Key News

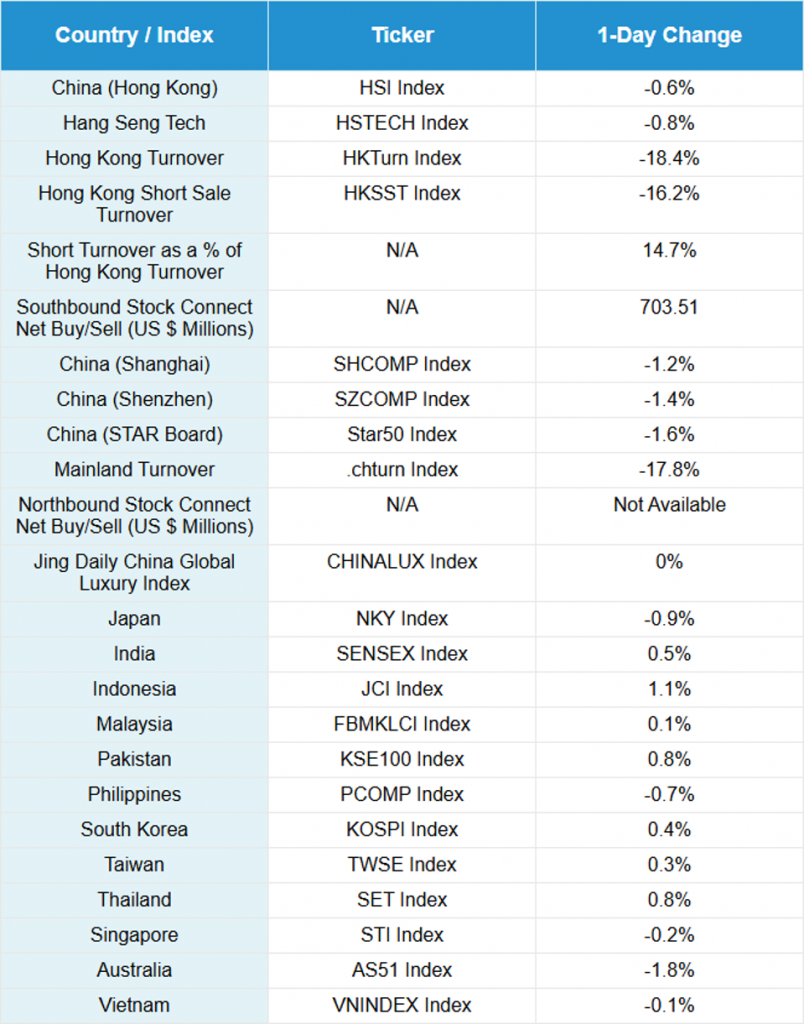

Asian equities were mixed overnight as the US dollar continued to strengthen and the 30 Year US Treasury yield approached 5%. Australia, Mainland China, and Japan underperformed, while Indonesia rebounded and Vietnam remained out for Independence Day holiday.

Both Hong Kong and Mainland China opened higher but slipped during the trading session, even as the August RatingDog China PMI Services, formerly sponsored by Caixin though now run by S&P Dow Jones, came in at 53 versus July’s 52.6 and consensus expectations of 52.5. This was a positive, given this survey focuses on smaller companies and provides a different read from the National Bureau of Statistics’ large-company survey.

Market strength was still absent, especially in the Mainland, which showed very poor breadth. Financial stocks in both Hong Kong and the Mainland, including banks, brokerages, and insurers, lagged. Mainland military and defense stocks underperformed, despite today’s big military parade, as did tech hardware and semis, including Cambricon, which fell -5.07%.

Healthcare continues to be a bright spot, with several companies announcing catalysts: Jiangsu Hengrui Pharmaceutical jumped +8.32% on a tumor drug trial, WuXi XDC popped +9.3% despite selling shares at a 4% discount, and Ping An Healthcare and Technology surged +10.3% as an AI play. Hong Kong-listed CATL gained +1.05%, though internet stocks were mixed with Tencent down -0.33%, Alibaba down -0.45% despite another strong buy via Southbound Stock Connect, JD.com up +0.92%, and Trip.com down -2.02%.

Was the parade the catalyst for underperformance? The optics aren’t great, especially since many kids end up at boarding school for hanging out with the wrong friends. The news flow included China and Russia signing multiple deals, and now 30-day China trips are visa free, though China’s large borders with both Russia and North Korea necessitate ongoing relationships. It looks like markets might just be overbought, MACD shows too few stocks with buy signals (oversold) and too many with sells (overbought). Hang Seng Index is close to its 50-day moving average, but Shanghai and Shenzhen remain a touch elevated, suggesting caution.

Following yesterday’s RenMac podcast recommendation, worth mentioning is the BG Squared podcast hosted by Brad—shout out to Nick for flagging their latest episode. The catalyst was Bill Gurley’s recent visit to China and the new book “Breakneck: China’s Quest to Engineer the Future” by Dan Wang. The team gave a compelling recap of Gurley’s tour of tech and EV companies in China and did a nice job framing the underlying issue as a debate between national security and economic hawks pushing for a full decouple/Mearsheimer approach, versus the compete/pragmatist crowd who prefer not to decouple, and the Jeffrey Sachs/free trade/collaborate camp. Like New York Times’ Thomas Friedman’s China trip last December, it’s refreshing Gurley emphasized his desire “just to learn” by actually seeing things in person. The podcast also touches on the feasibility of Chinese companies partnering with US firms for local manufacturing here, which seems like a real possibility. Worth a listen in my opinion.

Ran across the following line after catching the podcast on the train home last night:

“The whole drift of our law is toward the absolute prohibition of all ideas that diverge in the slightest form from the accepted platitudes, and behind that drift of law there is a far more potent force of growing custom, and under that custom there is a natural philosophy which erects conformity into the noblest of virtues and the free functioning of personality into a capital crime against society.” — H.L. Mencken.

New Content

Read our latest article:

Labubus: How Pop Mart’s Newest Craze Reflects Chinese Cultural Influence in the U.S.

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.14 versus 7.14 yesterday

- CNY per EUR 8.32 versus 8.31 yesterday

- Yield on 10-Year Government Bond 1.80% versus 1.82% yesterday

- Yield on 10-Year China Development Bank Bond 1.86% versus 1.87% yesterday

- Copper Price +0.50%

- Steel Price +0.10%