Many people don’t think of or are simply unaware of potential IRMAA Medicare surcharges when calculating taxes on a Roth conversion. While a well-timed Roth conversion can save on your lifetime tax bill, it may bump your Medicare costs for a full year if you’re not careful. This article illustrates both the tax and IRMAA considerations when considering a Roth Conversion.

What is a Roth conversion?

If you’re unfamiliar, a Roth conversion moves pre-tax dollars (from a traditional IRA/401[k]) into a Roth IRA. You’ll owe ordinary income tax on the amount you convert, but qualified withdrawals from the Roth later are generally tax-free. This can reduce your lifetime tax bill if you are able to pay taxes on a schedule more advantageous to you. I walk through the trade-offs in my Forbes article, “Roth vs. Traditional considerations for retirement.”

What Is IRMAA?

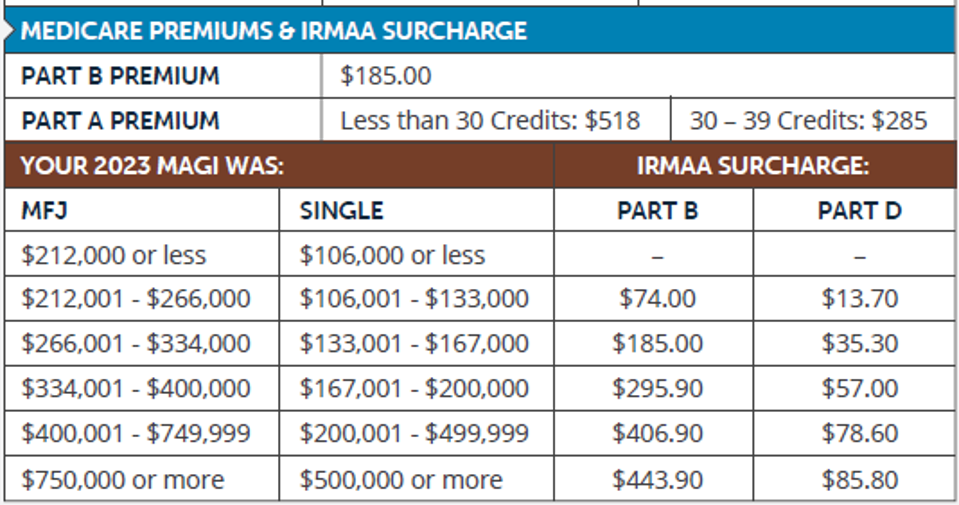

IRMAA stands for Income-Related Monthly Adjustment Amount. Technically, while it may feel like a tax, it’s not. It’s an extra charge added to your Medicare premiums if your income is above certain limits. IRMAA applies to Medicare Part B (doctor visits) and Part D (prescription drugs).

Here’s how it works:

- Based on income from two years ago. Medicare looks at your modified adjusted gross income (MAGI) from your IRS return two calendar years prior. That means, for 2026 it will use your 2024 MAGI.

- MAGI = AGI + tax-exempt interest. That means municipal bond interest can count, too.

- Cliff thresholds. If your MAGI is even $1 over a threshold, you pay the higher premium for the entire year.

- Filing status matters. The income limits differ for single filers and married filing jointly. Surviving spouses can get an unexpected adjustment to premiums when their filing status changes.

- You can appeal. If you’ve had a life-changing event (like retirement), you can ask Social Security to reassess using Form SSA-44.

As you can see, IRMAA can push MAGI over an IRMAA threshold, raising Medicare costs unless you plan the timing and amounts carefully.

IRMAA and the 24% tax bracket

These are the 2025 marginal tax brackets:

Let’s assume that someone has $200,00 of IRA money that they want to convert to Roth. For conversion planning purposes, I will illustrate the interaction using a Single filing status on a person with a projected MAGI of $110,000 in 2025 pre- conversion. This decision will at least affect their 2027 IRMAA. Recall, that IRMAA has a two-year look back.

If they were to convert all $200,000 in 2024 this would increase their MAGI to $310,000 pushing them into the 35% marginal tax bracket in 2025.

This decision will affect their 2027 IRMAA premiums. Assuming IRMAA premiums will stay the same, this would add an additional premium in Part B to $406.90 per month and Part D to $78.60. Instead of one big Federal tax and IRMAA hit, they may consider doing a series of partial conversions to try to stay within the 24% tax bracket. Notice from the chart that the top end of the bracket is $197,300. Looking back a the IRMAA table, see that the IRMAA bracket would then have an adjustment to Part B premiums of $295.90 per month and Part D $57 per month.

There are several other IRMAA brackets that they mind more palatable to deal with. In that case, they could convert an amount to that bracket and continue doing so annually until the conversion is complete. That said, if the long-term goal is to allow their beneficiaries to inherit tax free, the short-term pain of the higher IRMAA brackets may be worth it.

A simple IRMAA informed Roth conversion framework

When I talk through conversions with clients, here’s the step-by-step method we use:

- Project pre-conversion taxable income for the year (wages, pensions, IRA withdrawals, dividends, capital gains, etc.).

- Find your tax bracket and its ceiling (from IRS tables) and calculate your “room” before the next bracket.

- Estimate MAGI, not just taxable income. Add back items like tax-exempt interest. IRMAA uses MAGI.

- Locate the IRMAA brackets affected before your tax bracket for your filing status (Single or MFJ). Decide which tier you’re comfortable in paying in two years. If you expect your income to drop in future years, this may make up for a higher IRMAA charge.

- Year-end deadlines. Conversions must be completed by December 31 for that tax year; there’s no “recharacterization” of conversions under current rules.

Bottom line on IRMAA aware Roth Conversions

Roth conversions can be a powerful tax move, but the right annual amount is the one that fits your tax bracket and your IRMAA comfort level. If you’re in or near the 24% bracket, map out the IRMAA tiers inside that bracket first, then convert up to the lower of the two ceilings. Done thoughtfully, you’ll keep IRMAA costs in check while building more tax-free retirement income.

Helpful IRMAA and tax references

- How IRMAA is calculated (Social Security). MAGI includes AGI plus tax-exempt interest; page lists 2025 thresholds and surcharges.

- Roth conversion tax treatment (IRS FAQ/Publication). Untaxed amounts converted are taxable and generally reported on Form 8606.

- Optional: My deeper dive on: “Navigating The Roth IRA vs Traditional IRA Retirement Savings Rules.”