Markets surged to fresh record highs recently on the back of July’s consumer inflation reading. The data increased expectations for a rate cut at the Federal Reserve’s September meeting. Trade sentiment also improved after President Trump extended the U.S.–China tariff truce for an additional 90 days.

While the tone in markets this week has been broadly optimistic, valuations remain elevated. The S&P 500 trades at valuation levels not seen since the dot-com crash.

Identifying stocks that combine strong fundamentals with cheap valuations should remain a priority for diligent investors. My firm’s AI Agent is designed to screen for such opportunities by leveraging proven-superior data to produce more precise, transparent, and reliable signals.

The outperformance of the “Very Attractive Stocks Index”, which holds the stocks in the Bloomberg 1000 Index that get a Very Attractive Rating, is proof of the alpha the AI Agent produces in the market.

My Long Idea this week highlights a company with industry leading-profitability, revenue growth across all business segments, record profits, and a cheap stock price.

I originally made JPMorgan Chase (JPM: $293/share) a Long Idea in May 2020 and most recently reiterated my position on the stock in November 2024.

JPMorgan Chase recently beat both top- and bottom-line estimates in 2Q25, and now that the company has filed its latest 10-Q, I find that the stock still presents Very Attractive risk/reward.

JPM offers favorable Risk/Reward based on the company’s:

- strong growth across both interest income and non-interest income segments,

- record high profits,

- industry leading capital ratios and profitability leader, and

- cheap stock valuation.

What’s Working

JPMorgan Chase reported strong results across its business in 2Q25. The company’s firmwide average loans and deposits were up 5% and 6% year-over-year (YoY), respectively. More specifically, JPMorgan Chase reported quality growth across all three business segments, including:

- Debit and credit card sales volume was up 7% YoY in the Consumer & Community banking segment.

- Investment banking fees were up 7% YoY, and JPMorgan ranked #1 for Global Investment Banking fees with 8.9% wallet share year-to-date (YTD) in its Commercial & Investment Bank segment.

- Assets under management increased 18% YoY to $4.3 trillion, including $80 billion in net inflows in its Asset & Wealth Management segment,

These results continue a trend of long-term fundamental strength for the largest bank in the United States.

Strong Business Operations and Fundamentals

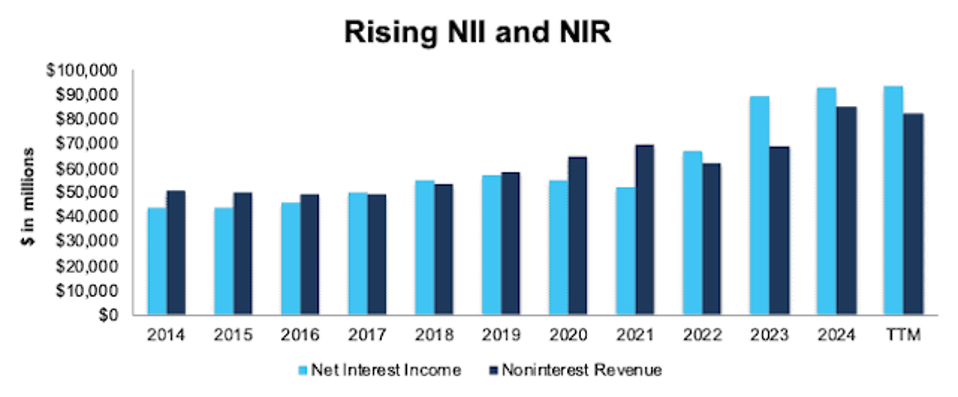

JPMorgan Chase’s revenue composition reflects a strategically balanced model, with total net revenue split nearly evenly between net interest income (NII) and noninterest revenue (NIR). This diversification mitigates earnings volatility tied to interest rate fluctuations and reinforces the firm’s resilience across market cycles.

Notably, JPMorgan Chase has demonstrated consistent growth in both revenue streams over the past decade. The company grew NII from $43.6 billion in 2014 to $93.2 billion in the TTM ended 2Q25, which represents compound annual growth of 7%. JPMorgan Chase grew its NIR from $50.6 billion to $82.4 billion over the same time, or 5% compounded annually. See Figure 1.

Figure 1: JPMorgan Chase’s NII and NIR: 2014 – TTM

JPMorgan Chase leverages its diversified business model to continually grow its top- and bottom-line.

JPMorgan Chase has grown revenue and net operating profit after-tax (NOPAT) by 10% and 11% compounded annually since 2014. See Figure 2. In each of the past three fiscal years, and the TTM ended 2Q25, the company’s NOPAT reached record highs.

The company improved its NOPAT margin from 21% in 2014 to 23% in the TTM while invested capital turns rose from 0.4 to 0.7 over the same time. Rising NOPAT margins and invested capital turns drive the company’s return on invested capital (ROIC) from 8% in 2014 to 16% in the TTM ended 2Q25.

Additionally, the company’s Core Earnings, a superior and cleaner earnings measure, grew 10% compounded annually from $22.2 billion in 2014 to $60.6 billion in the TTM.

Figure 2: JPMorgan Chase’s Revenue and NOPAT Since 2014

Industry-Leading Profitability

JPMorgan Chase has not only grown revenue and profits to record levels, but it has done so while maintaining industry leading margins and ROIC. As I mentioned earlier in the report, the company has improved both its operational efficiency (NOPAT margin) and its balance sheet efficiency (invested capital turns) over the last decade.

Per Figure 3, JPMorgan Chase has the highest NOPAT margin and ROIC among peers which include, Goldman Sachs (GS), Citigroup (C), Morgan Stanley (MS), Bank of America (BAC), and Wells Fargo (WFC).

Figure 3: JPMorgan Chase’s Profitability Vs. Peers: TTM

Safety That Lasts

Due to its superior capitalization, JPMorgan Chase maintains a stronger financial position than its peers, too.

At the end of 2Q25, JPMorgan Chase’s Common Equity Tier 1 Capital Ratio (CET1), the equity portion of its Tier 1 Capital, was 15.1%, which is up from 12.4% at the of 2019 and 10.2% in 2014. Importantly, JPMorgan Chase’s CET1 ratio is well above the 4.5% minimum required by the Federal Reserve.

Additionally, the company’s Tier 1 Capital ratio, which measures a bank’s core equity capital to its total risk-weighted assets is 16.1% through the 2Q25, which is up from 14.1% in 2019 and 11.6% in 2014. Once again, JPMorgan Chase’s Tier 1 Capital ratio is well above the 6.0% minimum required by the Federal Reserve.

JPMorgan Chase’s Tier 1 Capital and CET 1 ratios have been trending higher for over a decade. See Figure 4.

Figure 4: Tier 1 Capital and Common Equity Tier 1 Capital Ratios: 2010 – 2Q25

Per Figure 5, JPMorgan Chase’s CET1 ratio ranks above big bank peers mentioned earlier in the report. The company’s Tier 1 Capital ratio is higher than all listed peers except Morgan Stanley (MS).

Figure 5: JPMorgan Chase’s Capital Ratios Vs. Peers – 2Q25

Potential for 5%+ Yield

JPMorgan Chase has paid $87.7 billion (11% of market cap) in dividends since 2019 and increased its quarterly dividend from $0.80/share in 2Q19 to $1.40/share in 2Q25. The company’s current dividend, when annualized, provides a 1.9% yield.

JPMorgan Chase also returns capital to shareholders through share repurchases. Since 2019, JPMorgan Chase repurchased $95.9 billion (12% of market cap) shares. During the first six months of 2025, the company repurchased $15.1 billion shares.

In July 2025, JPMorgan Chase’s Board of Directors authorized a repurchase program of $50 billion. Should the company repurchase shares at the TTM pace, it would repurchase $25.7 billion of shares over the next 12 months, which is 3.2% of the company’s current market cap.

When combined, the dividend and share repurchase yield could reach 5.1%.

Strong Cash Flows Support Shareholder Return

Investors should take comfort in knowing JPMorgan Chase will be able to afford to pay its dividends and repurchase shares due to its large free cash flow (FCF) generation. From 2019 through 1H25, JPMorgan Chase generated $201.2 billion in FCF, which equals 25% of the company’s enterprise value.

Figure 6: JPMorgan Chase’s Cumulative Free Cash Flow: 2019 – 1H25

JPMorgan Chase’s $201.2 billion in FCF since 2019 is more than enough to cover its $183.6 billion in combined dividend payments ($87.7 billion) and share repurchases ($95.9 billion).

JPMorgan Chase’s repurchases have also meaningfully reduced its shares outstanding from 3.1 billion in 2019 to 2.7 billion in 2Q25. See Figure 7.

I like companies that choose to return capital to shareholders instead of spending it on costly acquisitions or executive bonuses that rarely drive shareholder value creation. Companies that sport strong enough cash flows to consistently lower their shares outstanding offer excellent value.

Figure 7: JPMorgan Chase’s Shares Outstanding: 2019 – 2Q25

What’s Not Working

Potential Rate Cuts in the Remainder of 2025

Expectations for a rate cut in September are on the rise, in part due to the latest CPI data and comments from Fed officials. Fed governor Bowman aims for three interest rate cuts in the remainder of 2025. An interest rate cut would put pressure on all banks’, JPMorgan Chase included, net interest margin (NIM) and in turn their NII.

In its 2Q25 10-Q, JPMorgan Chase disclosed its earnings-at-risk sensitivity depending on different movement in rates. In this analysis, JPMorgan Chase determined that a 100-basis point interest rate decline results in a $2 billion decrease in earnings. Similarly, a 200-basis point interest rate decline results in a nearly $5 billion decrease in earnings.

The good news? This exposure to lower rates is down from the company’s sensitivity in December 2024, which coincides with rising expectations for a rate cut.

JPMorgan Chase maintains the best capital ratios in the industry and is best positioned to grow noninterest revenue throughout all cycles.

Additionally, any pressure on profits is already more than priced into JPMorgan Chase’s current stock price, as I’ll show below.

Current Price Implies Profits Never Grow Again

At its current price of $293/share, JPMorgan Chase has a price-to-economic book value (PEBV) ratio of 1.0. This ratio means the market expects the company’s profits to never grow from TTM ended 2Q25 levels. For reference, JPMorgan Chase has grown NOPAT 11% compounded annually over the last five, ten, and 26 (longest period in my model) years.

Below, I use my reverse discounted cash flow (DCF) model to quantify the cash flow expectations for different stock price scenarios for JPM.

In the first scenario, I quantify the expectations baked into the current price. If I assume:

- NOPAT margin immediately falls to 20% (below five-year average of 26% and TTM NOPAT margin of 23%) through 2034, and

- revenue grows 3% compounded annually through 2034 (compared to 13% CAGR over the last five years and 10% CAGR over the last decade), then

the stock would be worth $293/share today – equal to the current stock price. In this scenario, JPMorgan Chase’s NOPAT would grow just 2% compounded annually from 2025 – 2034, which is well below the company’s historical NOPAT growth rates.

Shares Could Go 29%+ Higher Even If Profits Grow Well Below Historical Rates

If I instead assume:

- NOPAT margin never improves and is maintained at 23% through 2034, and

- revenue grows 5% compounded annually through 2034 (compared to 13% CAGR over the last five years and 10% CAGR over the last decade), then

the stock would be worth $377/share today – a 29% upside to the current price. In this scenario, JPMorgan Chase’s NOPAT would grow 5% compounded annually through fiscal 2034, which would still be below the company’s NOPAT compound annual growth rates over the past 5-, 10-, 15-, and 20-year periods.

Should NOPAT grow closer to historical rates, the upside would be even larger.

Figure 8 compares JPMorgan Chase’s historical NOPAT to the NOPAT implied in each of the above scenarios.

Figure 8: JPMorgan Chase’s Historical and Implied NOPAT: DCF Valuation Scenarios