Key News

Asian markets were mixed overnight following a strong Monday session, as US investors enjoyed a three-day Labor Day weekend. The highlight of the weekend, aside from time with friends and family, was witnessing my buddy Brian get his first hole-in-one, which was amazing!

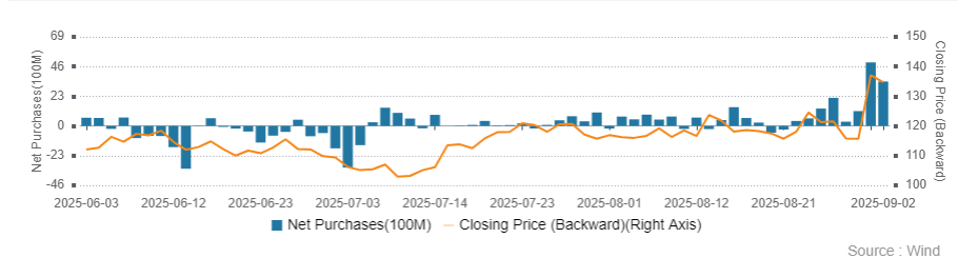

On Monday, Alibaba surged +18.46% in Hong Kong following Friday’s post-close results, powered by AI and Cloud strength, while Alibaba’s US listing advanced +12.9% on Friday. Mainland investors were significant buyers of Alibaba’s Hong Kong-listed shares via Southbound Stock Connect both yesterday and today (see chart below).

BYD dropped -5.24% Monday after missing analyst expectations, particularly on adjusted net income and earnings per share (EPS), but rebounded +2.21% today. Growth stocks broadly lagged in both Hong Kong and especially in Mainland China, after a sharp rotation from growth to value. Unlike other growth names, robotics stocks held up, as industry leader Unitree announced plans to IPO later this year, though without specifying the location, though it will likely be Hong Kong.

Stepping back, between yesterday and today, we saw Mainland indices meet a resistance level at near 3,900 for Shanghai and 2,500 for Shenzhen, with overbought readings flashing. A breather for these markets is healthy.

Market Snapshot (Monday vs. Today):

- Shanghai: -0.41% (yesterday +0.38%)

- Shenzhen: -2.0% (yesterday +0.79%)

- STAR Board: -2.09% (yesterday +1.10%)

- Hang Seng Index: -0.47% (yesterday +2.15%)

- HS Tech Index: -1.4% (yesterday +1.91%)

- Southbound Stock Connect net buying $1.53 billion (yesterday $1.55 billion)

- CNY was off versus the USD both days but not significantly.

The Shanghai market’s yield remains 2.39%, which is above the 10-Year China Government Bond’s 1.82%. New brokerage account openings jumped 34.97% year-over-year (YoY) in August to 2.65 million, following July’s 165.2% YoY surge to 1.94 million. Year-to-date, that’s 17.21 million new accounts and a total of 240 million A-share brokerage accounts, which is especially notable next to Charles Schwab’s 37.4 million active US accounts. Retail investors continue to dominate A-share ownership at 58%, compared with 32% for financial professionals.

Meanwhile, Caixin has ended its sponsorship of the S&P Dow Jones China PMI series, replaced by Rating Dog. August’s Rating Dog China Manufacturing PMI rose to 50.5 (from July’s 49.5 and ahead of the 49.8 forecast). August electric vehicle (EV) and hybrid sales are expected to climb 24% YoY and 10% month-over-month to 1.3 million vehicles, according to the China Passenger Car Association (CPCA).

Tomorrow marks the 80th anniversary of the end of World War II, with a giant military parade planned; in Beijing. Contrary to some reports, President Trump will not attend.

A weekend ritual is tuning into Renaissance Macro’s “Ren Mac Off-Script” podcast, which delivers a concise recap of the week in markets, economics, and policy. This week’s episode featured the show’s first guest, Josh Brown, ahead of the Future Proof conference. Ren Mac’s market strategist Jeff deGraff discussed the China equity breakout with Josh, a trend he’s been highlighting for almost a year. The podcast is well worth a listen for insights into global market dynamics.

New Content

Read our latest article:

Labubus: How Pop Mart’s Newest Craze Reflects Chinese Cultural Influence in the U.S.

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.14 versus 7.13 Friday

- CNY per EUR 8.31 versus 8.32 Friday

- Yield on 10-Year Government Bond 1.82% versus 1.84% Friday

- Yield on 10-Year China Development Bank Bond 1.87% versus 1.88% Friday

- Copper Price +0.09%

- Steel Price -0.19%