Warren Buffett built his reputation on discipline, patience, and avoiding what he calls the “big mistakes.” Yet his most painful misstep wasn’t some obscure stock pick; it was Kraft Heinz, once a fortress of household brands, now a lesson in how value can evaporate when structure and strategy are ignored. The deal, struck with 3G Capital, was supposed to deliver synergies and scale. Instead, it gutted innovation, left brands stale, and led to billions in write-downs.

The question is straightforward: how did the Oracle of Omaha, renowned for outsmarting markets for decades, become caught off guard? And why does Kraft Heinz’s recently announced breakup point to the real source of value creation today?

This isn’t just a story about Buffett. It’s a case study in how investors and CEOs misread capital allocation, underestimate changing consumer behavior, and overlook the structural levers that unlock returns.

Buffett And The Kraft Heinz Bet

In 2013, Berkshire Hathaway teamed up with 3G Capital to engineer the Kraft Heinz merger, a $55 billion deal that instantly created one of the largest food companies in the world. The move made Buffett the single biggest shareholder and gave him front-row ownership of a portfolio filled with some of America’s most iconic brands: Heinz ketchup, Kraft cheese, and Oscar Mayer hot dogs.

The thesis looked straightforward. Consumer staples were meant to be steady, recession-proof businesses. Scale promised to deliver cost synergies, stronger margins, and predictable cash flow. In an industry where distribution and shelf space were currency, bigger seemed better. Wall Street agreed. Analysts applauded the deal, and Kraft Heinz was quickly cast as the new juggernaut of packaged foods. Buffett himself called it a “dream partnership” with 3G, signaling full confidence.

At the time, it was textbook Buffett: durable brands, disciplined capital, and a trusted partner. On paper, the setup was nearly flawless.

The problems started with 3G’s playbook. Their approach to zero-based budgeting significantly reduced costs, but it also sacrificed efficiency. Innovation dried up, marketing spending was gutted, and the brands that once defined household staples were left without relevance in a marketplace moving faster than ever.

At the same time, consumer behavior was shifting underneath them. Shoppers turned away from processed cheese and packaged meats toward organic, fresh, and local options. Private labels gained credibility. Scale, which was supposed to be Kraft Heinz’s strength, became dead weight when it couldn’t adapt to changing tastes.

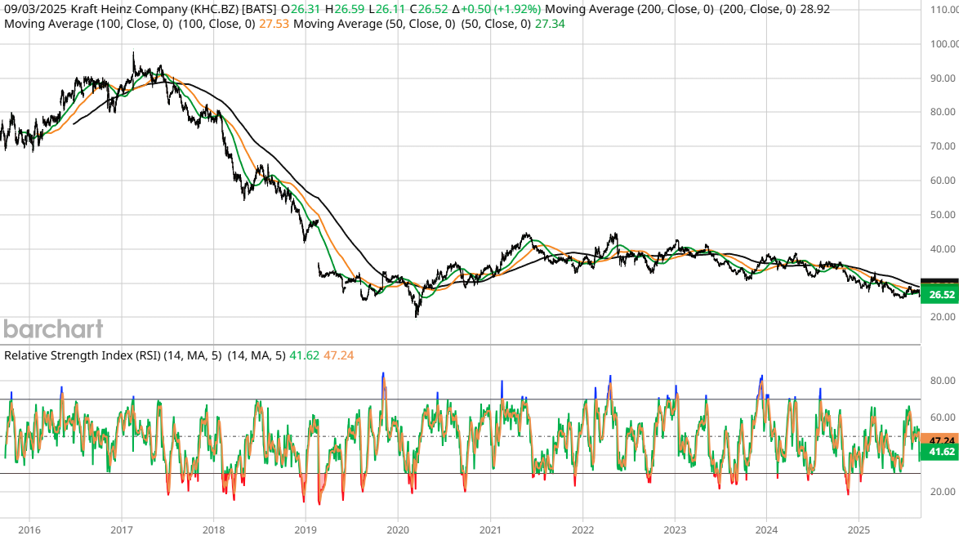

The numbers conveyed the narrative. In 2019, there was a $15 billion goodwill write-down. The dividend cut interrupted Buffett’s usual playbook of reliable payouts. The stock collapsed, wiping out tens of billions in market value. Buffett acknowledged the clear truth: he had overpaid, overestimated the moat, and underestimated the pace of change.

The irony was clear. What looked like a fortress of brands turned out to be a structure too bloated to compete. The misstep wasn’t just the price; it was the assumption that size and cost control were enough to protect value.

Where Value Creation Really Comes From

At The Edge, we’ve studied spinoffs and breakups for more than a decade. The evidence is clear: they consistently outperform because they force the market to reprice value based on focus, not legacy. A spinoff strips away layers of distraction and debt, giving each business a mandate of its own. Investors respond because clarity and accountability replace bloated complexity.

Consider GE. Its breakup delivered a 400% return in five years, not because the underlying assets suddenly changed, but because the structure finally aligned with the businesses inside it. Kraft Heinz is now moving down the same path. By separating legacy brands from faster-growth portfolios and by lightening the debt load that weighed on the entire entity, management is acknowledging what the market has already priced in: scale alone doesn’t drive returns.

Our proprietary data supports this. Spun entities receive, on average, a 33% takeover premium. Seventy percent of the value is realized within the first two years, long before most investors are even paying attention. Behavioral insight is just as important. CEOs cling to size because empires feel safer. Investors, however, reward focus, accountability, and a structure that frees businesses to compete.

The lesson from Kraft Heinz isn’t simply that Buffett overpaid for brands. The real mistake was holding onto the wrong structure for too long. Value creation doesn’t come from empire building; it comes from forcing the right change at the right time.

Lessons For CEOs And Investors

The Kraft Heinz saga carries clear lessons for today’s leaders. For CEOs, the first thing is that size does not equal strength. Scale without innovation becomes suffocating, not protective. Chasing efficiencies through cost-cutting may win headlines in the short term, but it is no substitute for strategy. And most importantly, structure should always serve the business. When leadership defends legacy empires out of ego or inertia, they bury the very value shareholders expect them to unlock.

For investors, the takeaway is just as sharp. Follow structure, not story. Markets reward businesses that simplify and sharpen their focus, and they punish those clinging to outdated models. Breakups should be considered catalysts, not disasters. They create a chance to reprice assets based on their true potential.

Even Warren Buffett, with decades of compounded wisdom, misjudged Kraft Heinz because he underestimated how quickly consumer behavior and market structures can shift. If an investor of his caliber can miss that signal, it underscores why the rest of us must make structure and catalysts central to our process.

The lesson is simple: value isn’t static. It’s unlocked when leaders and investors align around change, not size.

Warren Buffett’s Bet, Our Edge

Warren Buffett’s Kraft Heinz investment will be remembered not as a triumph of discipline but as a reminder of how even the sharpest investors can misjudge structure and change. The brands were real, the cash flows dependable, but the model was broken. Cost-cutting and scale weren’t enough to defend against shifting consumer behavior and a bloated structure that suffocated innovation.

The announced breakup offers shareholders a second chance. By forcing clarity on the businesses inside Kraft Heinz, management is finally doing what the market demanded years ago: separating the slow-growth legacies from the assets that can still compound.

At The Edge, we’ve built our process on spotting exactly these moments. Value creation rarely comes from empire building. It comes from catalysts, breakups, spinoffs, and restructurings that force change, unlock hidden value, and compel the market to reprice. Warren Buffett’s miss at Kraft Heinz proves the point: structure, not story, determines where returns are made.