In life, and in the market, when you want to be successful at something, it’s a good idea to study success and look for recurring patterns. There’s a famous saying that says, success leaves clues.

We are fortunate, because in the stock market, we can study the strongest stocks in history (a.k.a. true market leaders) and look for common traits that many of them shared. The most powerful truth I’ve learned is that markets and stocks trend. It is very simple and very powerful.

5 Timeless Lessons

Here are 5 timeless lessons I’ve learned from studying some of the strongest stocks and market cycles in history.

The strongest stocks tend to enjoy:

1. Strong fundamentals (sales & earnings growth)

2. A new product/service that disrupted/revolutionized an industry

3. Strong institutional accumulation (big investors piled in to the stock)

4. A strong/easy to understand story in a strong bull market, and

5. And the one big secret that most people miss = strong technicals (a strong uptrend, that has strong recurring patterns which I explain below).

I’ve been investing since the 1990’s and my experience taught me that most investors miss one critical truth: Stocks don’t go up in a straight line.

The biggest winners in the history of the stock market (a.k.a. true market leaders) —Tesla, Apple, Amazon, Netflix, Nvidia, etc —didn’t skyrocket overnight. They followed a rhythm, a subtle pattern that repeats itself over decades, industries, and market cycles.

Recognizing this pattern is the difference between watching opportunities pass by and actually being positioned to benefit from them.

Winning Stocks Follow A Similar Path

Look at the stories of the greatest stocks in history. What they have in common isn’t hype or luck—it’s a sequence of stages (a.k.a. bases) that shows when the market is ready to move.

Think of it like this: The market rewards those who understand its rhythm.

Here’s the sequence:

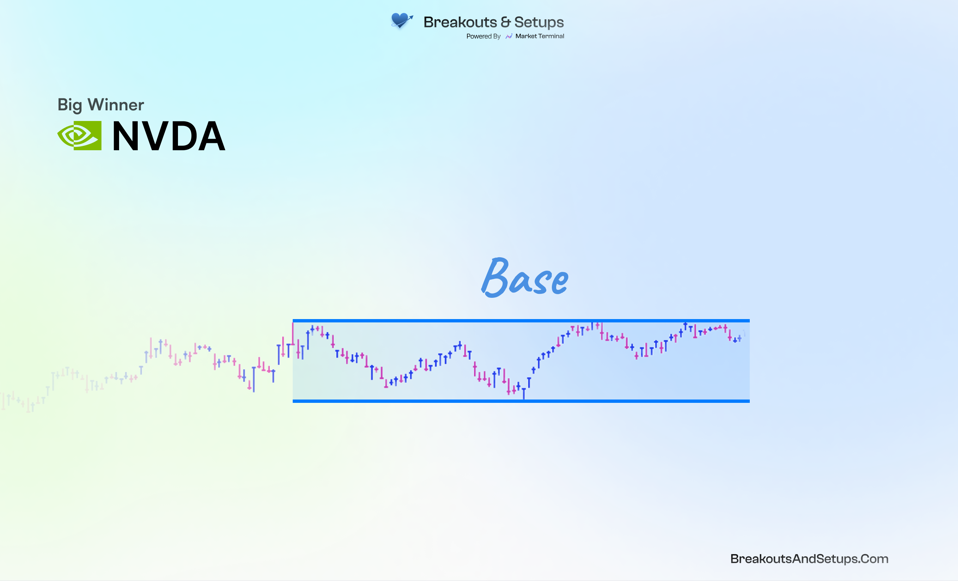

Stage 1 — Rest & Base

After a period of growth, a stock doesn’t just keep climbing. It pauses, consolidates, and trades sideways. This is the base stage—the market’s resting phase.

During this quiet period:

- Big investors accumulate shares without drawing attention

- Selling pressure diminishes

- Price movements tighten, creating a calm before the next storm (big rally)

To the average investor, this phase seems uninteresting— almost boring. But to someone who understands the market, this is where the opportunity begins to form. Recognizing it, means seeing potential before it becomes “obvious” to other investors.

Stage 2 — The Breakout

The base eventually gives way to a breakout—a decisive move where the stock begins to climb above the high (a.k.a. resistance) of its base.

Breakouts occur when buyers overpower sellers.

Think of the classic game of tug-of-war. Where one side pulls and eventually over powers the other side. The same thing happens when a stock breaks out above resistance. That’s the market’s way of showing us that the rest phase might be over.

It’s the moment when preparation turns into momentum.

Ideally, here’s what happens:

- Price and volume rise as big investors step in and buy

- Price begins to trend higher as confidence grows

- Early participants are rewarded for buying the breakout because they are able to get in before the new trend forms and the move becomes “obvious” to the crowd.

The break out is simple in concept but profound in effect: it shows where demand overwhelms supply. And it happens before the headlines catch on. Before we move forward it is important to note that not all breakouts work and lead to new big sustained uptrends. That said, all big uptrends start with a breakout to a new high.

Think about it, the only way a stock can double or triple or go up 10x is by breaking out and hitting new highs. I spoke to Luis Casas Co-Founder of BreakoutsAndSetups.com and told me via email: “Winning in the markets is about focus. Breakouts cut through the noise and reveal where real demand is. Our mission is to make sure you capture them.”

Stage 3 — The Run

Again, not all breakouts work. That said, once a breakout is confirmed, the stock enters the run stage. This is where the trend becomes self-reinforcing: momentum feeds momentum, strength begets strength, and the stock goes up.

This is the phase most people notice—but they are too late in most cases.

The good news, savvy investors that understand the first two stages allows them to be positioned ahead of the crowd.

This has worked over the centuries, different companies, industries, and market cycles, but the same recurring patterns. The sequence repeats over and over again. Why? Because human nature never changes. Fear and Greed are always prevalent in market. Human behavior drives these patterns.

Why Most Investors Arrive Late

Most investors only see the action after it’s obvious:

- They buy when the news hits

- They panic at minor pullbacks

- They miss the true opportunity (big trends)

It’s not because they aren’t smart—it’s because they are looking in the wrong place. The market’s signals appear in the quiet phase, and when the stock breaks out. Most people see the stock (or market/asset class) AFTER the big move up. Then they end up FOMOing (fear of missing out) into it right before it pulls back.

Human Behavior Drives the Pattern

The base-breakout-run sequence works because of psychology:

- During the base: uncertainty reigns supreme, fear dominates, volume fades, traders don’t know if the stock will breakout or breakdown.

- At the breakout: greed emerges, buyers rush in, momentum builds but most people don’t trust breakouts -or even look for breakouts, so they are not aware that a new trend may be forming.

- During the run: momentum fuels further momentum, attracting even more investors and then the move becomes obvious.

- At some point the stock rests again, builds a new base, and breaks out. That’s how patterns repeat.

The cycle repeats endlessly because human psychology does not change.

Understanding this gives you an informational advantage—you see what others miss.

Breakouts: The Real Opportunity

Here’s the insight most people overlook: the breakout isn’t noise – it’s a signal.

It’s the market telling you exactly where opportunity exists. If you can spot the setup and be ready for the breakout, you’re acting in alignment with the market’s natural rhythm, not reacting to its noise.

Consider the base as preparation. The breakout as the signal. The run as the reward. The sequence itself is the solution, and recognizing it is incredibly powerful.

How to Think About Breakouts

Like most things in life, the edge is simple and powerful.

It’s observation, understanding, and timing.

Savvy people look for:

- Quiet bases: Stocks moving sideways, digesting previous gains

- Volume patterns: Volume dries up in the base and, ideally, volume increases during the breakout.

- Price context: Breakouts near 52-week highs or all-time highs often signal leadership.

- Relative strength: Stocks that are in uptrends, are already outperforming their peers, before they breakout, are more likely to continue to trend higher. Remember, an object in motion, usually stays in motion.

All this is learning how to listen to the market. It’s about seeing the market’s language, understanding it, and positioning yourself before it becomes obvious to everyone else.

Avoiding False Signals

Not every breakout leads to a big run. Many breakouts fail. The key is understanding this truth and using proper risk management:

- Avoid weak breakouts – All things equal, heavy volume breakouts are usually strong breakouts. Low volume breakouts, tend to be weaker.

- Watch for reversals back into the base. Breakouts are binary, either they work and the stock rallies after the breakout or it rolls over and negates the breakout. If it rolls over, the risk is small because your protective stop can be below the breakout point or somewhere in the base. So when the breakout doesn’t work, it is a small loss. And when it works, it is a big win.

- Focus on leaders in strong sectors

Risk management is part of the solution. The breakout is the opportunity; how you navigate it determines whether it becomes an advantage.

Acting With the Market, Not Against It

Spotting a breakout isn’t about predicting miracles. It’s about aligning yourself with the market’s natural rhythm.

Think of it like riding a wave: when the wave comes in, you move with it. When the wave doesn’t work or crashes, you wait for the next wave. Breakouts are the same.

Seeing What Others Can’t

The most powerful lesson is simple: the path to success in markets isn’t about being lucky. It’s about understanding trends, identifying recurring patterns, and proper risk management.

The staircase is clear:

Rest → Breakout → Run

By seeing the stages, understanding the psychology, and recognizing the signals, you start seeing opportunities before they are obvious.

Breakouts aren’t tricks. They’re the market’s way of showing you where demand has overcome supply—the point where preparation turns into momentum. And that is exactly what smart investors act on.

Disclaimer: This article is for educational purposes only. It is not financial advice. Past performance does not guarantee future results. Buying breakouts isn’t for everyone. Always do your own research and consult a professional. Investing is inherently risks.