Key News

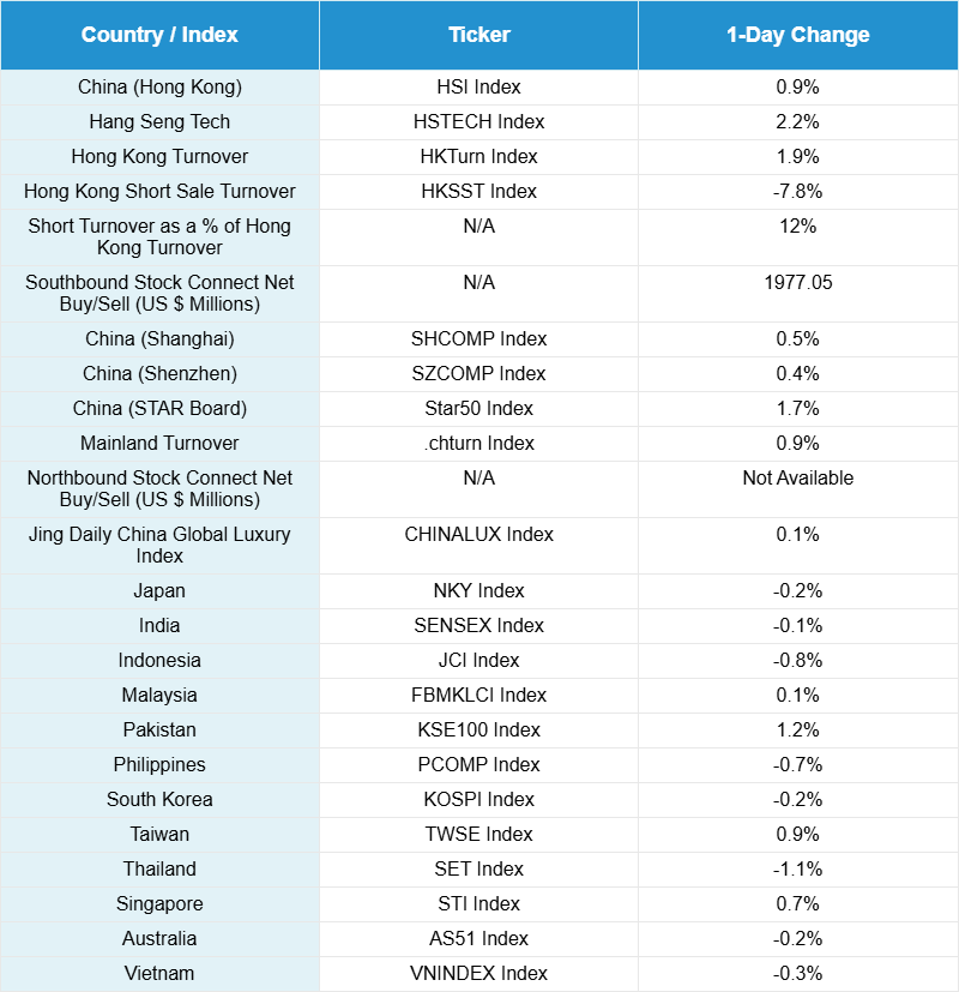

Asian equities were mixed overnight, as Hong Kong outperformed and Thailand underperformed.

After an initial dip, growth stocks in Hong Kong climbed higher on robust volume, propelling the Hang Seng Tech Index to a four-year high as it closed above recent resistance. Concerned with Hong Kong outperforming and Thailand underperforming about missing the rally? The index remains just -40.93% below its February 17, 2021, peak.

Both Hong Kong and Mainland China growth stocks benefited from positive sentiment following the previous day’s announcement by the National Development and Reform Commission (NDRC) of 500 billion Renminbi (RMB) (approximately $71 billion) in support for the artificial intelligence (AI) initiative, and privately held DeepSeek’s launch of its V3.2-Exp model. The NDRC also announced that 69 billion RMB raised from the issuance of ultra-long Treasury bonds has been distributed to local governments for consumer subsidies, pushing the year-to-date total to 300 billion RMB.

Further fueling growth stocks, privately held AI company Zhipu announced its GLM-4.6 large language model is utilizing chips from Cambricon. Hong Kong-listed humanoid robotics maker UB Tech Robotics gained +8.98% after selling 30 million RMB worth of Walker S robots to Tianqi, and Tesla Inc. stated intentions to manufacture its Optimus humanoid robot at scale in 2026.

Hong Kong hosted the world’s largest initial public offering (IPO) so far this year, as Zijin Gold International rose by +68.46% on debut. Mirroring yesterday’s trend, favored stocks in policy-supported subsectors led the market, including Alibaba Group Holding Ltd. (+2.08%), Tencent Holdings Ltd. (+0.45%), and Xiaomi Corporation (+0.85%). Software, retailers, automakers (especially electric vehicles), non-ferrous metals, entertainment, media, electrical equipment (with Contemporary Amperex Technology Co. Ltd. (CATL) up +4.48%), as well as pharmaceuticals and biotech, performed strongly.

For a sense of today’s dynamics, compare the factors driving outperformance in Hong Kong to those driving underperformance. Meanwhile, Mainland China also posted gains, led by growth-focused sectors, though market breadth was not as robust as in Hong Kong. The technology hardware, communication equipment, insurance, and brokerage sectors all experienced profit-taking.

September’s official Manufacturing Purchasing Managers’ Index (PMI) registered 49.8, versus August’s 49.4 and expectations of 49.6. The official Non-manufacturing PMI was 50, compared to August’s 50.3 and expectations of 50.2, while the Composite PMI edged up to 50.6 from 50.5. This means manufacturing activity contracted again—though at a slower pace—while the non-manufacturing and services sectors expanded at a subdued rate, dragged down by declines in real estate and the restaurant and catering sectors. The mediocre economic data raise the odds of further policy support for the economy.

The China Automobile Dealers Association reported that inventory levels increased year-over-year and declined month-over-month, with 54.8% of dealers citing weaker-than-expected sales in September.

Hong Kong investment bankers remained busy as China Guoxin Services Holding Ltd. and Shenzhen Rui Ming Technology Co. both filed for initial public offerings, following filings by China Natural Holdings Ltd. and Shenzhen JX Semiconductor Technology the previous day.

There will be no China Last Night publication tomorrow as Hong Kong and Mainland China are closed for the start of the Golden Week holiday. Mainland China’s markets will remain closed until Thursday, October 9. Hong Kong will reopen on Thursday but will be closed again next Tuesday, October 7.

Live Webinar

Join us Tuesday, October 7, 2025 at 10 am EDT for:

Anthropic’s Surge & The Potential Benefits of Pre-IPO Exposure in AI ETFs

Please click here to register

New Content

Read our latest article:

Are Commodity Executives The Best China Economists?

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.11 versus 7.12 yesterday

- CNY per EUR 8.36 versus 8.34 yesterday

- Yield on 10-Year Government Bond 1.86% versus 1.89% yesterday

- Yield on 10-Year China Development Bank Bond 1.98% versus 2.00% yesterday

- Copper Price +1.45%

- Steel Price -0.55%