PwC’s 2025 holiday outlook survey, released today, shows U.S. consumers are planning to cut back on their spending during the upcoming holiday season, with Gen Z shoppers feeling particularly frugal.

PwC reported that consumers, for the first time since 2020, expect their seasonal spending to decline, and that 84% expect to reduce spending over the next six months.

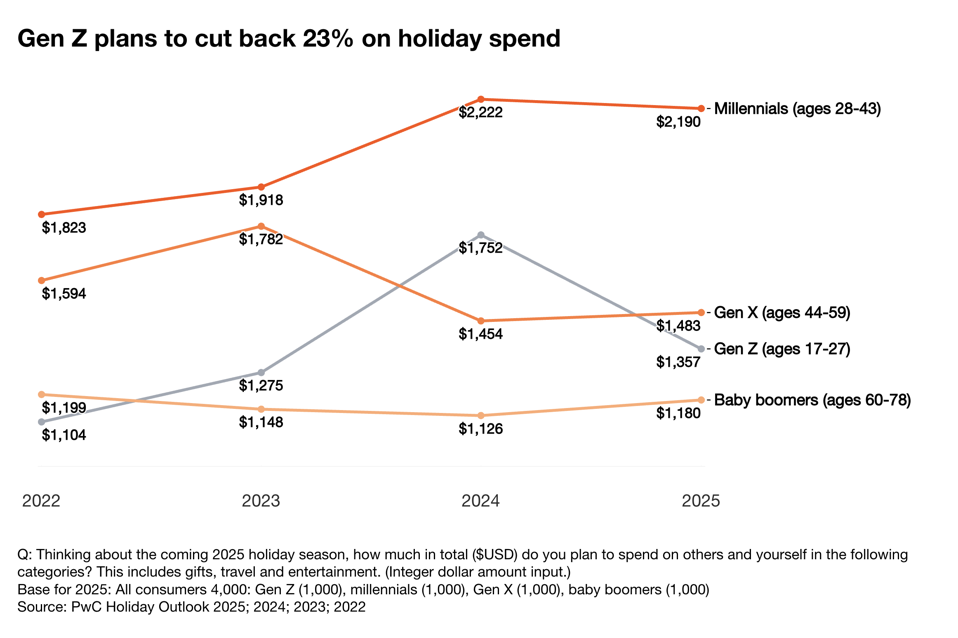

While overall average consumer spending is expected to drop 5%, Gen Z respondents (ages 17 to 28) said they plan to cut their holiday budgets by 23% – more than any other generation. “That means retailers could be fighting harder for a smaller pool of Gen Z’s discretionary dollars this season,” PwC reported.

PwC surveyed 4,000 U.S. consumers between June 26 and July 9. The report cautions that spending plans could shift if tariff concerns or economic conditions change.

While the overall average is expected to decline, based on the survey results, Americans still are planning to spend significant amounts for all holiday expenses, including gifts, travel and expenses. Millennials consumers plan to spend the most, an average of $2,190, followed by Gen X at $1,483, Gen Z at $1,357, and baby boomers at $1,180.

In addition to the spending forecast, the report contains additional insights into when, where and how consumers will shop and which purchases they will prioritize.

Gen Z Feeling The Economic Pinch

Gen Z’s frugal mood heading into holiday 2025 is in sharp contrast to last year, when that age group planned to increase their spending by 37%. In this year’s survey, 25% of Gen Z respondents said their financial situation is worse than it was 12 months ago, compared to 17% in 2024.

“What we’re seeing with Gen Z is a coming of age generation,” Ali Furman, PwC Consumer Market Industry Leader said in an interview about the survey results. “They’re average age is now 22. The oldest Gen Z is 29. So they are starting to have children, take on mortgages, they’re learning about budgeting and how to stretch their dollar and manage their expenses.”

But the problem isn’t just financial pressures, Furman said.

“We think it’s a validating signal that retailers are not needing their needs and expectations,” she said.

A Generation Laser-Focused on Value

“Price is Gen Z’s love language. This is the generation that’s been raised in an era of rising cost, so they are laser-focused on value and cost transparency, more than any other generation,” she said.

Gen Z also is the generation that has grown up “with an always on-feed” of social media, Furman said. “So they’re the generation that are the fastest to adopt trends and the fastest to abandon trends. And their expectation is that the social to shelf velocity is going to be lightning fast,” she said.

“What retailers are struggling with doing that as quickly as it appeals to Gen Z.”

Gen Z’ers are the generation that prioritizes in-person experiences, and they are driving an uptick in store and mall traffic. “But what’s not corresponding to their foot traffic is sales,” Furman said. “They’re not buying. So that bodes the question why, and it’s a real opportunity for retailers to capture that conversion,” she said.

“They need to make store more of a destination for experience” with things like limited drops, treasure hunts, collaborations with influencers, Furman said. “Retailers really need to do a better job of balancing Gen Z’s demand for uniqueness and price,” she said.

Consumers are expected to start shopping earlier, and complete 80% of their shopping by Cyber Monday, the survey found.

Gift cards, toys, apparel, and consumable goods are expected to be the top gift purchases.

Food is emerging as one of the most resilient gift categories this year, according to the PwC report.

“Unlike apparel or electronics, food delivers what many consumers are seeking this year – affordability, generosity, and a sense of personal care – without adding clutter to the home,” the report states.

Gift Cards Seen As A Way To Avoid Rising Costs

The PwC report notes that many consumers are choosing to buy gift cards as gifts as a way to avoid rising costs and stick to their budget. “A $100 gift card still signals generosity, even if it buys less than it did a year ago,” the report states.

Shoppers increasingly are using technology to make holiday purchasing decisions, the survey found. About 15% of Gen Z and millennials said they expect to use AI to generate gift ideas.

The report notes that for the first time, holiday gift shopping is nearing “channel parity” with roughly the same percentages planning to shop online as in-store. Fifty-one percent plan to complete their purchases through online marketplaces including Amazon, eBay and Etsy, with 53% shopping in person.

The survey found that nearly half of consumers (48%) “say they’re drawn into a store to interact with products directly” while 38% cited promotions and 25% holiday atmosphere for reasons to shop in stores.