That attractive lower payment often comes with many major downsides.

New vehicles, chock-full of innovative technology and premium luxury features, are getting expensive. According to Kelley Blue Book, the average new car costs $48,841—a significant increase from a decade ago, when the average price was $33,801. With sticker shock causing buyer resistance, dealers are enticing shoppers with 84-month car loans. Stretching the loan over seven years enables customers to afford pricier vehicles or features that would otherwise be out of reach with traditional 48- or 60-month terms. However, is this a good idea? Is the 84-month car loan a smart buy, or a financial trap?

Dealerships are pushing longer 72- and 84-month car loans for several reasons. First, longer terms lower monthly payments, which allows retailers to sell more expensive vehicles, bump shoppers up to premium trims, sell more add-ons, and create finance packages to increase their revenue. Second, long-term loans also help dealers close “payment shoppers,” who are customers focused solely on securing the lowest possible payment. Lastly, in the financing department, the lower monthly burden of a long-term loan improves the crucial debt-to-income ratio, making it easier for consumers to qualify for the new vehicle.

Unfortunately, that attractive lower payment—often luring shoppers into spending more than they can afford— comes with many major drawbacks. “84-month loans can make cars seem affordable with lower monthly payments, but you should be warned about the long-term financial burden due to accumulated interest. This is never a good deal,” says Lauren Fix of Car Coach Reports. Interest on a long loan accumulates over a longer period—interest is charged on the remaining principal balance, and with a longer loan term, there are more months for interest to accrue. For example, a consumer who takes a $40,000 loan at 7% interest will pay approximately $7,523 with a traditional 60-month loan, but the interest jumps to approximately $10,711 with an 84-month loan. Despite the lower payments, the longer loan has added more than $3,000 to the overall price of the vehicle.

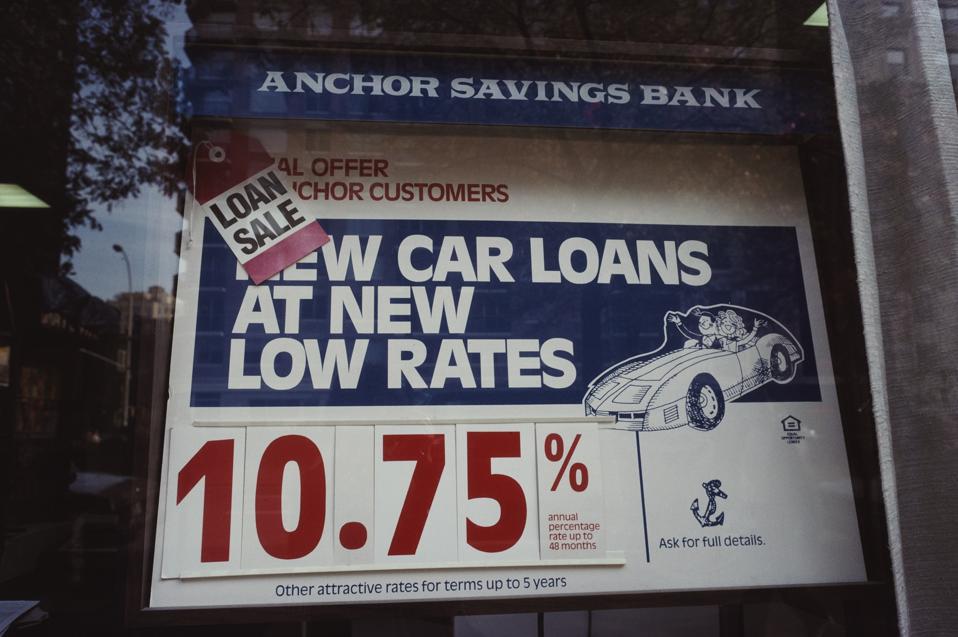

And that’s not the only concern in the financing department. Banks and credit unions typically charge higher interest rates for longer-term loans because there is increased risk of default, lost opportunity costs for the financial institution (their money is tied up, so they miss out on other potential investments), and inflation and economic uncertainty over the lengthened loan period. “Shorter loan terms (e.g., 36- to 60-months) minimize interest and maintain equity, especially for reliable, budget-friendly vehicles,” adds Fix.

High interest rates aside, consumers also need to be concerned with resale value. “Cars depreciate faster than the loan is paid off, leaving buyers upside down (owing more than the car’s worth) for years,” explains Fix. Typically, the average new car, truck, crossover, or SUV will depreciate about 20% the moment it is driven off the dealer’s lot—it can lose up to 30% of its original value within the first year. With typical amortization schedules, most of the early monthly payments in long-term loans go toward paying interest, while the loan principal decreases only slightly at first. This puts the consumer in a negative equity position, meaning they would owe the bank if they wanted to sell or trade in the vehicle within the first couple of years.

Then there are the issues with the warranty. The manufacturer’s warranty covers all new vehicles during the first few years. Most bumper-to-bumper warranties last 3 years or 36,000 miles, while powertrain warranties typically extend to 5 years or 60,000 miles. Traditional 36- to 60-month leases ensured that the vehicle was covered in the event of issues or expensive repairs. Long-term loans, which extend upwards of 7 years, put the consumer at risk—if the engine or transmission fails, they will be making payments on a vehicle that requires an expensive mechanical repair.

“The rising cost of cars, both new and used, makes longer loan periods not just a tempting option for many consumers, but a necessity when buying a vehicle,” says Karl Brauer, Executive Analyst at iSeeCars.com. “But while these loan periods work well for tight monthly budgets, they’re like financial quicksand for buyers, who will spend years owing more than the vehicle is worth. If any financial upheaval occurs during this period, the buyer could be faced with losing or selling their car and still being in debt for thousands of dollars.”

Long-term loans for vehicles are typically not a wise financial decision, but there are exceptions. Some automakers offer 0% APR financing deals for well-qualified buyers—there is zero accrued interest during the long loan. Some buyers are on a fixed budget, so they may need to use a 72- or 84-month loan to keep within their monthly spending plans. And there’s a good argument for those who buy a more expensive vehicle intending to keep it for a long time after the loan is paid off—they pay more interest for the lower payments, but it pencils out after a decade of ownership.

Most experts recommend that car shoppers opt for 48- or 60-month loans, favoring the shorter terms to save on interest, maintain positive equity, and keep the vehicle protected with a warranty throughout the loan. Shoppers should consider all financing options—including choosing a less expensive car or saving for a larger down payment.