Key News

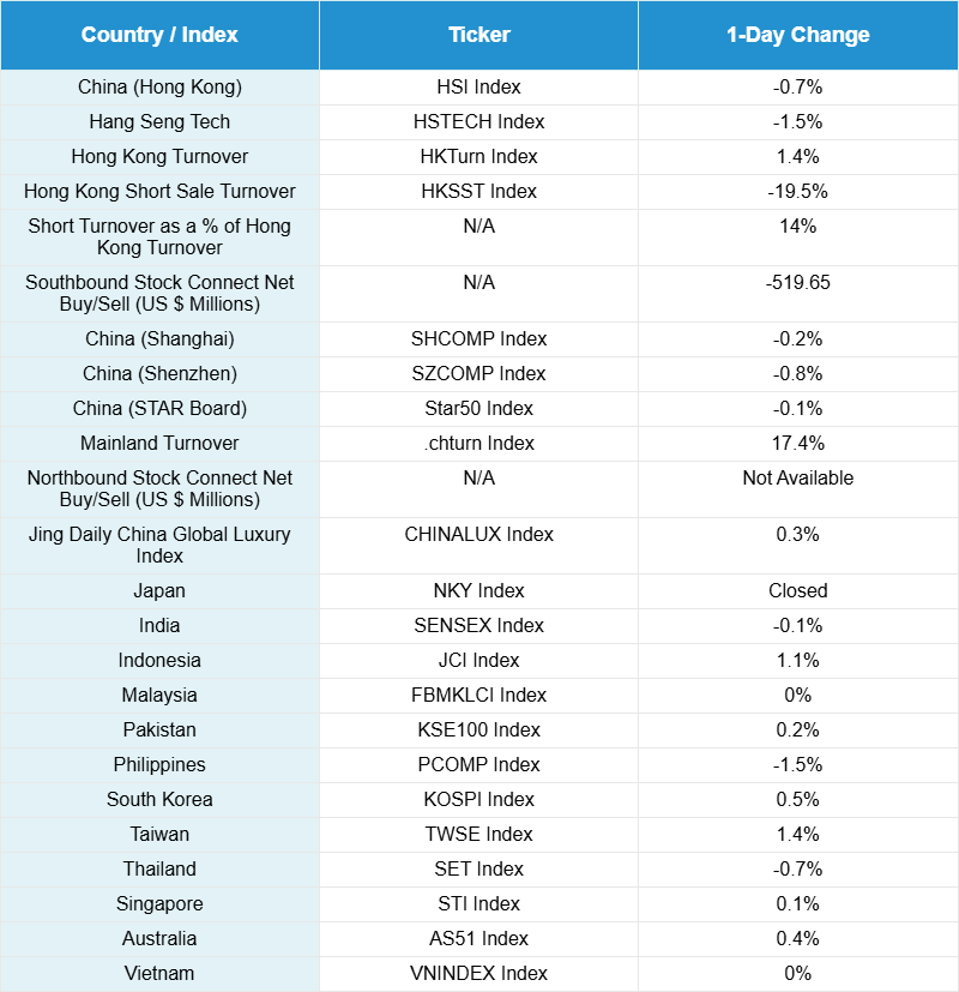

Asian equities were mixed overnight as Taiwan and Indonesia outperformed, while the Philippines and Hong Kong’s Hang Seng Tech Index underperformed.

China’s stock markets were lower overnight despite significant positive developments on the geopolitical front. A “bipartisan delegation” led by democrat Rep. Adam Smith, who also serves on the House Armed Services Committee, has met with Vice Premier He Lifeng and Defense Minister Dong Jun. Smith and his team have pointed out that they would like to improve transparency and communication between the two countries, especially restoring military-to-military communication lines, which have been lessened since Nancy Pelosi’s visit to Taiwan. This is the first type of visit from the US since 2019! 2019! There was also chatter that ongoing visits could result in China purchasing up to 500 Boeing jets. 500!

Internet names were mixed as there was some talk of new E-Commerce rules stemming from the continuing anti-involution campaign against over-competition and price wars, especially in instant commerce, though it does not appear to be that consequential. Baidu was lower on profit-taking, Alibaba was higher, and JD was weak.

Recent technology winners saw profit taking, especially Cambricon, which some call the “Nvidia of China.” China’s STAR Board has been on a decent run, so it was overdue for some profit-taking. Value sectors outperformed in both Hong Kong and Mainland China.

Warren Buffet’s Berkshire Hathaway sold its entire stake in BYD after 20 years. Their returns must have been stellar, at least 20 times. BYD has come a very long way. In Korea, they run ads for BYDs, despite the country being a vehicle manufacturing powerhouse. Their cars are absolutely everywhere.

We are approaching the Golden Week holiday, so we should be on the look out for some data on tourism and consumption in China. Many Macau casinos are reporting that they are sold out for multiple days during the holiday, which spans from October 1st to October 8th.

Mainland investors were net sellers of Hong Kong-listed stocks via Southbound Stock Connect for the first time in a week. Nonetheless, Mainland investors have still purchased a net $142 billion worth of Hong Kong-listed stocks and ETFs so far this year compared to 2024’s total of only $103 billion, and it is only September!

Live Webinar

Join us Tuesday, October 7, 2025 at 10 am EDT for:

Anthropic’s Surge & The Potential Benefits of Pre-IPO Exposure in AI ETFs

Please click here to register

New Content

Read our latest article:

Are Commodity Executives The Best China Economists?

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.11 versus 7.11 yesterday

- CNY per EUR 8.39 versus 8.39 yesterday

- Yield on 10-Year Government Bond 1.88% versus 1.86% yesterday

- Yield on 10-Year China Development Bank Bond 1.95% versus 1.93% yesterday

- Copper Price 0.15%

- Steel Price -0.35%