Key News

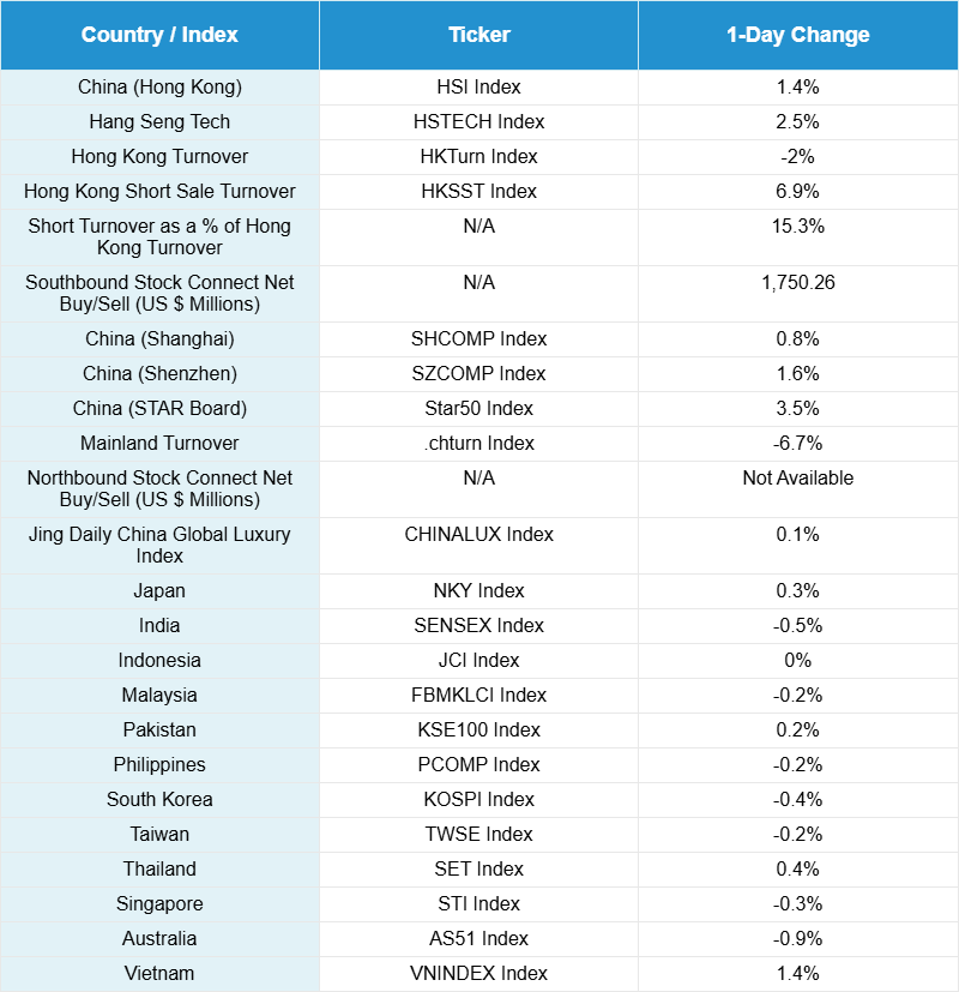

Asian Equities were mixed overnight as Mainland China’s STAR Market and Hong Kong’s Hang Seng Tech Index both outperformed, while Australia and India underperformed.

Alibaba announced that it will raise $53 billion for AI investments over the next three years, which was cheered by investors. Alibaba continues to be an AI leader in China, but this investment will help the company augment its profile and reach globally as well as establish new data centers across China. The company also announced, quite surprisingly, at a conference that it would be partnering with Nvidia on physical AI.

This was only one of multiple positive catalysts powering technology and growth stocks and sectors higher overnight. Trump and Xi are said to be planning a meeting next month. Kuaishou also released a new AI model after the company’s Kling AI video generation service has been extremely successful abroad.

Robotics stocks also outperformed, especially UB Tech Robotics, which was one of the top net buys by Mainland investors in Southbound Stock Connect.

The technology and AI rally overnight shows that investors are continuing to recognize China’s capabilities in this arena. It has been one year today (September 24, 2024) since China’s market regulators and central bank announced massive plans to stimulate China’s stock market. Many of the measures they announced were completely unprecedented, and the markets shot up immediately, with some overseas ETFs on China’s stocks shooting up while their underlying markets were closed for the Golden Week holiday, leading to steep premiums. The initial rally was interpreted by some to be a false start, as it quickly faded as the overseas momentum and enthusiasm was not matched onshore. But, following that initial spike, we have seen a steady grind higher ever since, both offshore and onshore, though the latter has outperformed. The MSCI China All Shares Index is up 42.63% since that announcement, as of yesterday’s US market close.

Live Webinar

Join us Tuesday, October 7, 2025 at 10 am EDT for:

Anthropic’s Surge & The Potential Benefits of Pre-IPO Exposure in AI ETFs

Please click here to register

New Content

Read our latest article:

Are Commodity Executives The Best China Economists?

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.13 versus 7.11 yesterday

- CNY per EUR 8.37 versus 8.41 yesterday

- Yield on 10-Year Government Bond 1.90% versus 1.88% yesterday

- Yield on 10-Year China Development Bank Bond 1.96% versus 1.95% yesterday

- Copper Price 0.03%

- Steel Price 0.03%