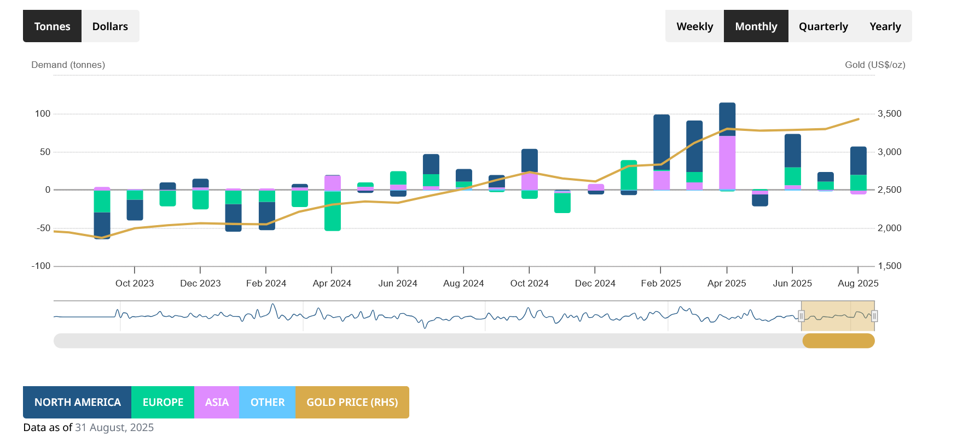

Global gold-backed exchange-traded funds (ETFs) recorded their third consecutive month of inflows thanks to strong interest among Western investors, according to the World Gold Council (WGC).

Gold funds added 53 tonnes of material to take total holdings to 3,692 tonnes, data showed.

The WGC said that “similar to July, North American and European funds led global inflows while Asia and other regions saw mild outflow.”

Holdings at the close of August were at the highest month-end level since July 2022, the Council noted. They were also just 6% below all-time highs of 3,929 tonnes reached in November 2020.

On a monetary basis, last month’s inflows totalled $5.5 billion, which in turn helped assets under administration (AUMs) reach $407.3 billion.

This represented a record high, the WGC said. Furthermore, year-to-date ETF inflows of $47 billion represented the second-strongest on record following pandemic-hit 2020.

Gold prices increased almost 5% over the course of the month as macroeconomic and geopolitical tensions rose.

They have since risen further in September, striking fresh all-time peaks of $3,589 per ounce on Friday (5 September). They continue to increase amid hopes over interest rate cuts by the Federal Reserve, growing concern over the central bank’s independence, and broader global economic uncertainty.

Strength In North America

In North America, gold-backed ETFs recorded inflows of 37 tonnes worth some $4.1 billion.

This was the region’s third consecutive monthly increase which the WGC attributed to “persistent trade risk and broader market uncertainty; the consensus short dollar trade, which reduces the opportunity cost of holding gold; and lower rate expectations as the market digested Powell’s Jackson Hole comments as dovish.”

Total holdings stood at 1,906 tonnes at the end of the month, while AUMs came out at $210.2 billion.

Interestingly, the WGC said it has witnessed a pick-up in demand for low-cost bullion funds.

It commented that “gold backed ETFs, often viewed as a proxy for long-term strategic positioning, are having their best year on record. We consider this to be a signal that — beyond short-term market noise — investors are steadily building safe-haven allocations in response to a backdrop of elevated risks.”

Mixed Results In Europe And Asia

Elsewhere, the Council said that Europe-based funds enjoyed their fourth successive inflow, adding $1.9bn or 37 tonnes of the precious metal.

This pushed AUMs to $154.2 billion, and total physical holdings to 1,398 tonnes.

The WGC noted that “the UK, Switzerland, and Germany led the charge,” with Swiss interest driven by the US slapping a 39% trade tariff on the country.

It added that “this sudden and unexpected hit has affected the country’s economic prospects, pushed up safe-haven needs among local investors and increased demand for gold.”

In Asia, gold-backed ETFs saw August outflows of five tonnes or $495.3 million. As a consequence, physical holdings dropped to 317 tonnes.

However, thanks to the stronger metal price Asian AUMs improved to $35.2 billion from $34.6 billion in July.

The Council said that “China lost the most,” with weak gold interest coinciding with rallies on the local stock market. However, India experienced its fourth straight monthly inflow last month, which the WGC put down to “supported by elevated safe-haven needs amid weak equities as well as ongoing global trade and geopolitical risks.”