After months of mixed signals on the economy, recent jobs and inflation data suggest that the economy is, at the margin, decelerating. As a result, it now appears likely that the Federal Reserve will lower interest rates at the next FOMC meeting on September 17. Historically, rate cuts are like potato chips; it is unusual to have just one. Table 1 below shows that the typical easing cycle involves on average six rate cuts with Fed funds making a low under 4%.

Usually, economic weakness, not slowing inflation, is the impetus for the Fed to cut rates. Did past rate cut cycles precede or coincide with an economic recession? Most often yes, in fact, in 11 of 13 rate cut cycles, there was a technical recession. However, there were two exceptions, 1998 and 1984, where there was no recession, one of which also had no spike in unemployment. In those two cases, the U.S. economy remained relatively healthy during the easing cycle. Currently, the unemployment rate is 4.3% which is historically very low. It remains to be seen if this statistic is going to follow the more common path and rise significantly in the future.

Recessions:

• 2019: Q1 2020 – Q2 2020. Peak unemployment 15%.

• 2007: Q4 2007 – Q2 2009. Peak unemployment 10%.

• 2001: Q1 2001 – Q4 2001. Peak unemployment 6%.

• 1990: Q2 1990 – Q1 1991. Peak unemployment 8%.

• 1981: Q2 1981 – Q4 1982. Peak unemployment 11%.

• 1980: Q1 1980 – Q3 1980. Peak unemployment 8%.

• 1974: Q4 1973 – Q1 1975. Peak unemployment 9%.

• 1970: Q4 1969 – Q4 1970. Peak unemployment 6%

• 1960: Q2 1960 – Q1 1961. Peak unemployment 7%

• 1957: Q3 1957 – Q2 1958. Peak unemployment 7.5%

• 1954: Q3 1953 – Q2 1954. Peak unemployment 6%.

No Recessions:

• 1998: Peak unemployment 4.5%.

• 1984: Peak unemployment 7%.

Source: Bureau of Labor Statistics

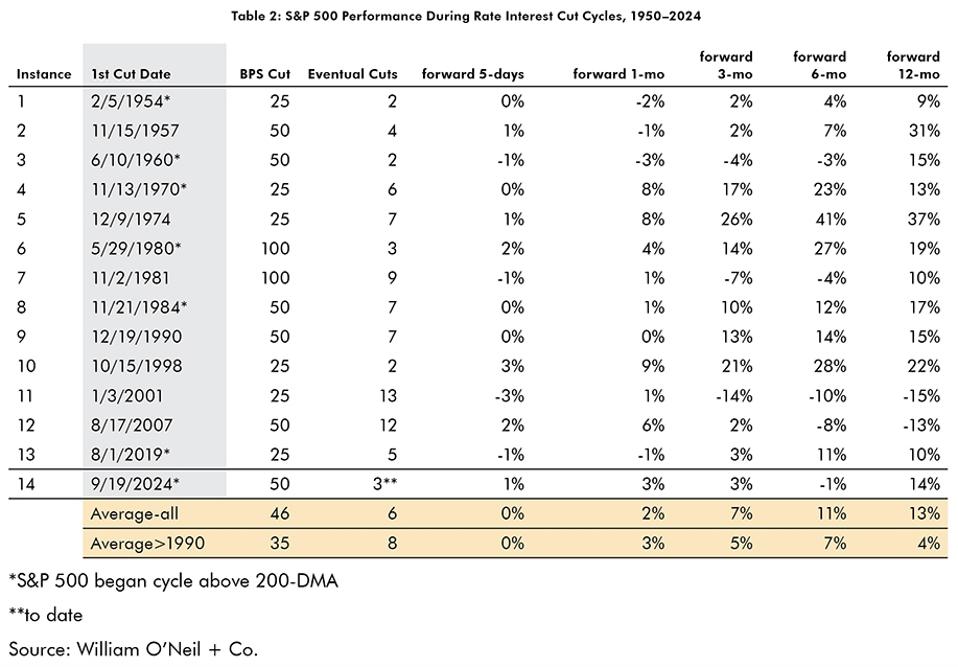

Normally, U.S. stocks respond quite favorably to rate cuts as demonstrated in Table 2. On average, in the post-war era, stocks generated positive returns on all monthly time periods up to one year once an easing cycle began. Note, if the Fed cuts rates next week, William O’Neil considers that a continuation of the easing cycle that began last September. Until the Fed hikes rates, we consider an easing cycle intact. It is worth noting that the S&P 500 has already had a better-than-average performance on a forward 12-month basis this time.

In our research, William O’Neil spends a great amount of time studying sector moves both absolute and relative. One of the things that stands out to us in the current cycle is the dominance of Technology this time. While it has been a leader

in the past and has the third-highest median sector performance during rate cut cycles, it only has the seventh-highest average.

It has also only been in the top spot one other time–in the short cut cycle in 1998. Currently, the Technology Sector is up 27% and solidly in the lead. We attribute this not to an economic cyclical factor but rather a secular change due to the emergence of artificial intelligence (AI). Also notable is the improvement over the last year in Consumer Cyclical. We believe this may be a signal that if the bull market continues, the market will broaden, and more cyclical areas will begin to perform better relatively. This would represent a shift toward early-cycle stocks, which often occurs as the U.S. economy strengthens with Fed easing. This aligns well with history and, in our view, is a positive sign that could extend the current bull market.

What we would note as a risk: While the Fed has historically navigated through recessions and the market has done well overall during rate cut periods, it has not always been the case. In three negative market periods from above (2001, 2007, 2019), it could be argued the Fed was either late to cut or was powerless to provide an immediate cushion to the market. So far, this does not seem to be the case, but we will continuously monitor the general market for any warning signs. The S&P 500 fell 29%, 37%, and 19%, respectively, during those cycles, but clear red flags had already emerged in index technicals (40-WMA breaches) and market internals.

If the market does remain intact and moves to earlier cycle stocks, we would expect small cap stocks to perform better relative to large caps. As shown below in Figure 1, small stocks represented by the ETF IWM have lagged their large cap peers heavily over the trailing one and two years, but have made some headway in the recent two months. A move towards more cyclical areas may allow small caps to catch up or lead for a period of time.

At the sector level, over the trailing 12 months, Technology has continued to lead. It joins Consumer Cyclical and Financial as the leadership group, with Basic Material and Retail also participating well. Of the five, all except Basic Material have pretty good history in rate cut environments. Health Care is bouncing from near all-time lows though remains under pressure due to worries about regulatory change, while Consumer Staple is still languishing with a huge negative spread. Both are in a challenging position to keep pace with their history during rate cuts. Utility and Energy are both underperforming but not extended. Their underperformance would align well with rate cut history.

Over the past 24 months, Technology is still the clear leader and is joined by only Financials as the other sector above the S&P 500 over the period. Materials are interesting in that a low looks to have been established, while Capital Equipment has softened somewhat recently. Consumer Cyclical is in a solid position, just below par but improving. Health Care, Consumer Staple, and Transports are still closer to lows after failing to sustain any relative recovery.

In conclusion, the resumption of Fed rate cuts should be a positive sign for stocks if historical precedents remain intact. In addition, while Technology has dominated the market due to the secular AI trade, rate cuts may cause the market to broaden towards more cyclical and small cap stocks. This could create the next leg to this bull market. As always, William O’Neil will take its signals from actual stock price and volume movements, but we are hopeful these trends can emerge over the next 3 to 12 months.

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Company, made significant contributions to the data compilation, analysis, and writing for this article.