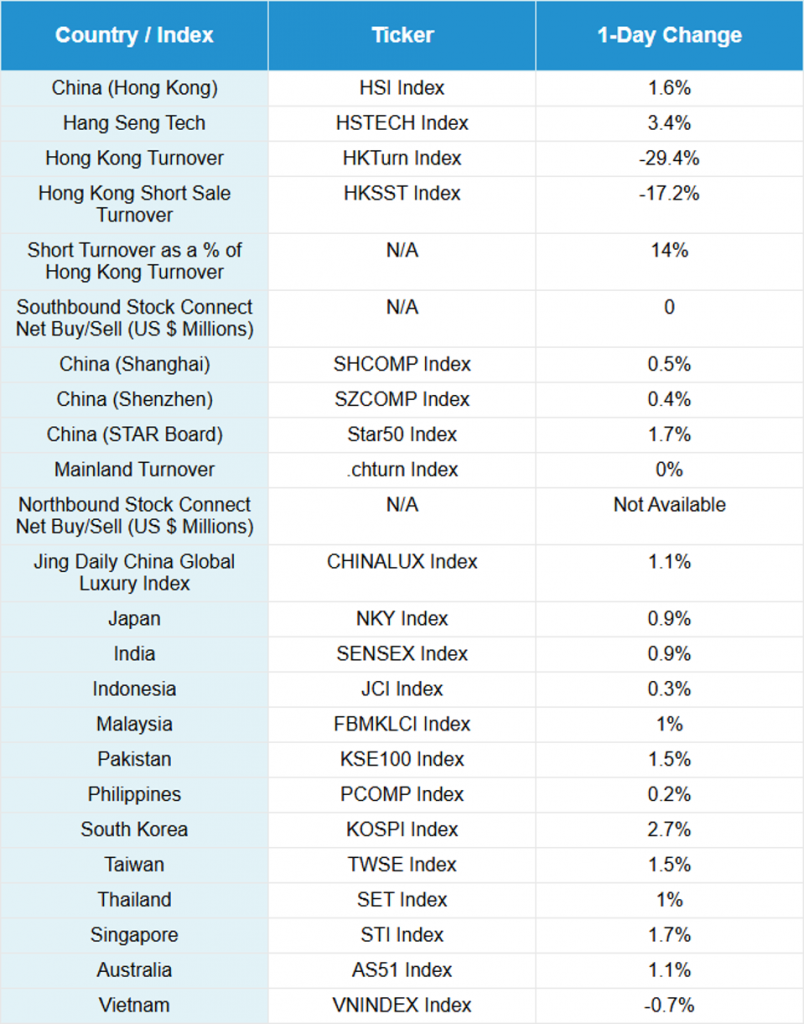

Asian equities had a strong day as Hong Kong, Taiwan, South Korea, Australia, Singapore, Malaysia, and Thailand all posted +1% daily returns. China is closed for the National Holiday or “Golden Week”, while India was closed for Gandhi’s birthday.

Concerns that Hong Kong’s market would fall due to the lack of Mainland Chinese buying via Southbound Stock Connect were quickly dismissed overnight as the market rallied. Volumes were decent, at 93% of the 1-year average, considering Southbound Connect accounts for ~25% of Hong Kong volume, as the Hang Seng Tech punched out above the 6,500 resistance level. Hong Kong was driven higher by the outperformance of growth subsectors such as internet, autos on yesterday’s strong September sales, pharmaceuticals, biotech, non-ferrous metals (precious metals and base metals), semiconductors, and technology hardware.

Alibaba gained +3.45% on decent volume, driven by two separate sell-side analyst upgrades, AI-driven cloud computing, and a rebound in core E-Commerce. One analyst called the company’s 17.6x non-GAAP FY 2027 estimated valuation “undemanding” compared to global peers. The company reported its recently enhanced “Amap” maps application that highlights local restaurants, hotels, sights, like a Yelp with Waze capabilities, had 360 million users yesterday who made 2.6 billion AI-assisted travel and local service-related requests. Alibaba’s quarterly filing with the Hong Kong Exchange reported spending $251 million on buying 2 million ADRs in Q3 2025. Quarter over quarter, the company decreased its share count by 0.02% for a net buy of 400k American depositary receipts (ADRs).

Tencent gained +2.05% on no news, though the company’s buyback has also been exceedingly impressive. Yes, they offset Prosus’ selling, but I commend them for their great shareholder-friendly effort! Tencent buys 800K shares a day. My favorite sleeper AI play, Kuaishou Technology +8.57% has officially shed its “sleeper” status, having gone vertical in the last week. CATL +5.95% as the company’s HK share closed above HK $600. Semis had a strong day on an analyst upgrade with SMIC +12.7% and Hua Hong Semis +7.13%.

It was interesting that Real Estate was Hong Kong’s worst-performing sector overnight, falling -3.89% despite a strong increase in inventory sold in September in Shanghai, up+8%, and 4% from last year. Shenzhen’s inventory sold increased +20.7% in September and 38.3% from last year, and Beijing’s inventory sold increased +19.4% in September and 20.5% from last year.

China’s Ambassador to the US, Xie Feng, held a reception at the DC embassy, giving a pro-US China relationship speech.

Often dubbed the largest human migration, today’s National Holiday week travel numbers will be exceedingly large. China State Railway Group reported 18.46 million passengers traveled by train, with 23 million expected today, though beneficiary Trip.com was off by 1.76%. Banks were off overnight.

A very large US and global asset manager is launching their EM ex China ETF today. Massive company ETF launches and liquidations are decent proxies for where we are in a market cycle. By the time the product development team identifies a trend, researches it, gains conviction to bring it to pitch, convince, and get approval from the executive committee, that trend is likely already in the review mirror. Exhibit A would be that Chinese equities have been in a bull market since January 2024, though most pundits will point to the YTD 2025 performance, and yet here is an EM ex-China launch.

With President Trump confirming his meeting in Korea with President Xi yesterday, I suspect this announcement marks the bottom in US investor anti-China sentiment. Fingers crossed at least. What’s the inverse of this trade? That’s where my chips are!

Live Webinar

Join us Tuesday, October 7, 2025 at 10 am EDT for:

Anthropic’s Surge & The Potential Benefits of Pre-IPO Exposure in AI ETFs

Please click here to register

New Content

Read our latest article:

Are Commodity Executives The Best China Economists?

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

Closed for National Day/Golden Week in Mainland China.